Serious Bitcoin Price Decline

Currencies / Bitcoin Aug 09, 2018 - 02:53 AM GMTBy: Mike_McAra

Bitcoin is depreciating. This might be just the turnaround you have been waiting for. But is there really enough weight behind the short-term action to pummel Bitcoin lower?

A startup backed by Starbucks, Microsoft and a couple of other companies is said to potentially pave the way for the Bitcoin ETF. In an article on CNN, we read:

Starbucks going all-in on cryptocurrency is "the biggest news of the year for bitcoin" — because it paves the way for a bitcoin ETF, according to BK Capital Management founder Brian Kelly.

Starbucks, the Intercontinental Exchange (ICE), Microsoft and BCG, among others, announced on Friday they are working to launch a new company called Bakkt. Along with enabling consumers to use bitcoin and other cryptocurrencies at Starbucks, Bakkt will leverage Microsoft cloud to create an open and regulated, digital asset ecosystem, ICE announced on Friday.

"They'll now have a U.S.-regulated exchange and they have a licensed warehouse, which is how commodities are stored and that's going to make it a lot easier for an ETF to come through," Kelly, a bitcoin enthusiast, said on CNBC's "Fast Money."

This sounds almost fantastic – Starbucks giving Bitcoin a leg up. In reality, the possibility of a regulated marketplace for digital currencies being developed is a positive piece of news but it is only a possibility and the link between this initiative and a potential launch of a Bitcoin ETF is tenuous at best. And even if we see such a marketplace in operation, which might take years, we would still have to wait for the SEC to catch up and approve another Bitcoin ETF proposal, which might take years still. Assuming that we see some kind of speed up in the process, it still leaves us with a couple of years before an ETF could be approved. So, we wouldn’t bet the ranch on a Bitcoin ETF based on this piece of news. If we don’t see a sudden turnaround in the SEC’s approach, A Bitcoin ETF is nowhere around the corner.

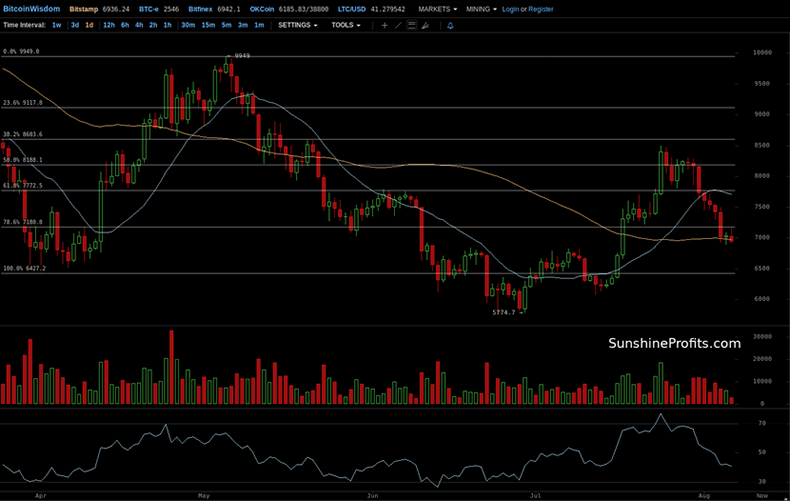

Retracements Pierced

On BitStamp, we have seen a period of pronounced depreciation. The move has brought the currency from $8,500 to around $7,000 at the moment of writing. This is a very strong move down. What might this mean for the market?

We immediately see that Bitcoin has recently gone through several Fibonacci retracement levels based on the preceding April rally. First, it danced around the 50% level, which acted mostly as resistance. Once away from this level, the currency went below the 61.8% level and this move was confirmed and this made the situation more bearish. But the move continued and Bitcoin went below the 78.6% level and has stayed below it. Such an extent of depreciation is quite strong and we might see a short-term rebound. Does this mean that we should switch to hypothetical long positions?

The answer to that question would be: “Most likely no.” Yes, we could see a short-lived upswing from here but the current situation suggests that the outlook remains bearish and any upswing might be weak. If we look at the RSI, we see that it is still quite far from oversold levels. This points to the outcome in which any correction would be erased and followed by even more declines.

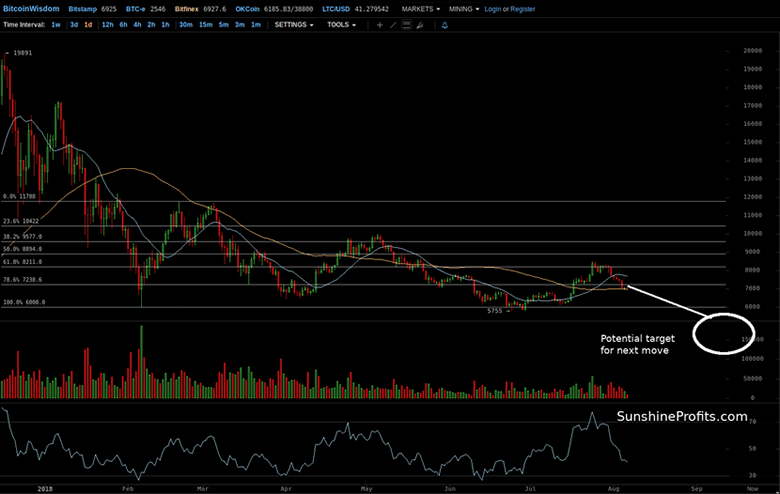

Long-term Downtrend

On the long-term Bitfinex chart, we see that the declines are already pronounced enough to be quite visible from the long-term perspective. So, it would be hard to brush the current move down off.

Looking at the Fibonacci retracement levels based on the February rally, Bitcoin was stopped by the 61.8% level and took a step down to the 78.6% level. This level is less important than the previous one, in our opinion, which suggests that we might have in fact seen the end of the corrective upswing from $6,000 to above $8,000. Bitcoin is now down from above $8,000 back to around $7,000, and the currency is below the 78.6% retracement. If we do see more closes below this level, the bearish outlook will be confirmed further.

From the long-term perspective, the recent rally fits quite well with the unfolding of the long-term trend to the downside. The recent move up seems to have formed a local top, which is lower than the preceding local top and, in fact, is another in a series of lower local tops. This is characteristic of a downtrend. In such an environment, the recent action to the upside looks increasingly like a correction within a longer decline and the decline looks like it’s set to continue into the future, increasing the profits on our hypothetical positions.

Summing up, in our opinion Bitcoin has started what might be a serious decline.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.