Sentiment Extremely Bearish, Setting Up the Stock market For a Nice Rally

Stock-Markets / Stock Markets 2018 Nov 02, 2018 - 12:59 PM GMTBy: Troy_Bombardia

For the first day in 2 weeks, the U.S. stock market did not selloff in the final hour of trading yesterday.

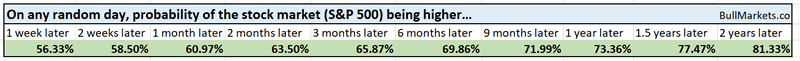

Let’s analyze the stock market’s price action by objectively quantifying technical analysis. For the sake of reference, here’s the random probability of the U.S. stock market going up on any given day, week, or month.

*Probability ≠ certainty. But if you consistently trade against probability, then you will underperform in the long run.

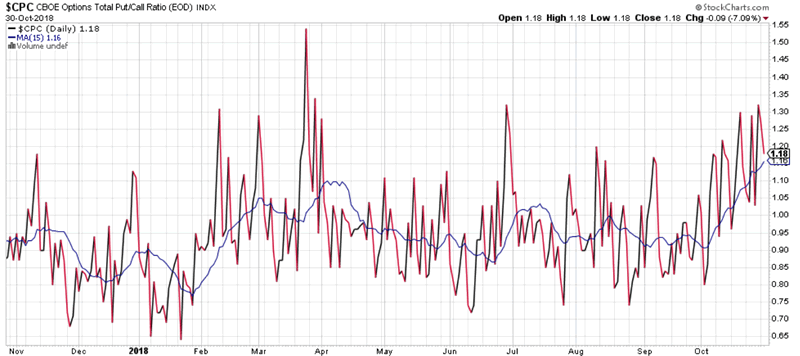

Sentiment is at an extreme

Sentiment for the U.S. stock market is very bearish right now. The Total Put/Call Ratio’s 15 day moving average (3 weeks) is now at 16.

Historically, this has been a nice setup for a rally over the next 2-3 months for the U.S. stock market.

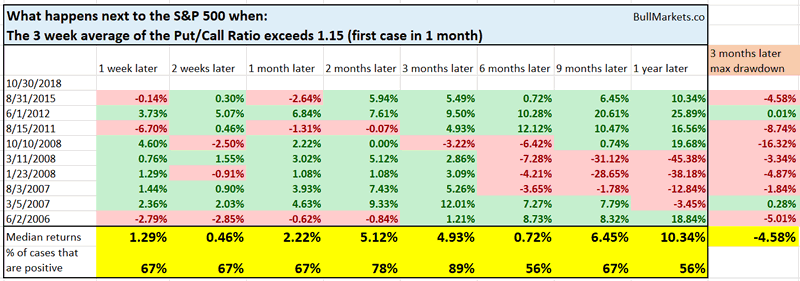

Here’s what happens (historically) when the Put/Call Ratio’s 3 week average exceeds 1.15 (first case in 1 month)

*Data from 1995 – present

As you can see, the stock market tends to go up 2-3 months later, even during the 2008 mega-crash.

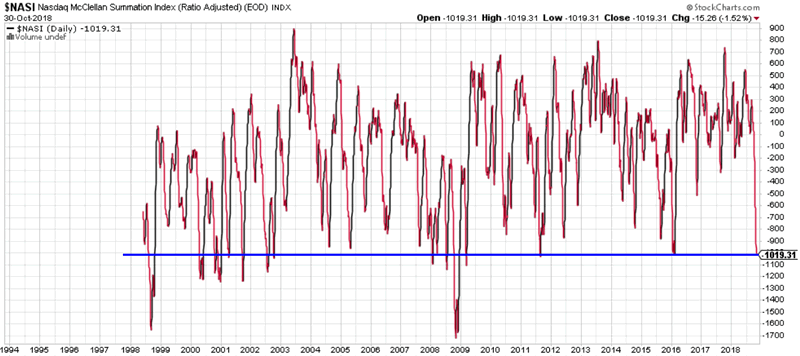

Breadth is very weak

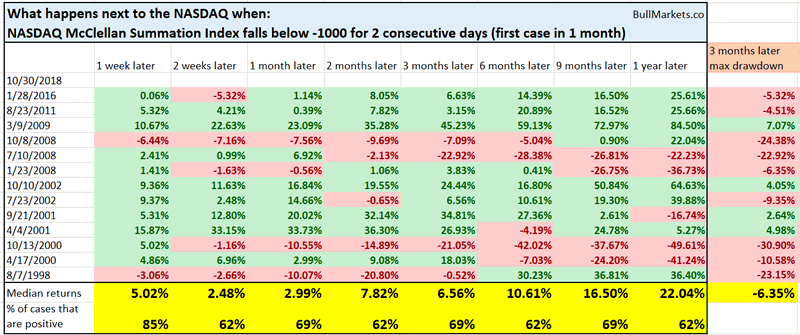

The U.S. stock market’s breadth is very weak. This is seen through the NASDAQ’s McClellan Summation Index, which is a NASDAQ breadth indicator.

