Precious Metals and Mining Stock Chart Paints A Clear Picture

Commodities / Gold and Silver Stocks 2018 Apr 30, 2018 - 09:21 AM GMTBy: Chris_Vermeulen

In this article, we are going to explain and show you an interesting pattern that has been slowly forming over the past year in the precious metals sector. This pattern along with our analysis point to a significant rally to start in the next 4 months for gold, silver, platinum, palladium, and miners.

Before we get into the details, below, it is important for every trader to step back and look at the bigger picture. It’s way too easy to get sucked into the markets movements, become an emotional trader, start losing a few trades, and second-guessing your open positions.

We receive hundreds of emails every week from followers, and to be honest, this is one of the most powerful indicators available for letting us know when the majority of people are frustrated and have become emotional traders. Based on recent emails, their tone of the message, and market outlooks we can tell everyone is emotional and not seeing the market from a normal unemotional perspective.

There is no doubt it is easy to get caught-up in the market and become an emotional trader if you don’t have a proven trading strategy for each type of market condition, advanced trading analysis, or trading guidance from a proven trading newsletter.

These past 30 trading days have been really tough to trade because the market is chopping around with huge one day moves back to back. Sometimes, its best to sit, watch and wait for some dust to settle before getting overly involved with new trades which is what we have done. Recently we traded YANG for a quick 8% profit, then we closed out two trades in TNA to profit 10.1%, then another 17.7% this month. Other than that, that’s about it. Now, with that said, things are about to get really exciting for us traders and we are getting ready for some new trades, both short-term and longer-term, looking forward many weeks and where the market should be headed.

Enough about all that emotional stuff, let’s jump right into the charts so you can see what we are excited about in this post!

Weekly Custom Precious Metals Weekly Chart

The chart below shows several interesting data points and it’s fairly easy to see and understand.

Starting at the bottom of the chart you will see the purple line which is the Relative Strength Index (RSI). If we look back 4 years you can see a similar pattern unfolding which leads to a massive rally for precious metals back in 2016.

Knowing human behavior patterns don’t change, but rather repeat, it is likely we see another upside breakout and rally later this year. That does not mean, the price will go straight up, it simply means on average over time we should expect higher prices.

Before any new rally can take place, the precious metals sector must breakout above the pink falling trend line, just as it did in 2016.

If you didn’t notice already, we have posted our weekly cycle analysis for the precious metals complex. Over the next 6 – 8 weeks the sector should start to rally and try to break out. Again, this does not mean everything in the precious metals sector will rise. In fact, there are a couple areas you will want to stay away from. We share the best trade setups and alerts with our subscribers as they occur.

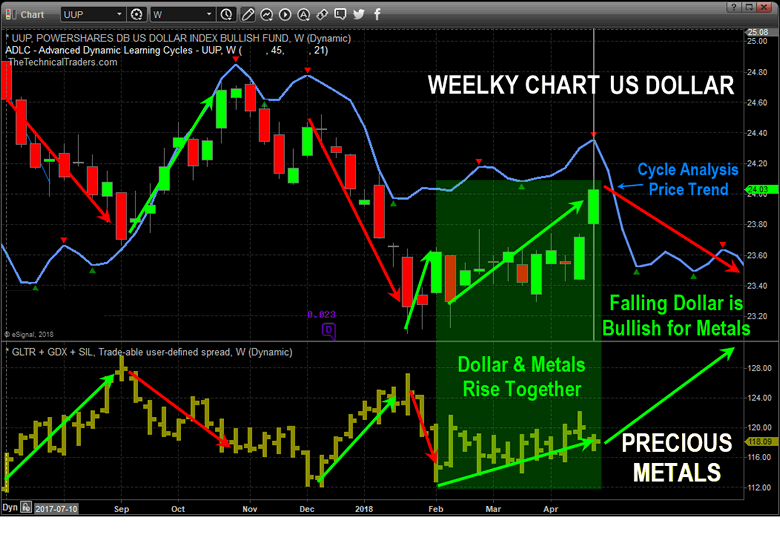

Weekly US Dollar and Precious Metals Comparison Chart

Here we show you on the chart the basic concept of how a falling dollar will push the price of gold higher, and how a rising dollar pulls metals lower on average. But this is not always the case. In fact, recent price action shows the dollar moving sharply higher while the precious metals sector moved sideways and higher. This looks like bullish divergence from their normal correlation and is likely caused by different global market dynamics injecting some new level of a fear that is funneling money into gold as a global safe haven.

Concluding Thoughts:

In short, we at www.TheTechnicalTraders.com have been talking about the new bull market slowly setting up for precious metals since late 2017. As an investor and trader its always nice to be able to look forward knowing with a high probability what asset classes should be moving in and out of favor so we can position our capital accordingly.

If our analysis is correct once again, then over the next couple months this sector should be testing critical resistance to breakout and rally above the pink trend line. If you want to stay ahead of the markets and profit from our technical analysis then join the Wealth Building Newsletter now and get ready for this week!

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.