Gold Largest One Day Price Rise in History

Commodities / Gold & Silver Sep 18, 2008 - 04:32 AM GMTBy: Mark_OByrne

Gold and silver surged yesterday with gold up $69.30 to $847.30/oz and silver up $1.11 to $11.59/oz.

Gold and silver surged yesterday with gold up $69.30 to $847.30/oz and silver up $1.11 to $11.59/oz.

Gold surged by 8.9% to $847.30 (silver +10.6%) at the close in New York and continued to surge in electronic trading to over $870/oz. Asian trading saw the surge continue and gold traded as high as $893/oz. Gold subsequently fell prior to rising to some $870/oz as markets began trading in London. These are unprecedented movements and gold rose from a low of $780 to a high of $893 or more than 14% in less than 24 hours. There is some confusion but some analysts say this is the largest one day dollar price move since 1980 and some saying the largest ever.

Gold has surged as predicted due to the spreading financial contagion (see below) and deepening crisis of global capitalism. Every day brings a host of worrying financial and economic news and yesterday saw a resultant flight to quality as investors sought the safe haven of gold. Supply shortages of physical coins and bars continues in many retail markets with demand remaining unprecedented internationally. The surge in prices yesterday and worsening financial and economic conditions will lead an even greater increase in demand and central banks internationally look set to curtail gold sales and indeed to become gold buyers again.

Also there are concerns that some large financial institutions may have very large short positions in the precious metals and that in the event of an insolvency such as Lehman they would have to buy back their gold and silver short positions to square the books, creating an even larger price spike.

The Lloyds HBOS shotgun marriage and a mooted shotgun marriage between Morgan Stanley and Wachovia and plunge in the value of Morgan Stanley and Goldman Sachs are shattering already frayed nerves. There are also concerns regarding Washington Mutual, the U.S.' largest savings bank.

Gold surged yesterday even as the dollar remained firm against major currencies and it is important to note that the dollar only weakened later in the trading day. Thus gold acted independently of the dollar and surged in all major currencies including the euro, British pound, Japanese Yen and Swiss franc.

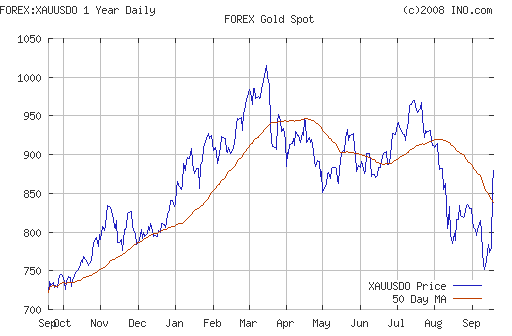

As the global financial and economic system confronts its greatest challenge since the Great Depression, gold looks very likely to reach $900 in the coming days and should regain the record high of $1,030/oz far sooner than expected (see chart below) . Gold's recent brutal correction is almost certainly over and the sharp falls witnessed in recent weeks are likely to be matched by an even sharper rebound in prices as safe haven demand for gold continues to increase.

Central Bank Demand Due to Gold as “Perfect Hedge” and “Confidence and Stability-building Function”

The world's central banks , already the biggest holders of gold, are again looking at gold as an alternative and safer reserve asset than the dollar. Sales of gold by European central banks may total 365 metric tons in the year through September 26, below the cap of 500 tons, the World Gold Council said yesterday. That would mark the lowest amount since the banks agreed to sell the metal in 1999. Venezuela said it may buy 15 metric tons of gold a year to develop investment products, including coins. At a conference in London, Maria Ramona Gertrudes Santiago, the managing director of the treasury at the Philippines Central Bank, called gold a ''perfect hedge.''

Recently, the Bundesbank reaffirmed its belief in the importance of retaining significant holdings of gold bullion in their monetary reserves.

The Bundesbank has said that financial and political uncertainty make the gold reserves even more important than before. The Bundesbank is the world's second-largest holder of gold after the US Federal Reserve, and has sold just 20 tonnes out of total reserves of over 3,000 tonnes in the past five years.

"National gold reserves have a confidence and stability-building function for the single currency in a monetary union,” the Bundesbank said.

Contagion Spreading to Other Financial Products such as Tracker Bonds, E xchange traded funds (ETFs) and most Worryingly Money Market Funds

Worryingly, the crisis is getting worse on a daily basis and the meltdown witnessed in the asset backed securities and credit default swap markets is spreading into other markets – insurance market for example. The contagion is now spreading and affecting other financial products – the latest victims being exchange traded funds (ETFs) and now the perceived safe haven of money market funds are being questioned.

There is anecdotal evidence of massive withdrawals from money market funds in the U.S. The FT reports that operators of money market funds, which manage a record $3,500bn, were on Wednesday rushing to reassure investors while bracing themselves to make further bail-outs of their funds. There were fears of a run on funds following news that one had “broken the buck”. Wachovia said it would back $494m (€350m, £280m) worth of Lehman Brothers debt held in its Evergreen money market funds, rather than let the funds fall below the amount investors paid in – or “breaking the buck”.

The Reserve Primary Fund, the oldest in the US, said on Tuesday night that investors could lose money as a result of it holding debt in Lehman, which has filed for bankruptcy. It is the first time in 14 years the value of a money market fund has been allowed to fall below the amount investors paid in and is a signal that ripples from the financial crisis have begun directly to affect retail investors.

Money market funds' safety has been of serious concern to regulators because they are considered by retail investors to be as secure as a bank account – but they have lost value during the credit crisis and are not backed by any government guarantee.

Gold Chart (1 Year)

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.