The Euro Crashed Yesterday. Bearish for Euro and Bullish for USD

Currencies / Euro Jun 15, 2018 - 07:27 PM GMTBy: Troy_Bombardia

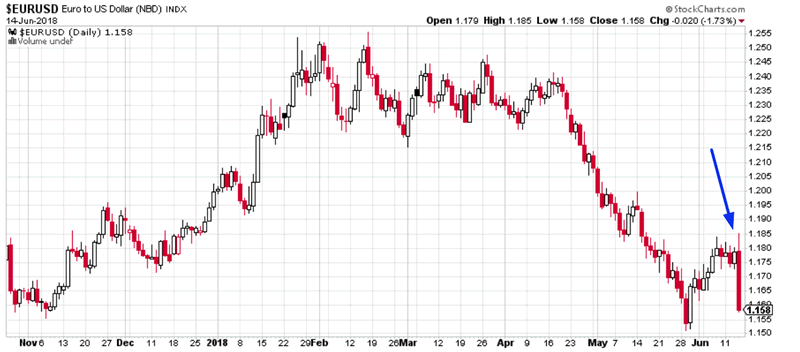

The Euro crashed yesterday on the ECB’s meeting. This is the worst 1 day crash since June 2016 (Brexit).

Previous market studies demonstrated that the U.S. Dollar would probably head higher in the next few months and the Euro would head lower, which seems to be happening right now. Yesterday’s EURUSD crash exceeded 1.7% in one day, which is a lot for forex.

Here’s another market study that comes to a similar conclusion.

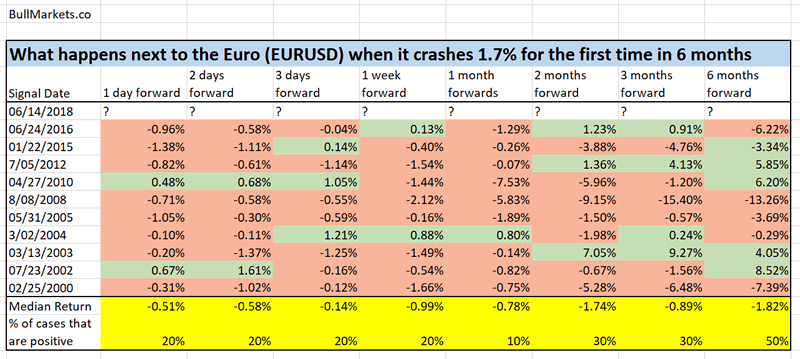

Here’s what happens next to the Euro when it crashes 1.7% in 1 day (excluding overlapping cases in the past 6 months).

Click here to download the data in Excel.

Notice how the Euro’s forward returns are very bearish. Here are the historical cases in detail.

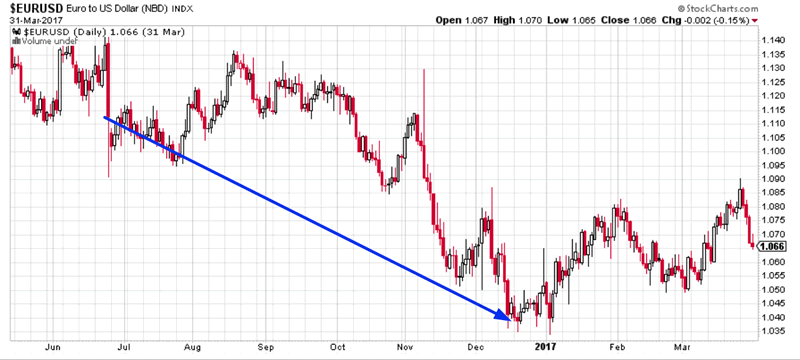

June 24, 2016

The Euro kept going down over the next half year.

