Is A Top Forming In Natural Gas?

Commodities / Natural Gas Nov 15, 2018 - 05:17 PM GMTBy: Chris_Vermeulen

The recent upswing in NG prices has been an incredible trade for many, yet we believe a top is now forming in Natural Gas that could catch many traders by surprise. The recent upside gap in price and upward price volatility would normally not concern long traders. They would likely view this as a tremendous success for their long NG positions, yet we believe this move is about to come to a dramatic end – fairly quickly.

The recent upswing in NG prices has been an incredible trade for many, yet we believe a top is now forming in Natural Gas that could catch many traders by surprise. The recent upside gap in price and upward price volatility would normally not concern long traders. They would likely view this as a tremendous success for their long NG positions, yet we believe this move is about to come to a dramatic end – fairly quickly.

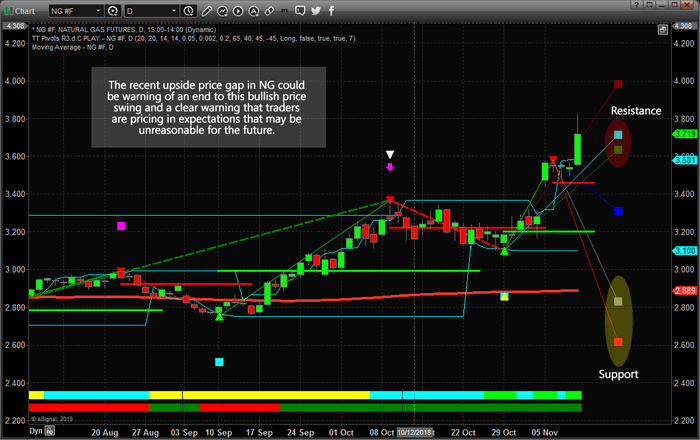

Our predictive price modeling systems are suggesting that Natural Gas may be setting up a topping pattern on weakness near our Fibonacci price target levels. As you can see from this Daily NG chart, the upside price gap recently has prompted a big upside price move that ended near our Fibonacci price target levels marked as “Resistance” on the right side of this chart. Normally, when the price reaches these levels, or near these levels, we expect price resistance to become a dominant factor. Additionally, we need to highlight the potential for the higher Fibonacci target, near $4.00-4.15, to be reached on an extended move higher. If this were to happen, we believe price would be strongly overextended and would likely rotate lower towards the $3.20 level rather quickly.

Support can be found near $2.60 to $2.80 on this chart and we believe the new highs, near $3.80, will likely extend the Fibonacci support targets a bit lower as price rotates to form the top pattern we are expecting.

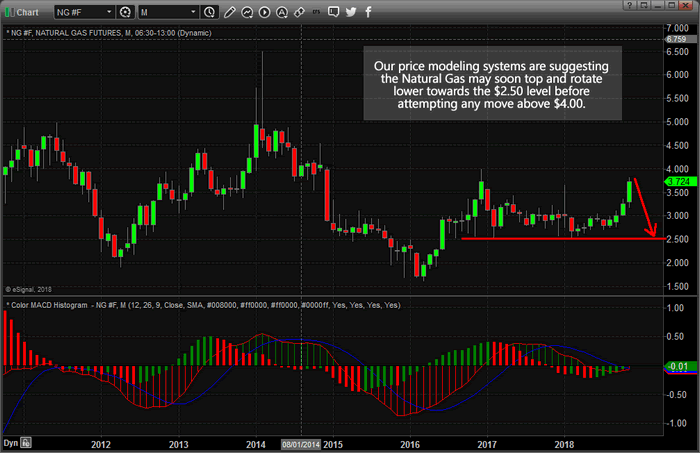

It is a bit too early to actually “call a top” in Natural Gas at the moment, but we believe we are very near to setting up and forming a top reversal pattern in NG and are alerting our followers and members to this setup before it happens. We believe a price top will continue to setup over the next week or so before a new downward price trend pushes prices back towards the $2.50 level where support will likely hold.

Historically, the month of November has shown a moderately positive outcome over the past 25 years (resulting in a +0.59 average upside bias with a nearly 52% probability ratio). As of right now, NG is +0.46 for the November 2018 – indicating very limited upside range still exists.

For the month of December, NG historically results in a negative outcome (resulting in a -$2.61 average downside price bias with a nearly 60% probability ratio). For the month of January, NG has shown a decidedly negative price outcome (resulting in a -$6.69 average downside price bias with a nearly 71% probability ratio). Obviously, assuming these 25-year price studies are correct and their probability factors continue to be accurate, the upside move in Natural Gas may be very near a top and traders need to be aware of the potential for a quick and dramatic price trend reversal.

If you believe this type of research and analysis can assist you in finding and executing better trades, take a few minutes to learn about our team of researchers and how we can help you stay ahead of these market moves – visit www.TheTechnicalTraders.com today. Our team of professional researchers and traders has been developing proprietary price modeling and analysis tools for decades and we believe we have some of the best predictive modeling systems on the planet. Watch how this move in NG plays out to see how well we can help you find better trades and visit www.TheTechnicalTraders.com/FreeResearch/ to read more of our public research posts.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.