Currency Wars: The Race to the Bottom has Begun

Currencies / Currency War Apr 27, 2018 - 03:38 PM GMTBy: Richard_Mills

As a general rule, the most successful man in life is the man who has the best information.

As a general rule, the most successful man in life is the man who has the best information.

If trade wars and actual shooting wars (Syria, Yemen) weren't enough for the world economy to worry about, pressuring stock markets and threatening to derail robust global economic growth, there is another elephant in the room looking to stomp on traders, investors and everyday consumers, and that is a currency war.

What is a currency war?

A currency war is what happens when countries intentionally devalue their currencies through their central banks. Increasing the money supply lowers interest rates and the value of the currency, thereby depressing the exchange rate. The best example of this type of expansionary monetary policy is that of the United States Federal Reserve. The Fed buys Treasury notes from its member banks, giving them more money to lend. To do this, the Fed must print more US dollars. The idea is to stimulate demand by reducing lending rates and therefore entice businesses and individuals to borrow and spend more money. Until last September, when the Fed wound up its last round of quantitative easing, this policy led to rock-bottom interest rates and has been behind the record-setting highs hit on US stock markets. Low interest rates mean companies can borrow, expand and grow, thus boosting profits and share prices.

In a currency war, those on the losing end of trading relationships decide to engage in a policy of competitive devaluation. By keeping their currencies low, through monetary policy explained above, the idea is that exports will be cheaper. On the other hand, devaluing a currency also makes imports more expensive, which can hurt companies that purchase a lot of foreign parts for assembling their products.

The term “currency war” was first coined by Guido Mantega, the former finance minister of Brazil, in 2010. Mantega was describing the competition between the US and China to have the lowest currency value, ergo the cheapest exports, which hurt Brazil because it meant that low interest rates implemented in the wake of the 2008 financial crisis caused investors to pour cash into Brazil, which had much higher bond yields. This made commodities that Brazil exported more expensive, because commodity prices rise when the dollar falls.

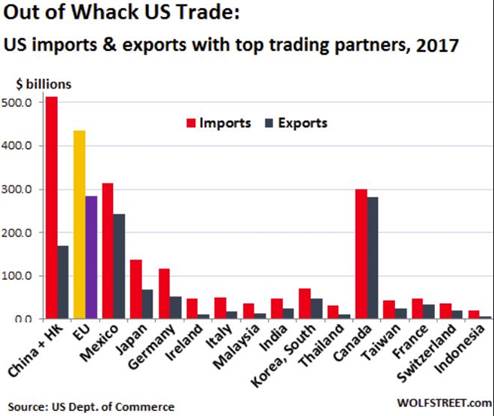

The problem for the United States is that throughout the past several years, the dollar has remained high in relation to other currencies, and that has created a large trade deficit – at last count $566 billion for 2017. It's a problem because a trade deficit means the US imports more than it exports – meaning consumers are buying more goods and services from abroad than locally. Exporters face resistance from buyers because products priced in dollars are more expensive.

It is primarily the result of the trade deficit – and especially the trade deficit with China, $337 billion in 2017 – that has prompted the Trump Administration to engage in a series of tariff threats with its most powerful economic competitor.

This article will show that not only is Trump engaging in a trade war, but also a currency war with China. Plus a bit of a history of currency wars. What does a currency war, and a low dollar, mean for investors and for commodities?

Trump and a currency war

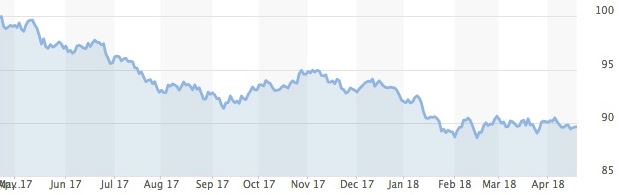

Trump campaigned on reducing the deficit by hammering US trading partners and promising to rip up “horrible trade deals” previous administrations had negotiated. This included NAFTA, the Trans Pacific Partnership which the US withdrew from, and the trading relationship with China which Trump has always described as unfair. Trump and other US officials have accused not only China but Germany, Russia and Japan as trying to gain a trade advantage by keeping their currencies weak. But Trump has been doing the same thing. Over the last year the US dollar index (the dollar against a basket of other trading partner currencies) has dropped 11.4%.

On Monday the President repeated his complaints about competitive currency devaluations from China and Russia, just as the US is raising interest rates – which will put upward pressure on the dollar. “Not acceptable,” Trump tweeted.