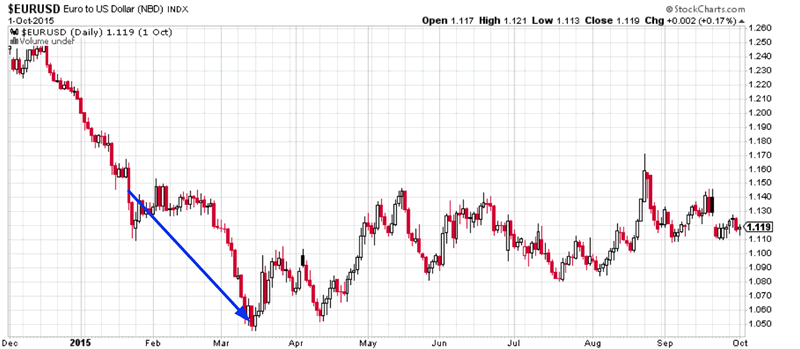

January 22, 2015

The Euro fell for another 2 months.

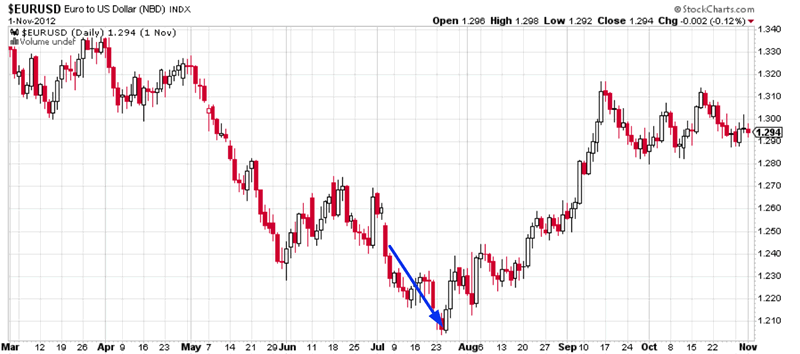

July 5, 2012

The Euro fell for another 3 weeks.

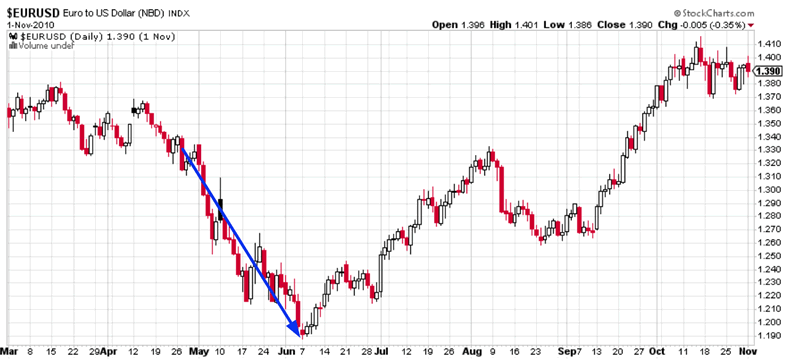

April 27, 2010

The Euro fell for another 1.5 months.

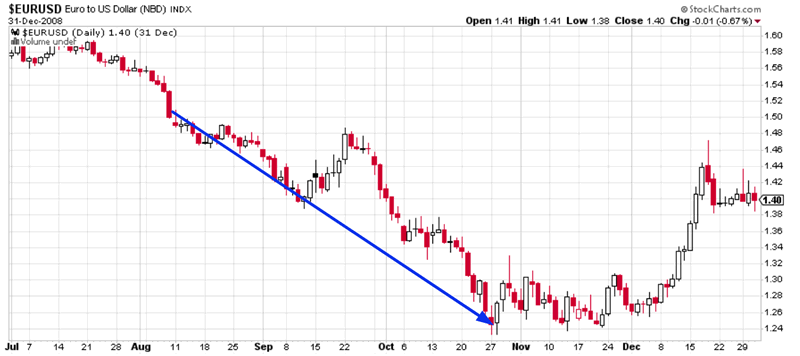

August 8, 2008

The Euro fell another 2.5 months.

