Investing in Recession Proof Trailer Parks

Companies / Investing 2018 Nov 27, 2018 - 01:14 PM GMTBy: Submissions

By ROBERT ROSS : Last month was a bloodbath for stocks.

By ROBERT ROSS : Last month was a bloodbath for stocks.

The S&P 500 sat on a 9.4% gain for the year on October 1.

By October 29, the index was down 1.1%—its worst month in seven years.

But I found one group of stocks that bucked the trend. While other stocks fell in tandem, these stocks showed gains.

Here’s the best part: They pay healthy, reliable dividends, and have done better than the S&P 500 every year this decade.

These stocks are hidden in the real estate sector. They make a certain type of home that is in high demand.

Trailer Parks: A Recession-Proof Industry that Many Investors Overlook

Most people know them as trailer parks. But the industry term is manufactured homes.

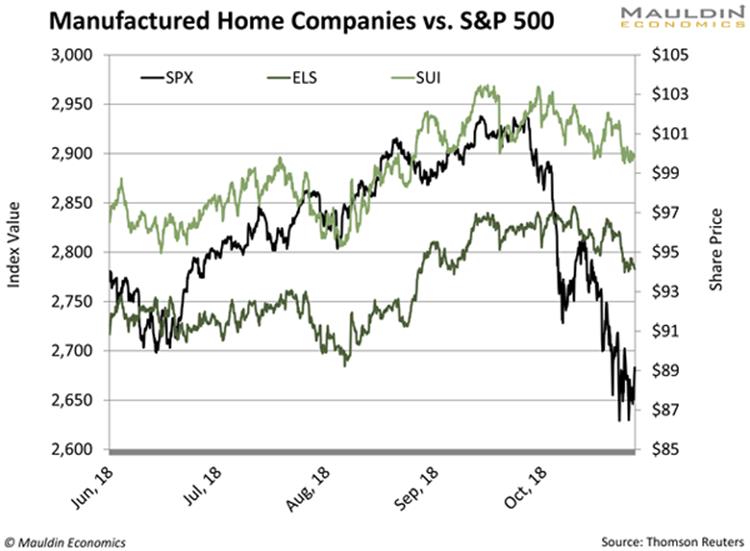

As the S&P 500 cratered last month, stocks of manufactured home companies held their ground.

There are two companies that target this market: Sun Communities (SUI) and Equity LifeStyle Properties, Inc. (ELS).

Take a look at this chart:

From October 1 to October 30, the S&P 500 fell 7.9%. Meanwhile, Sun Communities and Equity LifeStyle Properties, Inc. gained 0.2% each.

The gain might be small. But just the fact that these stocks didn’t decline tells us that the industry has staying power.

And there are good reasons why it is so.

Baby Boomers Are in for Rude Awakening

40% of Baby Boomers will see their living standards drop in retirement, according to The Wall Street Journal.

That’s 15 million American households that will see a downgrade in their lifestyle.

It gets worse. One in three Boomers have zero money saved for retirement. And six in 10 have less than $10,000.

High debt levels are to blame.

Boomers are entering retirement with more debt than ever before. The average Boomer has $99,000 in debt.

Too much debt and too little savings are making Boomers rethink their retirement plans. For many, retiring into a manufactured home is the only viable option.

The Great Downsizing Is Coming

Every day, 10,000 Boomers are retiring with nowhere near enough money.

But there’s a solution: 60% of US households own a home.

And Duke University economics professor Charles M. Becker thinks many will sell their homes and move into manufactured homes.

"You can't buy $30,000 worth of house in a site-built house without being afraid of the neighborhood you live in. Trailer parks can be thought of as gated communities for people who aren't so wealthy,” said Becker.

That’s right, gated communities. These aren’t your grandma’s trailer parks.

This Industry Won’t Stop Booming Any Time Soon

Manufactured homes have been the largest source of affordable housing in the US for 30 years.

Look at this chart of US house prices:

Source: Federal Reserve Bank of St. Louis

US home prices are the highest they’ve ever been. This means two things:

- Retiring Boomers can sell their homes on the highs

- They can take that money and buy an affordable manufactured home

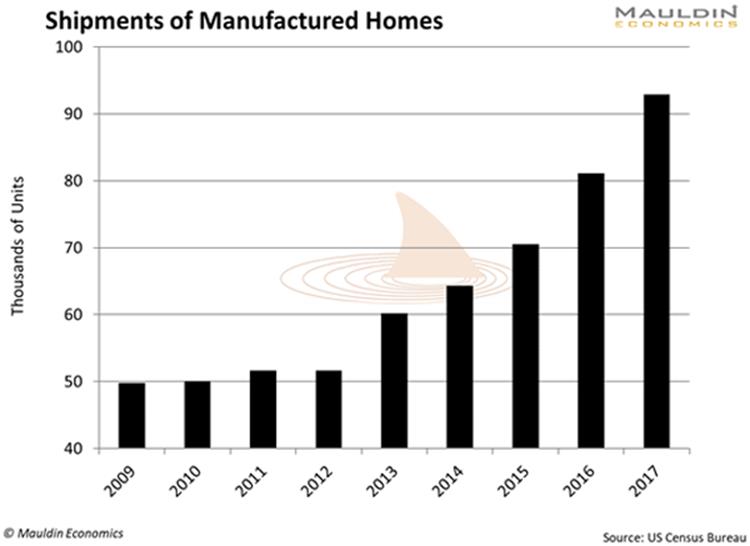

And many are doing just that. Shipments of manufactured homes are surging:

It’s not a fluke that manufactured home sales started rising in 2013. That’s the first year Boomers started to retire.

The trend is undeniable. But to confirm my research, I decided to visit a manufactured home community to see for myself.

These Are Not Trailer Parks You’d Imagine

I found a manufactured home community that was getting rave reviews on Yelp. So I drove north of San Francisco to Napa Valley to check it out.

And it didn’t disappoint.

I parked my car and walked over to the green of a perfectly manicured mini golf course. Behind me, kids splashed around in an Olympic-size swimming pool. About 100 yards away, a community library sat in the shade of giant palm trees.

Manufactured home communities like this are more akin to a resort than a trailer park. And the price is certainly right. A manufactured home costs nearly $300,000 less than a site-built home.

This is especially true for seniors who worry that their nest egg may not last them through retirement.

John Mauldin calls this problem longevity risk. And it’s something many seniors are coming to terms with.

Most retirees simply cannot afford their dream house on the beach. Many will turn to manufactured home parks as a back-up plan.

Investing in this Industry Is a No-Brainer

Buying these stocks is a no-brainer. Here’s why.

For one, the trend is undeniable.

Second, with high volatility in equities, safe and stable stocks is a must in your portfolio.

And manufactured home companies have proven that they can weather volatility well.

Plus, the US bull market is long in the tooth. So it’s a good time to add one more hedge to your stock portfolio today.

By ROBERT ROSS

© 2018 Copyright ROBERT ROSS - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.