Bloomberg notes that China is indeed considering re-evaluating where it wants the level of the yuan to be, as it also weighs retaliatory measures on the United States which has threatened a total of $150 billion worth of tariffs, not including 10% tariffs on aluminum and 25% on steel indirectly aimed at China's steel industry which produces most of the world's steel. But it also points out that the yuan has gained 10% against the dollar over the past year, in March to the strongest level since August 2015. So much for the yuan undercutting the dollar.

Yuan rise against dollar

The publication states the latest Trump missive is evidence that the President plans to engage China, Russia and likely other trading partners in a war over exchange rates, with the goal being a weak dollar. His Treasury Secretary Steven Mnuchin said as much earlier this year when Mnuchin stated that a weaker dollar in the short term benefits the economy.

[Trump's comments are] “another implicit signal of the administration’s desire for a weaker U.S. dollar -- especially against major trading partners. These weak dollar expectations will remain entrenched in currency markets, especially if the administration continues its mercantilist [maximize trade] policy focus.” Viraj Patel, a London-based currency strategist at ING Groep NV

It's clear that a low dollar is part of Trump's plan to bring jobs back to the US after many were exported abroad to take advantage of lower labor costs, and therefore rebuild the US manufacturing sector, primarily, through cheaper exports. Quoting Trump:

“You look at what China is doing to our country in terms of making our product. They’re devaluing their currency, and there’s nobody in our government to fight them… they’re using our country as a piggy bank to rebuild China, and many other countries are doing the same thing.”

“Our country’s in deep trouble. We don’t know what we’re doing when it comes to devaluations and all of these countries all over the world, especially China. They’re the best, the best ever at it. What they’re doing to us is a very, very sad thing.”

Currency wars: A brief history

You don't have to be an economic historian to know that currency wars are nothing new. Previous presidents have intentionally depressed the dollar's value to increase trade, and in fact the idea goes as far back as the Roman Empire.

When the Romans gobbled up Egypt, Judea, Britain and Gaul, the Empire became stretched, with long supply lines requiring more money to maintain. The drain on gold and silver meant the Treasury could no longer meet its expenses with revenues, so Emperor Nero decided the only way to bridge the shortfall was to print more money (sound familiar?). He did this by reducing the amount of silver in the coins. This soon caught on with later Emperors, who during the next two centuries cut the amount of silver in coins from 96% to 0%. The printing of too many coins led to inflation and a trade deficit with its provinces, as explained nicely by Stephen Pope in Forbes.

Trump may seems like an outlier economic nationalist with his “Make America Great Again” slogan and promises to be more protectionist, but previous presidents have sung the same tune. Examples include all candidates in the 2016 Presidential election criticizing the TPP; Barack Obama and Hillary Clinton denouncing NAFTA in 2008 – threatening like Trump to renegotiate the treaty; and Ross Perot back in 1992 with his description of “the great sucking sound” of jobs disappearing to Mexico.

The first modern-day instances of currency wars occurred in the 1930s when countries decoupled their currencies from the gold standard. After the Great Crash of 1929 there was rampant unemployment throughout the developed world. When Germany devalued its currency in 1931, Britain – then the leading industrial power – was hard hit by having its foreign exchange reserves drained by speculators. The Brits thus decided to end the attachment of sterling to gold. Countries with ties to the British Commonwealth quickly exited the gold standard as well – leaving currencies to float on their own. The first modern-day instances of currency wars occurred in the 1930s when countries decoupled their currencies from the gold standard.

Free from a gold peg, these countries found that devaluing their currencies would boost their economies, a policy that became known as “beggar thy neighbour” because they could literally export unemployment to another higher-value currency country, just as China has done to the US.

Interestingly, Market Realist notes that this “go it your own” system destroyed any reason for countries to cooperate in financial matters and may have contributed to the Second World War:

The combination of the U.K split with gold and a U.S devaluation against gold that occurred in 1933 promoted the intended currency war tactic. Both economies' competitive devaluations prevented prices from falling, allowed money supplies to increase and bolstered production. The division between states created a chasm in cooperation. While this lack of international unity was not the sole catalyst to the destruction of peace that brought World War II, it was a part of a growing rivalry that would eventually experience real war. - Market Realist

The Bretton Woods Agreement of 1944 set up an international economic system resting on both gold and the US dollar. The signatories included all the major industrial powers including the US, Japan, Canada, Australia and Western Europe. The system worked well for about 30 years but in 1973 US President Nixon took the US off the gold standard. Other countries followed and currencies were again allowed to float against one another. But the US was clearly the most powerful currency, especially following an arrangement with Saudi Arabia in the early 70s to sell Saudi oil in US dollars in exchange for US military protection.

