Soybean Price Hits 9 Year Low Due to Trade War

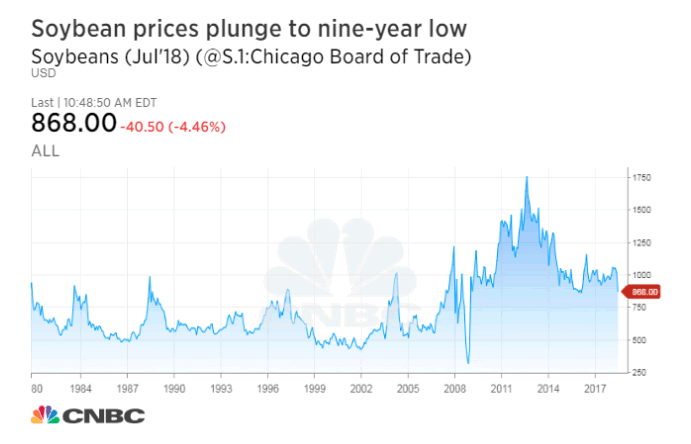

Commodities / Agricultural Commodities Jun 24, 2018 - 04:50 PM GMT Early this week the price of Soybean futures (ZS_F) plunged to a new low in more than 9 years due to the tit-for-tat trade war between U.S. and China. Soybean Futures started to drop on Friday last week after Trump administration decided to go ahead with 25% tariff on $50 billion worth of goods from China. The list of targeted goods includes technology products which are part of Beijing’s Made in China 2025 initiative.

Early this week the price of Soybean futures (ZS_F) plunged to a new low in more than 9 years due to the tit-for-tat trade war between U.S. and China. Soybean Futures started to drop on Friday last week after Trump administration decided to go ahead with 25% tariff on $50 billion worth of goods from China. The list of targeted goods includes technology products which are part of Beijing’s Made in China 2025 initiative.

China quickly retaliated with its own 25% tariff on 545 U.S. goods worth equal value, including agricultural products such as soybeans, corn, and wheat. Soybean futures for July delivery dropped more than 7% to $8.415 a bushel, the lowest since March 2009. The price is now 10% down for the year, and more than 17% down for the quarter.

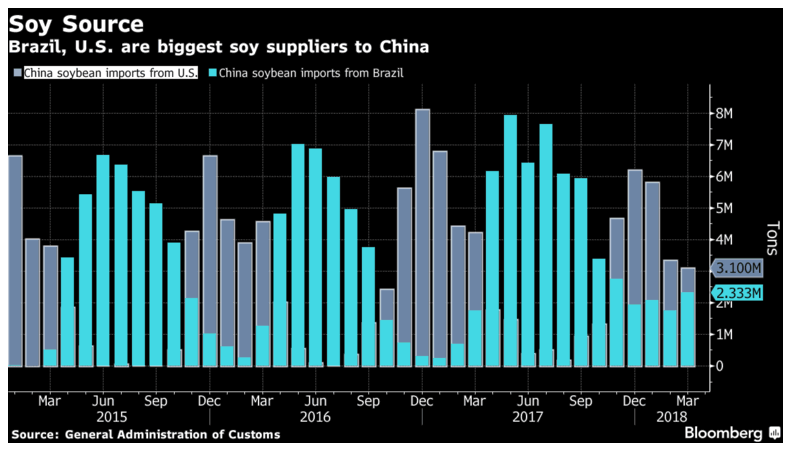

According to the study by Purdue University, if Beijing applies 10% tariff on U.S. Soybeans, total soybean exports could drop by 18%. China still buys more soybeans from the U.S. than any other agricultural commodity. Last year, China bought $14 billion worth of soybean. China is the world’s biggest importer of soybean and America’s largest buyer.

In the short term, as the world’s top importer, China can not fulfill its soybean needs without importing massive quantities of the U.S. product. China still needs U.S soybean in a few months, even next year. However, if the trade war drags on for a long time, China can look for an option which could have irreversible effects on U.S. markets.

Due to the tariff, short term China will feel the pain of having to purchase U.S. soybean at higher cost in the next couple of months. The higher price that China needs to pay however is somewhat offset by the declining Soybean Futures price. U.S farmers on the other hand are also feeling the pain with soybean futures price near 10 year low. In the long run, depending on how long the conflict persists, the unintentional result can be that China can adapt without U.S soybean.

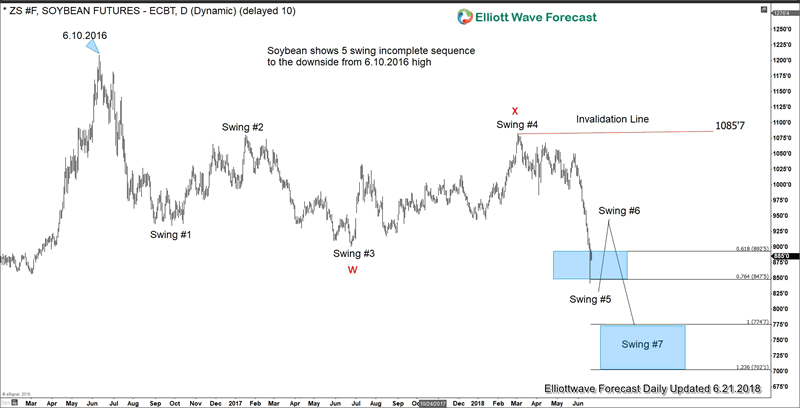

Soybean Daily Elliott Wave Analysis

Daily chart of Soybean Futures (ZS_F) shows a 5 swing incomplete sequence from 6.10.2016 high, favoring further downside. Please note that this 5 swing does not refer to well-known 5 waves impulse in Elliott Wave Theory. Rather, it’s part of a 7 swing structure, which is also known by the name of double three Elliott Wave structure (WXY). You can learn more about this special structure by watching the video “How to trade WXY Elliottwave Structure.” Soybean Futures is expected to bounce in swing #6 and as long as the rally fails below swing #4 (1085.7), then it’s expected to extend lower towards 702.1 – 774.7. So the price per bushel target is $7.02 – $7.75 approximately.

If you are interested to see Elliott Wave analysis on Soybean or other commodities, forex, and Indices, you are welcome to take 14 days FREE Trial, You can check our service and get Elliott Wave chart updates in 4 time frames, live session, and signal service (live trading room).

By Ayoub Ben Rejeb

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 78 instruments including Forex, Commodities, Indices and a number of Stocks & ETFs from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup and Weekend videos .

Copyright © 2018 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.