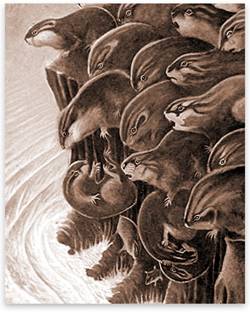

Bailout Lemmings Getting Ready to Jump Over the Cliff

Stock-Markets / Financial Markets Sep 13, 2008 - 09:15 AM GMT

Now that Fannie Mae and Freddie Mac are placed under conservatorship, you would think that the politicians would step away from that mess and let things settle down. Instead, the U.S. Senate Banking Committee members urged Fannie Mae and Freddie Mac , the mortgage companies placed under federal control this week, to freeze foreclosures on loans in their portfolios for at least 90 days.

Now that Fannie Mae and Freddie Mac are placed under conservatorship, you would think that the politicians would step away from that mess and let things settle down. Instead, the U.S. Senate Banking Committee members urged Fannie Mae and Freddie Mac , the mortgage companies placed under federal control this week, to freeze foreclosures on loans in their portfolios for at least 90 days.

Fannie and Freddie can foreclose on loans they either own or guarantee, which is nearly half of the $12 trillion U.S. residential mortgage market. While they can direct servicers to stop foreclosure proceedings, other stakeholders, including private mortgage insurers, have some say in the process. ``Schumer really has to start thinking about what's in the best interest of the majority of taxpayers and I'm not sure that freezing foreclosures is in the best interest of the majority of taxpayers,'' said Joshua Rosner , an analyst with independent research firm Graham Fisher & Co. in New York. ``It would just prolong the agony.''

Folks, the agony is already being prolonged. One of the reasons why Fannie and Freddie were placed into conservatorship is the fact that many mortgages being held or guaranteed by these companies are already over 2 years in arrears! Our senators need to step away from this mess before they create an even larger one. Of course it is obvious that they simply want to delay the inevitable until after the elections.

Lehman; “Buy me, please!”

Lehman Brothers Holdings Inc. Chief Executive Officer Richard Fuld is seeking buyers for the investment bank amid signs that the U.S. government may balk at providing the funding that enabled Bear Stearns Cos. to sell itself and avoid bankruptcy. Without a ``strategic arrangement'' in the ``near term,'' Lehman's credit ratings may be downgraded, Moody's Investors Service said after Lehman reported the results. A downgrade could ratchet up Lehman's borrowing costs and deter others from trading with the firm. This could spell bankruptcy for Lehman. The sharks are circling…

The line in the sand is drawn…

…and the S&P 500 index is only a step away. U.S. stocks fell for the first time in three days, led by consumer and financial shares, as retail sales unexpectedly decreased and concern grew that the government will balk at funding a bailout of Lehman Brothers Holdings. ``The worst in terms of the economy, financial crisis and the banking crisis is ahead of us, not behind us,'' said New York University economist Nouriel Roubini . ``The U.S. consumer is now on the ropes. The only light at the end of the tunnel is that of the incoming train.''

…and the S&P 500 index is only a step away. U.S. stocks fell for the first time in three days, led by consumer and financial shares, as retail sales unexpectedly decreased and concern grew that the government will balk at funding a bailout of Lehman Brothers Holdings. ``The worst in terms of the economy, financial crisis and the banking crisis is ahead of us, not behind us,'' said New York University economist Nouriel Roubini . ``The U.S. consumer is now on the ropes. The only light at the end of the tunnel is that of the incoming train.''

The trap is sprung.

Treasury bonds and notes consistently for two months as investors flocked to this perceived “safe haven.” Bond investors were even betting that the Federal Reserve may lower interest rates again in October. Whether they do or not, this rally was very extended and getting old by any technical measure. Just when the “bullish talk” and sentiment became extreme is when the turn came. Virtually no one was expecting this.