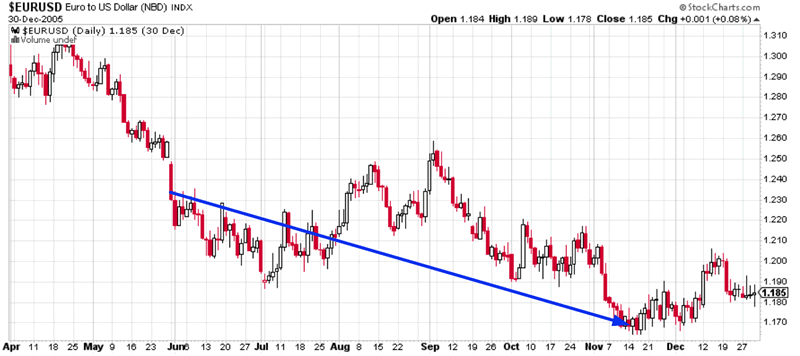

May 31, 2005

Euro trended lower over the next 5 months.

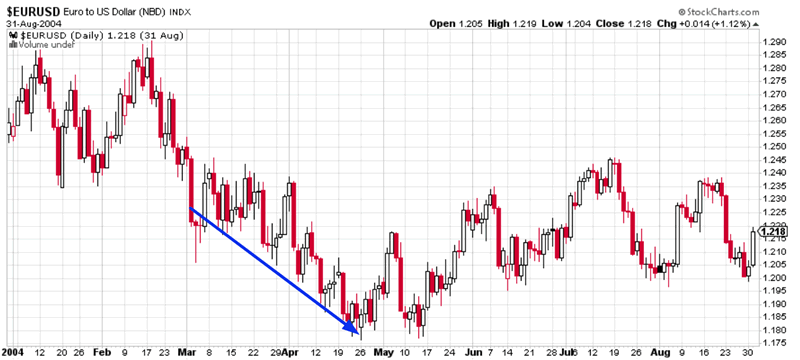

March 2, 2004

The Euro fell another 1.5 months.

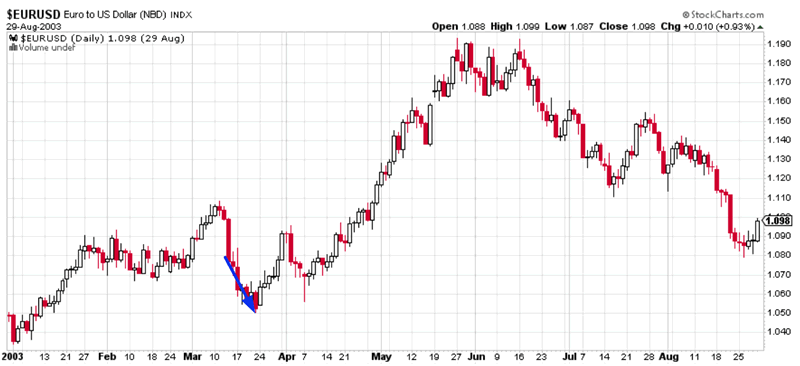

March 13, 2003

The Euro fell 1 more week.

July 23, 2002

The Euro fell another 2 weeks and then swung sideways for months.

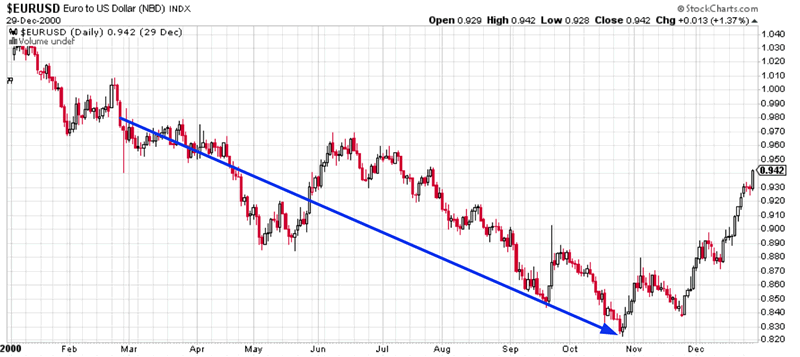

February 25, 2000

The Euro fell throughout the rest of the year.

Conclusion

As you can see, this is a short-medium term bearish sign for the Euro. And since EURUSD accounts for 57% of the U.S. Dollar Index, this is a bullish sign for the USD.

Pretty much every single case saw the Euro head lower in the next few weeks or months.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.