Is Jeff Gundlach Correct on Gold’s $1000 Upside?

Commodities / Gold and Silver Stocks 2018 Apr 30, 2018 - 02:17 PM GMTBy: Jordan_Roy_Byrne

It was music to gold bug ears.

It was music to gold bug ears.

We’ve all heard the seemingly shocking or outrageous price targets for Gold. So it’s not new.

But this time from a non gold pusher. Someone with credibility in the larger financial world and a track record to boot.

Gundlach’s comment was included in every piece of Gold literature that recently crossed my desk. No doubt, if Gold starts breaking to the upside, Gundlach’s quote will be used by aggressive marketers and publishers. But I digress.

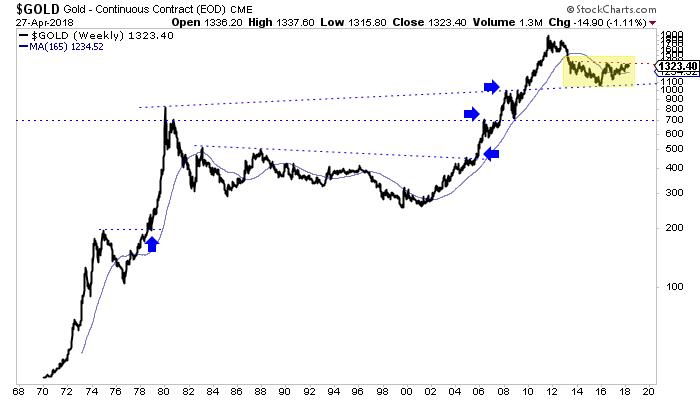

According to ZeroHedge, Gundlach said that based on classic chart reading, there is an “explosive, potential energy” of a huge “head and shoulders bottom” base, signaling a move of $1000/oz.

But there’s one problem.

I like Jeff Gundlach. He’s way smarter and way more successful than me.

But there’s no technical basis for $1000/oz upside in Gold.

The measured upside target from the recent years of consolidation projects to $1700/oz. Upon a break above $1375/oz, the target becomes $1700/oz, with a pit stop likely around $1550/oz.

The next strong technical targets, following $1700 are $1800 and $1900, the all-time high.

The biggest moves (in nominal terms) in most markets occur after breakouts to new all time highs.

As you can see, Gold is one of the best examples of this. Look at how Gold surged after 1971, 1978 and 2009.

Gold Weekly Line Chart

The potential breakout through $1375/oz would be the most significant one since 2005 when Gold took out +20 year resistance to make a new multi-decade high. Sure, the breakouts in 2008 and 2009 were quite significant but Gold’s bull market was already well established.

Circling back to Gundlach’s target, I don’t see anything technically that points to $2,375 being a strong target. The strongest targets are $1700, $1800 and $1900. The most significant upside move would likely be a retest of the all time high. That is roughly $525/oz of upside.

But upside of $1000/oz sounds better and makes for better headlines than $525/oz of upside. In other words, it will get picked up by media outlets. (Think of Jim Rickards $10,000 target which has been given quite a bit of coverage on mainstream outlets).

My guess is Gundlach thinks Gold is going to break to the upside and his $1000/oz upside call is a way for him to get credit for calling the breakout while remaining front and center in the media.

At present, Gold is trying to recover after failing to make a weekly close above $1350/oz for five consecutive weeks. The good news is the gold stocks have held up quite well and so too has Gold priced against foreign currencies. If these conditions persist during weakness in Gold then it suggests Gold would have another chance to breakout sooner rather than later. In anticipation of that breakout, we have been accumulating the juniors with 300% to 500% upside potential over the next 18-24 months.

To follow our guidance and learn our favorite juniors, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.