Powell is Playing “Chicken” With $10 Trillion in $USD Shorts

Interest-Rates / US Federal Reserve Bank Jun 25, 2018 - 03:09 PM GMTBy: Graham_Summers

Thus far in his tenure as Fed Chair, Jerome Powell has emphasized that he is more concerned with the real economy than the financial markets.

Thus far in his tenure as Fed Chair, Jerome Powell has emphasized that he is more concerned with the real economy than the financial markets.

Put another way, the Powell Fed, unlike the Bernanke or Yellen Feds before it, is willing to sacrifice stocks in the name of normalizing monetary policy provided the economy can withstand it.

As a result of this, the Powell Fed intends to continue with its rate hikes as well as the increase in QT (we go to $50 billion per month in July), despite the clear evidence that these policies is putting the financial markets under duress.

Indeed, already we’re seeing something of a meltdown in the Emerging Market space with Brazil, Turkey and other Emerging Stock Markets crashing.

Here’s where it gets interesting.

Globally there is over $10 trillion in $USD shorts floating around the system. And with both rate hikes and QT strengthening the $USD, Powell is effectively playing “chicken” with this massive issue (at $10 trillion, this is roughly the size of the GDP of China).

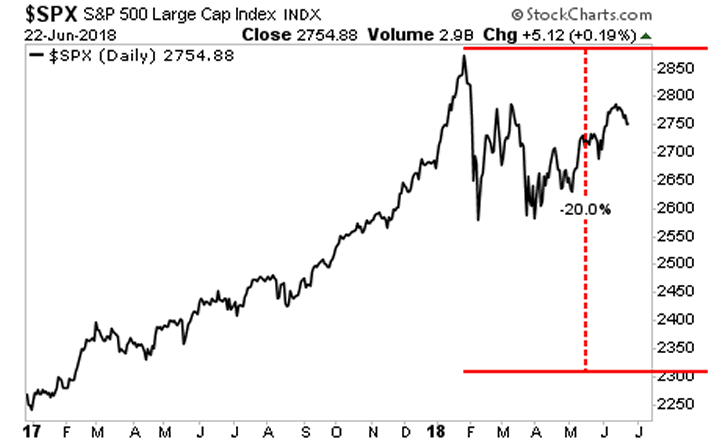

So while he claims he is willing to stomach market volatility, this might prove to be a bluff if the $USD short issue becomes systemic. Most Emerging Markets are already 20% off their recent peaks. If US stocks were to experience a similar drop, the S&P 500 would be at 2,300.

On that note, for the first time in 18 months, there is a significant risk that the markets might actually enter a free fall. Powell is playing a dangerous game. And if the Fed doesn’t walk back its policy there is a very real chance that the US markets could experience carnage similar to that which has already hit the Emerging Market Space.

If the Fed doesn’t figure this out soon, we could very well see a market bloodbath hit.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We’ve extended our offer to download this report FREE by one week. But this week is the last time this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.