Red States vs Blue States - Breaking Down Trump’s Trade Wars

Politics / US Politics Aug 04, 2018 - 12:24 PM GMTBy: Harry_Dent

There’s ideology.

There’s ideology.

And then there’s reality and outcomes.

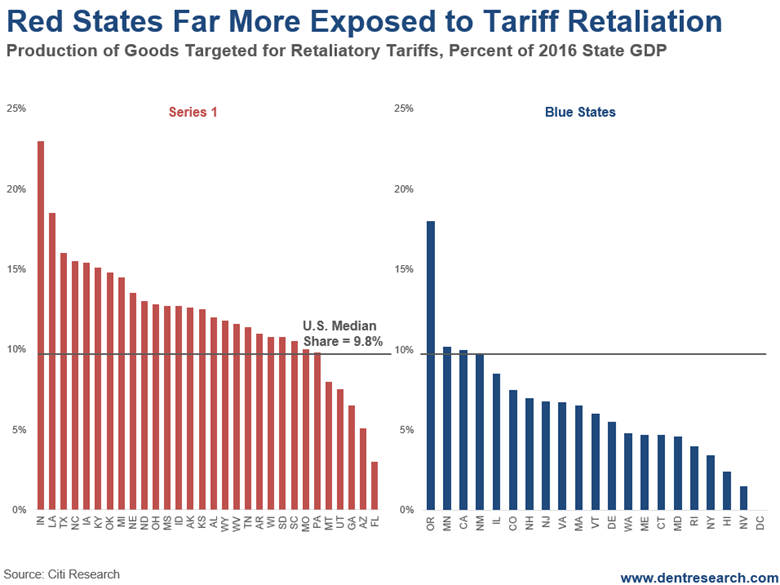

Unfortunately, the trade war overtures in the name of fairer competition, disfavors jobs in the red states far more than in the blue ones.

In Thursday’s issue, I looked at how curbing immigration is likely to be a major factor tipping us into the next recession.

That recession will turn into a depression, given the extreme bubble economy created by QE policies, and – now – tax cuts.

Trump quickly learned in 2016 that the top Republican voters’ “hot buttons” were immigration and unfair foreign trade agreements.

These were the far right’s concerns. But his trade policies will hurt the red states more, as the chart below demonstrates.

The far left campaign of Bernie Sander’s was more about the 1% taking all the gains, and the corruption of Wall Street…

As it turned out, everyday voters cared more about those hot button topics than the rich getting richer.

And more of the everyday blue-collar democratic voters leaned towards the right on Trump’s issues. That’s how key swing states in the Midwest were won, earning the electoral college despite losing the total vote.

The red states have exports of $2.1 million versus blue states at $1.7 million. That’s 24% higher for red state exports.

But the numbers get worse…

When you look at exposed jobs in red states at 3.9 million versus 2.5 million in the blues states, things don’t look so good.

The red states have 56% more exposed jobs than blue states.

The chart below shows the states that have a higher median exposure of 9.8% of GDP to the tariff retaliations expected.

Texas – the largest – is at 16%.

There are only four out of 20 for the blue states, with Oregon the highest at 18%.

And the largest, California, near the median at only 10%.

Also, notice how there are 30 red states against 20 blue. The red are generally more rural, while the blue more urban, which means less territory, but higher density (and hence more liberal).

It was the rural leaning states that gave Trump the edge in winning the white swing voters there at more like 80%.

And it also favored him in the electoral college, which favors space over density.

Red states – being more numerous and affected – had an especially large impact on the Senate. Each state gets two, regardless of population (unlike the House).

The red states with the highest exposure to GDP, in order, are: Indiana, Louisiana, Texas, North Carolina, Iowa, Kentucky, Oklahoma, and Michigan.

The blue states are: Oregon, Minnesota, California, and New Mexico.

So, we’ll see how those swing voters feel when they start losing their jobs…

And a recession – an eventual depression by my forecasts – will clearly hurt the incumbent president and his party.

This will very likely happen by early 2020, just ahead of the next major election.

I always stated that whoever won in 2016 would not be re-elected in 2020!

When the 1929 crash and Great Depression set in, a businessman (Hoover) had been elected in 1928 as a Republican…

And who won big in 1932? Well, you should know the outcome of that by now…

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2018 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.