Stock Market vs. Gold, Long-term Treasury Yields, 10yr-2yr Yield Curve 3 Amigo's Update

Stock-Markets / Financial Markets 2018 Jul 15, 2018 - 03:27 PM GMTBy: Gary_Tanashian

You have better things to do than read droning macro analysis or long, drawn out investment theses. It is a weekend in the dead of summer and for that reason we go easy this week; real easy.

You have better things to do than read droning macro analysis or long, drawn out investment theses. It is a weekend in the dead of summer and for that reason we go easy this week; real easy.

The 3 Amigos are here to simply say that things are as they have been, with Amigo #2 (long-term yields) getting home and pulling back on cue, and the other two (SPX/Gold ratio & Yield Curve) still in process and indicating risk ‘on’ and ‘boom on’, respectively.

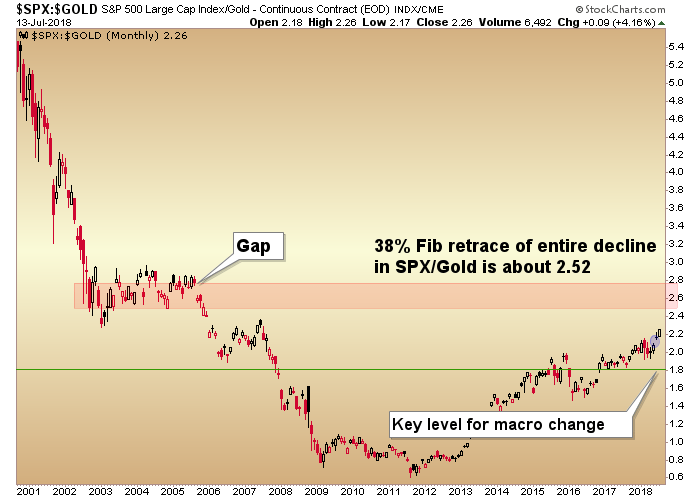

Amigo #1 (Stock Market vs. Gold)

While gold bug sentiment, Commitments of Traders and the historical seasonal pattern all indicate a good potential for a gold rally coming soon, the stock market’s ratio to gold continues to indicate that risk is on and the play has certainly not been to be hiding in precious metals from the stock crash that never arrives. Quite the contrary.

The question here is whether or not SPX/Gold is going to take an interim downturn before registering the upside target. We are working with short-term charts and indicators each week in NFTRH to refine the potential and be ready for such an outcome. But this big picture view is what it is and has been since early 2013; bullish for the cyclical, risk ‘on’ world.

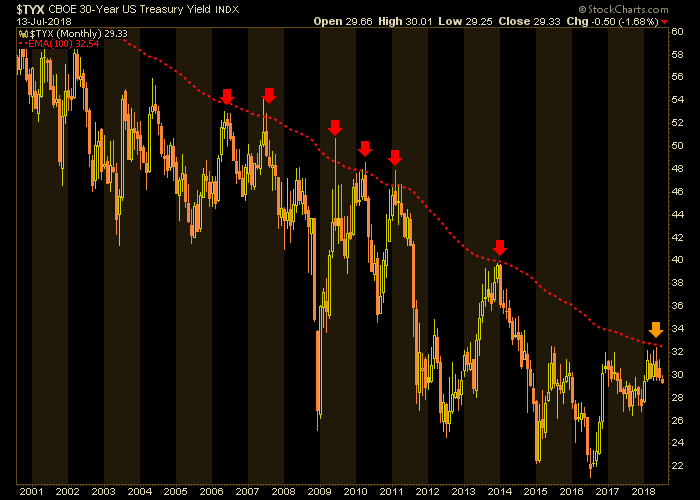

Amigo #2 (Long-term Treasury Yields)

The pullback in yields continues after the 30yr smashed right into our limiter, the 100 month EMA. This Amigo is recuperating and resting at the hacienda, enjoying sangria and waiting for the other two to finish their rides across the macro. Amigo #2 may well ultimately decide whether the next crisis will be inflationary or deflationary. He’s home, and waiting.

As a throw-in, this reminder that the experts may one day be right, but the fact is Treasury yields have gone from 3.2% to today’s 2.9% (i.e. bonds have gone up) since this headline riled everyone up. Your friends at nftrh.com stand ready to highlight the errr, folly of sensational media headline making as needed. ;-)

Another Heavy Hitter Calls Bond Bear (March 1, 2018)

Moving on to the much obsessed about (lately) Amigo…

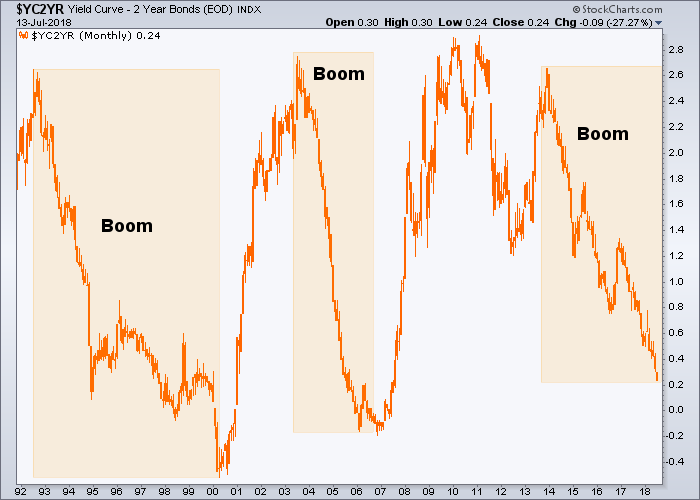

Amigo #3 (10yr-2yr Yield Curve)

What, you expected something different?

It’s a boom.

Same as it has been since, yup, 2013.

The advice here continues to be to tune out the noise about the curve heading toward inversion and how recessions follow inverted yield curves. Well yes, recessions tend to follow inversions after the curve begins turning up. But a note of caution on that; you might also want to tune out the media’s obsession with inversion all together. The curve is under no obligation to invert before turning up.

Such an upturn could be factored along with the state of Amigo #2’s nominal long-term yields in order to define the nature of the bad stuff that would be brewing at such time. But as of now to paraphrase Babu, where is upturn? You see upturn? Show me upturn! There is no upturn!

The positive Amigos (1 & 3) above could be interrupted this summer for a bearish market phase within a still bullish bigger picture or they could spike up and down respectively, intensifying then ending the party sooner rather than later. Another alternative is that the bullish grind could continue with sentiment never really going over the top bullish. The Macro Tourist checked in this week with some thoughts on that scenario.

The bottom line however, is that as of this fine Friday afternoon in mid-July, things are as they have been since Amigo #2 smashed into the limiter and recoiled. The macro picture is still bullish on the big picture. The short-term work we do weekly in NFTRH will help us define any interim events to the contrary. We work on that in an ongoing way while enjoying the summer and what is left of the boom.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.