This post-Bretton Woods arrangement worked until 1999 when the European Union set up a monetary union with a single currency, the euro. This ended competition between European countries and instead set up a showdown between the dollar and the euro for currency dominance.

Unexpectedly however, the threat came from Asia, not Europe, in the mid-1990s. The collapse of Thailand's currency, the baht, in 1997 caused a contagion of devaluations throughout the region. Members of the ASEAN block were unable to pay their debts, forcing a bailout from the IMF. But as a condition of the bailouts, the countries were required to make regular debt repayments and to have a greater amount of foreign reserves. This created a new demand for the US dollar, the most powerful currency.

Fast forward to 2008, the financial crisis. With global growth in the tank, a new currency war was about to break out, with most developed countries seeing increased exports as the way out of the low growth dilemma. Countries began lowering interest rates to encourage borrowing and consumer spending, which also dropped currency valuations.

“In its latest effort to try and stimulate the U.S. economy, the Federal Reserve cut its key interest rate to a range of between zero percent and 0.25%, and said it expects to keep rates near that unprecedented low level for some time to come.” CNNMoney.com, December 16, 2008

Money started flowing to emerging economies out of developed economies, which offered higher bond yields such as the situation with Brazil described above.

One exception was Japan, which saw the yen lose about a third of its value between 2012 and 2014, meaning higher profits for exporters like Toyota.

Dollar Yen Exchange Rate

The Japanese took their success one step further, in 2016, lowering interest rates below zero in order to further stimulate their economy, through bond buying similar to what the Fed did during its quantitative easing rounds. The European Central Bank did the same thing in 2014.

An important milestone in currency war history was China's devaluation of the yuan in 2015. Cutting its rate by 1.9%, the biggest rate drop since 1994, caused a lot of pushback from the US and China's other trading partners. This however didn't stop the yuan from being allowed into the International Monetary Fund's Special Drawing Rights in 2016, which are supplementary foreign exchange assets controlled by the IMF.

Who benefits? Who loses?

There is a lot of debate about who are the winners and losers of a currency war. Intuitively the winner is the lowest currency but in reality the war is a race to the bottom where everybody loses. While exporters may receive a bump, higher import costs also hurt businesses dependent on foreign inputs, while consumers face higher prices ranging from food to gasoline to patio furniture from Walmart. The most pertinent question right now is, can the US win a currency war? The opinions are mixed.

On the loser end, pundits argue that because China owns the lion's share of US Treasuries, about $1.2 trillion, the “nuclear option” would be for China to dump its US Treasuries which would immediately raise interest rates because the new buyers would require an incentive to sop them up. Rising rates would increase the value of the USD. Mission accomplished. I don't think the Chinese would ever do this, for a couple of reasons. First, as long as the dollar remains the reserve currency, China will need dollars to buy commodities and to build infrastructure – such as those needed for the New Silk Road. Second, by buying Treasuries, China must print a lot of yuan, which decreases in value as it is used for international exchange purchases. The yuan is kept low. US bonds are also extremely liquid, so if China needed cash quickly, they could easily find buyers for them.

Jeffrey Frankel, a Harvard prof who writes for Project Syndicate, says that China doesn't need to sell any Treasuries to win a trade war with the US. All China needs to do is say it's planning to cut back on Treasury purchases. We saw this earlier this year. A rumored slowing of Chinese Treasury purchases immediately crashed bond prices and hiked yields. Falling bond prices usually signal a higher inflationary environment which would mean higher interest rates and increased stock market volatility.

Frankel and others also point out that while the Trump Administration frets over the trade deficit with China, what really matters is China's current account surplus with the US, which has actually been falling since 2008 (the trade deficit is the largest component of the current account deficit which includes interest and dividends, and foreign aid).

The recent Republican tax cuts are said to increase the current account deficit with China:

Simply put, the Republicans’ tax law – which emphasizes big cuts, especially for corporations and the highest-income earners – is virtually certain to widen the budget deficit and, in turn, increase the current-account deficit. Trump’s legislative victory implies the return of the infamous twin deficits that followed George W Bush’s tax cuts of 2001 and 2003, and Ronald Reagan’s cuts of 1981-1983. - The Guardian

Another factor likely to weigh on the dollar is Trump's promised infrastructure bill which should generate around $1.5 trillion. How will this be financed? The likelihood is the issuance of more Treasury bills, which will also be needed to finance the tax cuts. That would keep driving the dollar down, along with bond yields (demand for T-bills goes up which raises their prices and yields drop inversely) meaning a flight of capital to emerging markets, like China. The 10-year yield in January jumped above 2.7%, its highest level since 2014.

