Gold Stocks vs. Gold – Cryin’ Time Again

Commodities / Gold and Silver 2018 Nov 14, 2018 - 09:09 AM GMTBy: Kelsey_Williams

When will people wake up to the fact that investing in gold mining shares is not a good idea?

When will people wake up to the fact that investing in gold mining shares is not a good idea?

What are the experts seeing and thinking when they talk about the “positive outlook for mining shares”? For the life of me, I just don’t get it.

And, as far as gold stocks outperforming gold, well, just forget about it.

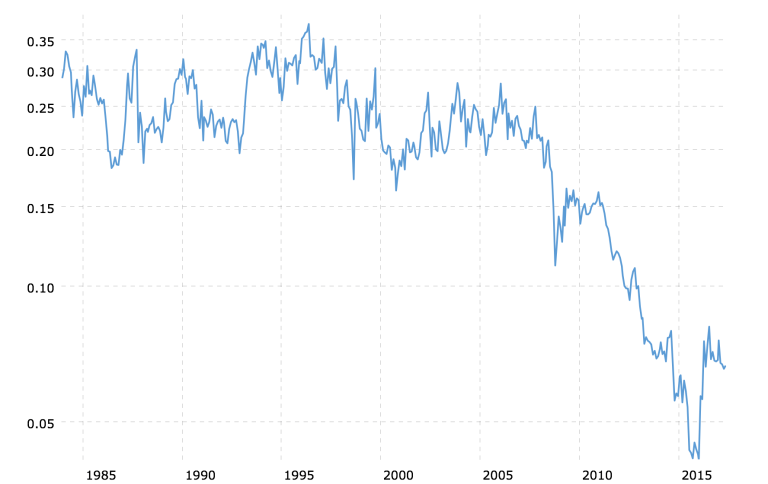

Below is a chart depicting the XAU-to-gold ratio over the past thirty-five years:

For twenty-five years, from 1983 to 2008, the ratio pretty much stayed within a range of .20 to .35 but, after that, the bottom fell out.

What is ironic, is that while gold’s price was rising strongly from its low of $260.00 to its eventual high of nearly $1900.00, the ratio was dropping – from .30 to .11. So much for the leveraged advantage of gold mining shares over gold bullion.

Adding insult to injury, mining shares ‘outperformed’ gold bullion – on the downside, with the ratio dropping to .04 in January 2016.

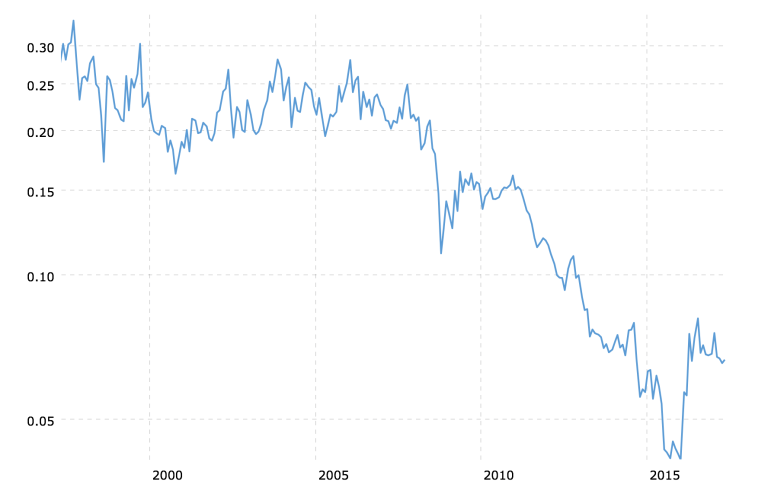

Lest someone think that the XAU is not broadly representative of the gold mining sector, I have included a chart of the HUI-to-gold ratio below:

The HUI-to-gold ratio chart covers a shorter period (twenty-two years) than the previous chart, and there are differences in the scope and timing of trends and price points in the two ratios.

For example, the XAU-to-gold ratio peaked in May 1996, whereas, the HUI-to-gold ratio peaked in November 2003. Also, the XAU index is comprised of more traditional mining companies. The HUI index has more of the newer, more speculative companies, and is more broadly based.

However, even allowing for those differences, the patterns and impressions are similar.

Here are both charts in the same order, but both showing only the past twenty-year history:

Not a pretty picture if you own gold stocks instead of gold bullion.

Gold stocks have underperformed relative to gold, and woefully underperformed according to expectations. And it isn’t getting any better.

Gold stocks have declined more than twice as much as gold since their respective peaks in 2011.

Most gold stocks today are priced about where they were in 2003, when the HUI-to-gold ratio peaked. Yet gold, since 2003, is up nearly two hundred percent.

Except for one, brief period from 1999 to mid-2003, price action in gold stocks relative to gold is a disappointment, at best.

After November 2003 anyone would have been better off holding gold, itself, rather than the gold stocks. And with a lot less risk.

also see: Gold vs. Gold Mining Shares: Just The Facts, Ma’am

(source for all charts)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2018 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.