*Data from 1998 – present

As you can see, the NASDAQ’s McClellan Summation Index has been below -1000 for 2 days in a row.

Here’s what happens next to the NASDAQ (historically) when the McClellation Summation Index fell below -1000 for 2 consecutive days (first case in 1 month)

As you can see, the NASDAQ tends to rally over the next 1 week. The 1 really bearish case was October 2008, when the stock market had already crashed more than -30%.

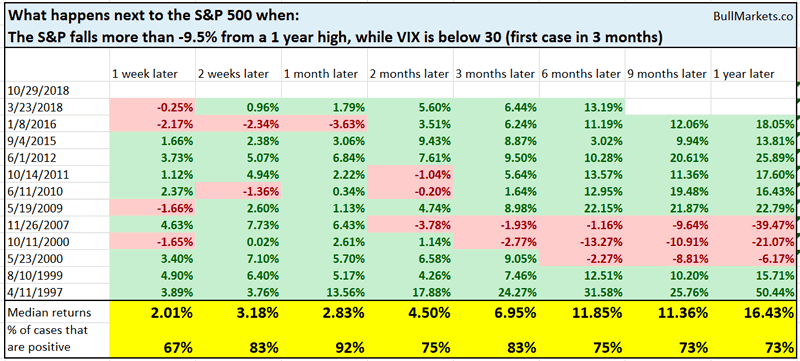

Stocks tanked while VIX remaind subdued

What’s interesting about the recent correction is that while the stock market fell almost -10% (using daily CLOSE), VIX has remained relatively subdued. These 10% declines usually see VIX rise above 30.

Here’s what happened next to the S&P 500 when it fell more than -9.5% from a 1 year high, while VIX was below 30 (first case in 3 months).

*Data from 1990 – present

As you can see, the S&P usually went up 1 month later. This included the 2000 and 2007 cases in which the bull market had already topped.

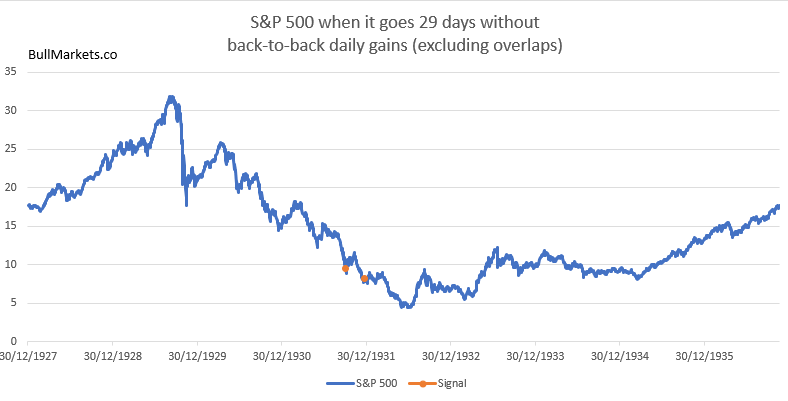

This isn’t the Great Depression

The S&P hasn’t had back-to-back daily gains for the past 28 days. If the S&P doesn’t go up tomorrow, it’ll be the 29th consecutive day in which the S&P hasn’t made back-to-back gains.

This is extremely rare. From 1927- present, this has only happened 2 other times:

- October 1, 1931

- December 21, 1931

As you can see, this last happened during the Great Depression. This study isn’t very applicable to today. By no means does it imply that today = Great Depression. In those 2 historical cases, the S&P had already crashed more than 70% and the economy was in the worst recession of the past century. Today, the S&P is down approximately -9%, and the economy is doing just fine.

So think about this before someone tells you “today is just like the Great Depression”. Same symptoms, different context.