Treasury bonds and notes consistently for two months as investors flocked to this perceived “safe haven.” Bond investors were even betting that the Federal Reserve may lower interest rates again in October. Whether they do or not, this rally was very extended and getting old by any technical measure. Just when the “bullish talk” and sentiment became extreme is when the turn came. Virtually no one was expecting this.

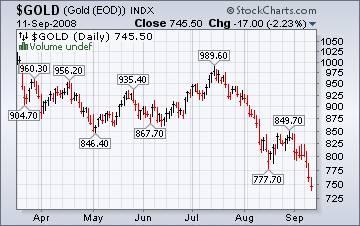

Gold may bounce here, but the decline isn't over.

Last week I asked “Where is your exit strategy?” to those who were still long in gold. The decline has since extended below the support levels that I had suggested. According to the latest Bloomberg article , “Gold rebounded from an 11-month low in London as the dollar fell against currencies such as the euro, bolstering the appeal of the metal as a hedge against further declines.” Another comment made, “The bottom seems close.” Is yet another sign that investors haven't thrown in the towel. That means more declines to come.

Last week I asked “Where is your exit strategy?” to those who were still long in gold. The decline has since extended below the support levels that I had suggested. According to the latest Bloomberg article , “Gold rebounded from an 11-month low in London as the dollar fell against currencies such as the euro, bolstering the appeal of the metal as a hedge against further declines.” Another comment made, “The bottom seems close.” Is yet another sign that investors haven't thrown in the towel. That means more declines to come.

The Nikkei is on a roller coaster.

The Nikkei hit a 6-month low on Thursday, then rallied 106 points on Friday on hopes that Lehman Brothers holdings would find a buyer. But time is running out for Lehman and the backlash from the rescue of Bear Stearns is leaving doubt that the Feds will do it again.

The Nikkei hit a 6-month low on Thursday, then rallied 106 points on Friday on hopes that Lehman Brothers holdings would find a buyer. But time is running out for Lehman and the backlash from the rescue of Bear Stearns is leaving doubt that the Feds will do it again.

Remember, if its Friday, the FDIC will probably be closing another bank over the weekend. That suggests the market may wake up with a hangover on Monday.

China to raise electricity rates. Power companies rebound, but little else.

Central banks efforts to cool down the economy have led to a 61% decline in the Shanghai index this year. Now Chinese investors are again looking to the government to “do something.” However , raising electricity rates will not help the general populace, only the big utility companies and their stockholders. As we have noted earlier, government meddling can only make things worse, as the law of unintended consequences takes charge.

Central banks efforts to cool down the economy have led to a 61% decline in the Shanghai index this year. Now Chinese investors are again looking to the government to “do something.” However , raising electricity rates will not help the general populace, only the big utility companies and their stockholders. As we have noted earlier, government meddling can only make things worse, as the law of unintended consequences takes charge.

Did Lehman sink the dollar today?

The press is always looking for a fundamental reason for financial events, such as the sudden decline in the U.S. dollar. The fact is, there has been bad news on Lehman for a long time, yet the dollar rose. Why did it drop today? Could there be another reason that is not found in the headlines, such as human behavior patterns? Earlier this morning, the Sydney Morning Herald attributed gold's demise to the rising dollar. Can you really say that one event causes another to happen? Historically, there is not proven long-term link between the price of gold and the U.S. dollar. Could it be that every asset is marching to its own drummer and the chance of any correlation is purely coincidental?

The press is always looking for a fundamental reason for financial events, such as the sudden decline in the U.S. dollar. The fact is, there has been bad news on Lehman for a long time, yet the dollar rose. Why did it drop today? Could there be another reason that is not found in the headlines, such as human behavior patterns? Earlier this morning, the Sydney Morning Herald attributed gold's demise to the rising dollar. Can you really say that one event causes another to happen? Historically, there is not proven long-term link between the price of gold and the U.S. dollar. Could it be that every asset is marching to its own drummer and the chance of any correlation is purely coincidental?

Did the Bank of China force the Fed's hand on Fannie and Freddie?

