Fed Plans $200 Billion Bailout of AIG To Prevent Financial Collapse

Companies / Nationalization Sep 16, 2008 - 04:15 PM GMTBy: Mike_Shedlock

The Fed held firm today as noted in Bernanke Breaks From Greenspan Fed: No Change .

The Fed held firm today as noted in Bernanke Breaks From Greenspan Fed: No Change .

Futures sold off on the news then came roaring back when the Fed decided to consider to extend its moral hazard policy on a case by case basis.

Please consider Fed Said to Reverse Stance, Consider a Loan Package for AIG .

The Federal Reserve is considering extending a "loan package" to American International Group Inc., the insurer facing a cash shortage, according to a person familiar with the negotiations.

The stance by federal regulators is a reversal from a position they held as late as last night, and people with knowledge of the talks are "cautiously optimistic," said the person, who declined to be identified because negotiations are confidential.

The person gave no timetable for reaching an agreement or estimate on how much money New York-based AIG would need. New York Fed spokesman Andrew Williams declined to comment.

Once again the Fed is hoping to buy time. Notice that the Fed did not agree to do anything but AIG acted as if it did.

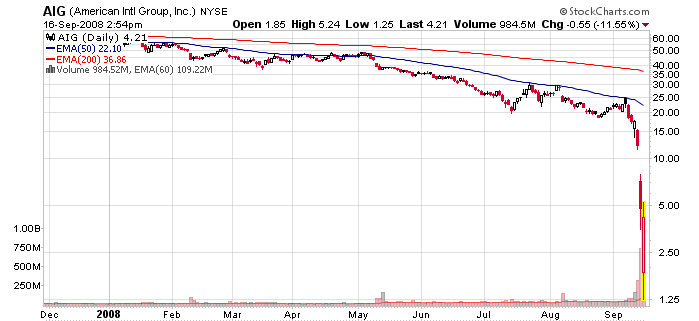

AIG Daily Chart

AIG traded as low as $1.25 then bounced all the way to positive territory.

Bazooka Bernanke

The Bazooka Bernanke Fed Policy is a continuation of the Bazooka Paulson Treasury Policy.

Paulson: "If you have a bazooka in your pocket, and people know you have a bazooka, you may never have to take it out."

Mish: "It seems to me Paulson took out his bazooka, fired it, and shot Fannie Mae in the arse. After Fannie Mae blew sky high, Paulson was adamant not to fire another shot."

Bernanke has a Bazooka in his pocket that he is hoping he does not have to fire. Whether or not Bernanke fires that bazooka, AIG is not going to survive in its present form, if indeed it survives at all.

Remember that in the bailout of Fannie Mae and Freddie Mac that equity holders and preferred shareholders were both wiped out. Expect the same if there is an AIG bailout. Expect taxpayers to be on the hook for another $90-200 Billion if it happens.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.