US Government Works Better When Divided

Politics / US Politics Nov 25, 2018 - 03:21 PM GMTBy: Steve_H_Hanke

The results of the U.S. mid-term elections were good news for not only the winners, but for most Americans. Yes, the federal government works better when divided, not unified. The 116th Congress—with the House of Representatives controlled by the Democrats and the Senate and White House under Republican command—may work better than the unified 115th Congress did.

The idea and evidence supporting this somewhat counter-intuitive idea was first presented to me many years ago by my good friend and collaborator, the late William A. “Bill” Niskanen. Bill was sharp as a tack. Indeed, he was one of Secretary of Defense McNamara’s “Whiz Kids” during the Kennedy-Johnson years. At the ripe old age of 29, Bill had a civilian rank equivalent to that of a brigadier-general. Bill was one to speak his mind, too. His sharpness and outspokenness occasionally landed him in hot water. Famously, while operating as the director of economics at Ford Motor Company in the mid-1970s, Bill publicly opposed U.S. government restrictions on the imports of Japanese automobiles, demonstrating why the restrictions would hurt Ford. For that infraction, Bill was sacked.

I worked with Niskanen in many different settings: first, at the U.S. Office of Management and Budget in 1971, then at the University of California, Berkeley in the early 1970s, then on President Reagan’s Council of Economic Advisers, and finally at the Cato Institute—where Bill was chairman. Over the years, Bill repeatedly expounded on his case for a divided government. He often made that case to the high priests of both the Republican and Democratic parties. This, of course, annoyed them to no end. But, facts are facts.

In making the case for a divided government, Niskanen played three cards. First, the likelihood of entering a major war is much lower with a divided than a unified government. In the 20th century, all major wars have been entered into during periods when the President and Congress were of the same party. Interestingly, the Democrats have been the war party. Indeed, all the major U.S. wars lasting more than a few days, with the exception of the Iraq War, were undertaken when Democrats occupied both the White House and Congress.

Niskanen’s second card concerns major reforms. They have a better chance of being sustained when enacted with bipartisan support by divided governments. Remember Reagan’s revolutionary tax reforms of 1981 and 1986. They came to life during divided governments. Both of those tax reforms have largely survived, as have many other major reforms that were the products of divided governments.

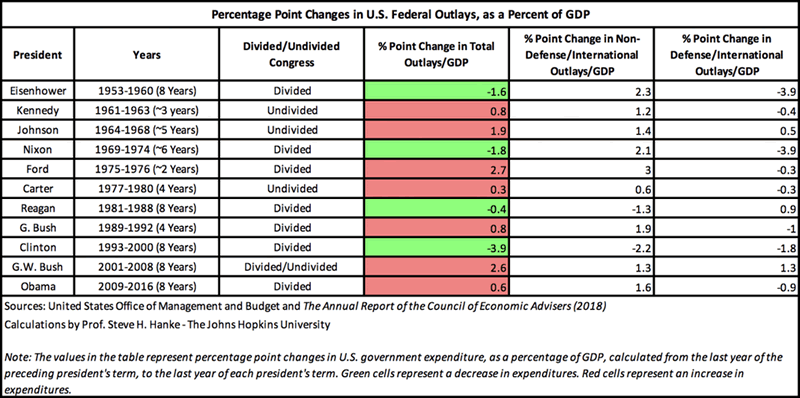

The third card is government spending and the size of government spending relative to GDP. The real rate of growth in (inflation-adjusted) federal spending tends to be lower with divided governments. Consequently, the size of government, measured by the ratio of government outlays to GDP, shrinks—the ratio becomes smaller. This pattern is shown in the table below.

Percentage Point Changes in U.S. Federal Outlays, as a Percent of GDPProf. Steve H. Hanke

A divided government is a necessary but not sufficient condition for government “shrinkage.” Indeed, every instance of government shrinkage since World War II has occurred during a period of divided government. The shrinkages transpired during the Eisenhower, Nixon, Reagan, and Clinton administrations, as indicated in the table above by the green highlight. Although these four administrations all cut government’s share of GDP, President Clinton was the King of the fiscal squeeze. Indeed, he was the King by a huge margin. Clinton cut government’s share of GDP by a whopping 3.9 percentage points over his eight years in office. President Nixon’s six years in office yielded a distant second place, with a 1.8 percentage point drop in the federal government’s slice of GDP.

Some argue that Clinton’s fiscal squeeze was largely the result of the so-called “peace dividend”—the post-Cold-War military drawdown. Well, Clinton did benefit from the peace dividend, but as shown in the table above, the majority of Clinton’s cuts came from reductions in non-defense expenditures. Crucially, the driving force behind many of these non-defense expenditure reductions came from the other (read: Republican) side of the aisle, under the leadership of Speaker Gingrich.

Why was the Clinton-Gingrich fiscal restraint so extraordinary? Well, Speaker Gingrich might have been a Republican firebrand, but he was a smart Speaker who knew how to maneuver. And, President Clinton was a smart operator, too. Indeed, he did not acquire the attribution “Slick Willy” for nothing. These two operators knew all about the art of the deal. Their deals would keep the U.S. out of new major wars, produce major reforms, and cut back the scope and scale of government. The result was a long economic boom.

Today, with the 116th Congress, we will have a divided government—a condition for government to work better than usual. While President Trump and the new Democratic Speaker of the House will probably not be able to trump Clinton and Gingrich, they might be able to strike deals. And, there is already a glimmer of hope on the horizon. Just this past Saturday, the Wall Street Journal headline read: “Trump Offers Help Securing Votes for Pelosi in Speaker Race.” The President went so far as to say, “I can get Nancy Pelosi as many votes as she wants in order for her to be the Speaker of the House.” That’s what I call starting on the right foot. After all, Pelosi looks to be the favorite to lead the Democrat-controlled House.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2018 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.