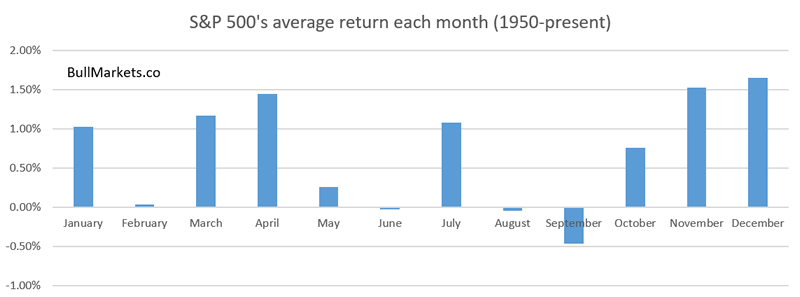

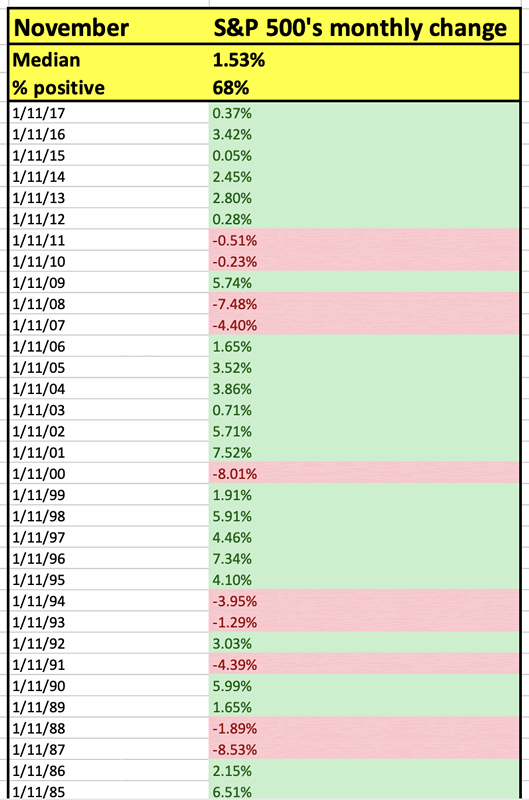

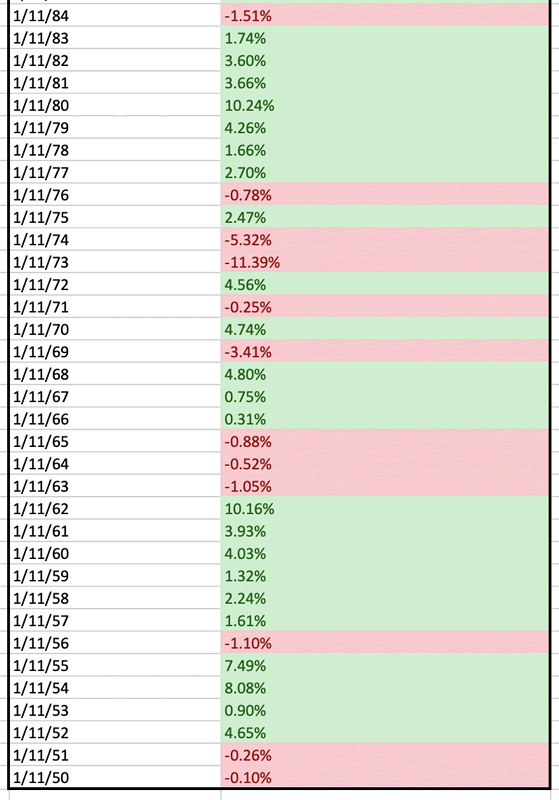

November seasonality

November tends to be one of the more bullish months in terms of seasonality.

As always, we believe that seasonality indicators are of secondary importance. With that being said, seasonality certainly isn’t bearish in November. Here are all the Novembers from 1950 – present, and what the S&P 500 did next.

Click here to see yesterday’s market study

Conclusion

Our discretionary technical outlook remains the same:

- The current bull market will peak sometime in Q2 2019.

- The medium term remains bullish (i.e. trend for the next 6-9 months). Volatility is extremely high right now. Since volatility is mean-reverting and moves in the opposite direction of the stock market, this is medium term bullish.

- The short term is a 50-50 bet right now. The stock market will probably remain volatile in the short term (big up and down swings).

- When the stock market’s short term is unclear (as it is most of the time), focus on the medium term. Step back and look at the big picture. Don’t lose yourself in a sea of noise.

Our discretionary outlook is usually, but not always, a reflection of how we’re trading the markets right now. We trade based on our clear, quantitative trading models, such as the Medium-Long Term Model.

Members can see exactly how we’re trading the U.S. stock market right now based on our trading models.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.