For anyone who still doubted the growing global influence of such emerging powerhouses as China, consider this: The U.S. government's decision to take control of foundering mortgage giants Fannie Mae ( FNM ) and Freddie Mac ( FRE ) was driven not by worries about the fading U.S. housing market, but by concerns that foreign central banks in China, Japan, Europe, the Middle East and Russia might stop buying our bonds.

For anyone who still doubted the growing global influence of such emerging powerhouses as China, consider this: The U.S. government's decision to take control of foundering mortgage giants Fannie Mae ( FNM ) and Freddie Mac ( FRE ) was driven not by worries about the fading U.S. housing market, but by concerns that foreign central banks in China, Japan, Europe, the Middle East and Russia might stop buying our bonds.

Our country is now dependent on the charity of strangers who may not even like us. The Fed's hand may have been forced by threats of foreign central banks of selling their mortgage bonds and causing even more devastation in the mortgage market. But the bailout option is also very slippery and expensive , according to Mish. We are between a rock and a hard place.

A happy outcome for petroleum prices.

The Energy Information Administration reports that, “ Whether Americans decided against vacations this summer—or at least made them more efficient or closer to home (“staycations”)—or are carpooling or using more public transportation, the message is clear: sustained high retail prices for motor gasoline are having an impact on the American driver. U.S. gasoline demand, according to the Energy Information Administration (EIA), declined by 2.3 percent in May and 4.4 percent in June, compared with the same time periods a year ago. This reflected the largest decline in year-ago gasoline demand in May since 1980 and the fifth-largest year-ago decline in any May since at least 1945. For June the comparisons are even more dramatic, with the year-ago decline this June the largest since 1980 and the third-largest since 1945.”

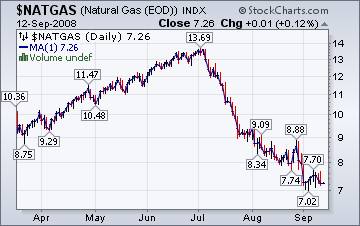

Will Ivan make a difference?

The Energy Information Agency's Natural Gas Weekly Update tells. “ Natural gas spot prices increased at most market locations in the Lower 48 States this report week (Wednesday–Wednesday, September 3-10), as the fifth hurricane of the season moving through the Gulf of Mexico has prompted mandatory evacuation orders in some areas as well as evacuation of personnel from offshore platforms. Mandatory evacuation orders in Louisiana have led to the shutdown of at least two processing plants, with a total of 700 million cubic feet (MMcf) per day of processing capacity.”

The Energy Information Agency's Natural Gas Weekly Update tells. “ Natural gas spot prices increased at most market locations in the Lower 48 States this report week (Wednesday–Wednesday, September 3-10), as the fifth hurricane of the season moving through the Gulf of Mexico has prompted mandatory evacuation orders in some areas as well as evacuation of personnel from offshore platforms. Mandatory evacuation orders in Louisiana have led to the shutdown of at least two processing plants, with a total of 700 million cubic feet (MMcf) per day of processing capacity.”

Don't Bail them out!

Lewellyn H. Rockwell Jr. has done it again. In his article entitled, “ Don't Bail them Out !” He gives many sources of research on the Great Depression and how it was made worse by well-intentioned politicians. This article is a must-read for those of you who want to know where we are headed.

Lewellyn H. Rockwell Jr. has done it again. In his article entitled, “ Don't Bail them Out !” He gives many sources of research on the Great Depression and how it was made worse by well-intentioned politicians. This article is a must-read for those of you who want to know where we are headed.

America is now imprisoned by these fallacious views of cause and effect. For this reason, we see virtual unanimity that the bailout (call it want you want: conservatorship, nationalization, socialization, whatever) of Freddie and Fannie must take place.

On the day following the nationalization, a day that will live in infamy, the Wall Street Journal editorialized against the Democrats and their reform efforts, but didn't actually oppose the bailout; instead it observed that we are all somehow "on the hook." The paper also published a piece by McCain/Palin which said that the bailout is "sadly necessary."

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.