Others argue that the US could win a currency war.

According to the Pimco Blog the US is engaged in a “cold currency war” and it is winning. Why? Because Trump “carries the bigger stick” of protectionism. China seems to have more to lose in a trade and currency war, with a smaller economy than the US - $13.09 trillion compared to $20.2 trillion.

Author Joachim Fels also states that other parties in this trade dispute, like the EU and Japan, have done nothing so far to defend their economies against rising currencies and tariffs – both the Bank of Japan and the European Central Bank have trimmed bond purchases which should strengthen their respective currencies against the dollar.

Effects of a low dollar

A strong currency is generally thought to be good for the US economy because it keeps interest rates low and inflation at bay. A strong dollar however, as mentioned, is bad for exporters, but exporters are a relatively low percentage of the total economy, around 13% versus 66% for consumers. The more expensive import prices that result from a weaker dollar, including gasoline, therefore hurt more Americans than are helped by cheaper exports. Tourism of course rises and falls based on the value of the dollar, with a weak dollar keeping more Americans at home. Multinational firms that do a lot of manufacturing in the US, or do business in countries whose currencies are beating the greenback, will benefit from a low dollar.

The dollar and commodities

A weak dollar usually means stronger commodities prices. Because the USD is the reserve currency and most commodities are traded in dollars, the value of the dollar is of crucial importance in determining the value of the commodity in question. Take the case of a low dollar. When the dollar drops it takes less of another currency to buy dollars needed to purchase the commodity, so the demand for that commodity will increase. The inverse happens when the dollar strengthens. The two graphs below compare the USD Index for one year versus the Thomson Reuters/ Core Commodity Index.

Gold and the dollar also have an inverse relationship, though it's a bit more complicated than with other commodities because gold is an investment instrument. When the dollar falls, gold tends to rise, but this isn't always the case. Inflation, or the threat of inflation, economic and political upheavals, wars, and interest rate fluctuations all affect the gold price, as well as supply and demand drivers. Lately gold has risen as the dollar has fallen, but here have been other factors Ie. the threat of a trade war dragging the dollar down at the same time as propping up gold. In a trade war, as we have suggested, the Chinese could start dumping US Treasuries to push the dollar up against the yuan, and this would also be bullish for gold.

The dollar and mining

Whether or not a mining or exploration company is profitable is often dependent on currency fluctuations. Let's take two examples: a Canadian gold company operating in Brazil, and a Canadian oil and gas firm doing business in the United States. In the first case, the company will pay all of its gold mining costs in Brazilian reals, and with the Canadian dollar stronger than the real, this means a significant cost savings – the exchange rate is currently 1 Brazilian real for 0.37 Canadian dollars. The company then produces gold that is priced in US dollars. Even though the dollar is now low, it is still stronger than the Canadian dollar, so when this company converts its USD revenue, it will get another bump – currently an extra 26 cents for every USD it exchanges to CAD. This firm should be quite profitable in this scenario.

In the second case, suppose a Canadian company is drilling for oil in the US. Now the Canadian oil explorer must pay all their expenses in USD, which are 26% higher than if the operations were in Canada. When oil is produced, dollars flow back to the firm, which are then converted to Canadian, like in the first case, at a 26% premium. Imagine though that the Canadian dollar appreciates in relation to the US dollar. Now the company's expenses drop, because less Canadian dollars need to be converted into USD to pay its suppliers. Oil sales comes back as USD, but now, converting them back to Canadian doesn't yield the same premium, maybe only 10% versus 26%. So a higher Canadian dollar helps on the cost side but it could even out on the revenue conversion.

Conclusion

Currency wars are not new, but the fact that this currency war is tied into the trade dispute presently happening with China, and at the same time a series of geopolitical tensions that are making the threat of a real war possible, makes this round of competitive devaluations particularly interesting to follow. In the race to devalue the Chinese yuan versus the US dollar, who would win? My bet is on China, simply because the US has allowed itself to become so indebted to the Chinese Central Bank, that any hint of selling off US Treasuries is bound to scare the bond markets and raise yields, with a negative knock-on effect on the stock markets, which fear inflation and interest rate hikes. The dollar would have to rise.

But, it's also clear that the Trump Administration favors a low dollar in order to keep exports competitive and to bring jobs back to America. How far Trump is willing to go to make this happen remains to be seen. Like in any war, there will be winners and losers, but so far it all looks positive for commodities. I've got what a potential currency war and what it does for commodities like gold, lithium and oil on my radar screen. Do you?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2018 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.