Should Gold Bulls Open the Champagne?

Commodities / Gold and Silver 2018 Nov 29, 2018 - 05:27 PM GMTBy: Arkadiusz_Sieron

Powell spoke yesterday. The gold market considered his remarks as dovish. And the market is always right, isn’t it?

Powell spoke yesterday. The gold market considered his remarks as dovish. And the market is always right, isn’t it?

Just Below Neutral

On Wednesday, Powell delivered a speech “The Federal Reserve’s Framework for Monitoring Financial Stability” at The Economic Club of New York. The majority of analysts judged the speech as dovish. Why? The key reason was Powell’s view that interest rates were close to neutral:

Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy – that is, neither speeding up nor slowing down growth.

And indeed, it looks like an important change since last month, when Powell believed that the federal funds rate was far from neutral level. On October 3rd, in a question-and-answer session with Judy Woodruff of PBS, the Fed Chair said:

Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral. We may go past neutral, but we’re a long way from neutral at this point, probably.

However, the analysts omit less dovish parts from Powell’ speech. First of all, the Fed Chair started his speech noting that the U.S. has almost fulfilled the goals of maximum employment and price stability:

Congress assigned the Federal Reserve the job of promoting maximum employment and price stability. I am pleased to say that our economy is now close to both of those objectives. The unemployment rate is 3.7 percent, a 49-year low, and many other measures of labor market strength are at or near historic bests. Inflation is near our 2 percent target. The economy is growing at an annual rate of about 3 percent, well above most estimates of its longer-run trend.

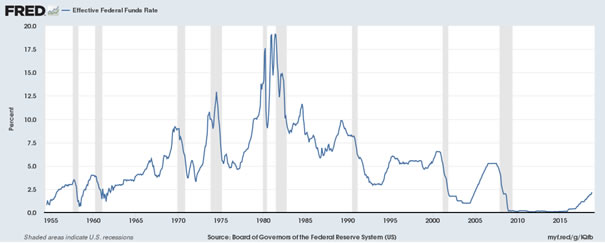

Let’s make it clear: with the unemployment rate at a 49-year low, inflation rate above 2-percent target, and GDP growth above the potential, the federal funds rate at merely 2.2. percent is definitely not close to the neutral level. Just look at chart below which paints the policy rate over time. Interest rates are ultra low by historical standards.

Chart 1: Effective Federal Funds Rate between 1955 and 2018.

And Powell knows that. He just wanted to calm investors after the recent stock market volatility. It suggests that the gains in gold might be temporary.

Vulnerabilities at a Moderate Level

Moreover, Powell was optimistic about the risk balance of the US economy. The major part of his speech was the discussion of the new Financial Stability Report that the Fed published earlier on Wednesday. Powell concluded that although he noted some growing risks to the US economy, he did not see significant warning signals:

My own assessment is that, while risks are above normal in some areas and below normal in others, overall financial stability vulnerabilities are at a moderate level.

And we will see similar conclusions when we dig into the report. Although corporate debt is high, while asset valuations are elevated, the risks of destabilizing runs are far lower than in the past, while the key financial institutions are more resilient. It’s not good news for gold.

Implications for Gold

As one can see in the chart below, the gold market agreed with the market analysts and judged Powell’s speech as dovish. The price of the yellow metal jumped yesterday above the $1,200, which indicates that gold welcomed the Fed Chair’s remarks.

Chart 2: Gold prices between November 26 and November 28, 2018.

However, the Fed does not see neither a broad-based buildup of abnormal leverage, nor dangerous excesses in the stock market. Therefore, it should continue its policy of gradual tightening. The next hike is still coming in December. And a few more next year. So, gold bulls should not open the champagne too early. But who knows: today, the FOMC will publish the minutes of its last meeting and we could learn more about the mindset of the Fed officials. Stay tuned!

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.