Financial Markets Make Stunning Reversals Following Fannie and Freddie Takeover

Stock-Markets / Credit Crisis 2008 Sep 08, 2008 - 01:22 PM GMTBy: Mike_Shedlock

I went to bed at 4:00 AM. At the time....

I went to bed at 4:00 AM. At the time....

- Treasuries were absolutely getting crucified

- The Dollar was sinking vs. the Euro

- Nasdaq Futures were up 40 points

- S&P Futures were up 38 points

- Gold was soaring

At 10:30 AM

- The long bond is flat with a minor selloff on other parts of the yield curve

- The Dollar is green vs. the Euro

- Nasdaq futures are -15

- S&P futures are +16

- Gold is flat and the $HUI is getting crushed after a strong opening

I went to bed thinking "This is insanity. Fannie and Freddie equity holders are going to be wiped out. If the Fed bails out any other financial institution equity shareholders will also be wiped out. Thus it makes no sense for financials to rally on this news."

It took the market all of the opening bell to come to this conclusion. Let's take a look at two institutions very likely to fail.

Lehman 5 Minute Chart

Washington Mutual 5 Minute Chart

Wachovia 5 Minute Chart

As of 11:00

- Lehman (LEH) -18%

- Fannie Mae (FNM) -85%

- Freddie Mac (FRE) -80%

- Washington Mutual (WM) - 16%

- Merrill Lynch (MER) -2%

- $HUI -3%

- Wachovia (WB) +5% and falling rapidly

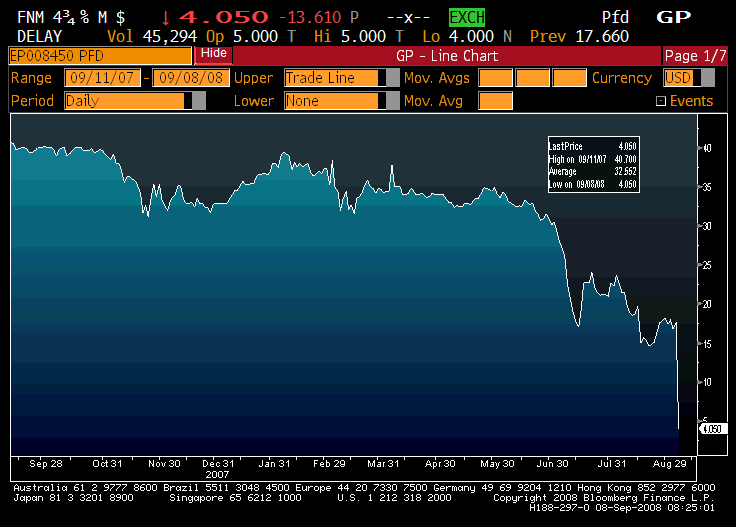

Fannie Mae Preferred

That is a chart of one Fannie Mae preferred issue. Down 13.6 points to 4. In June it was trading over 30.

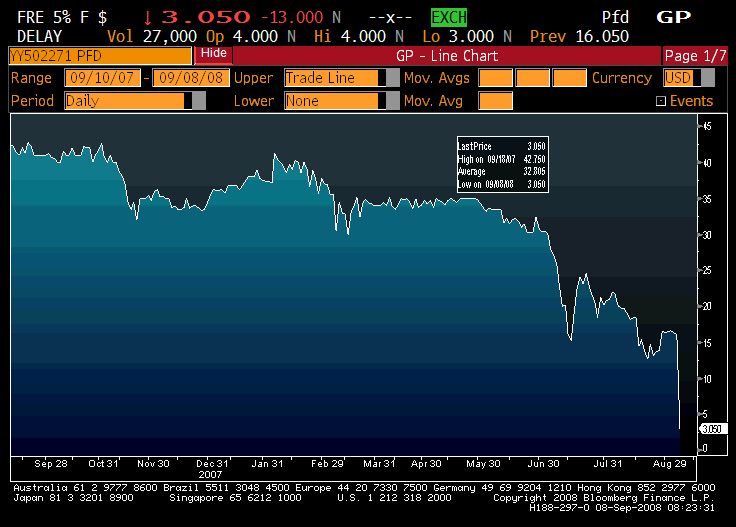

That is a chart of one Freddie Mac preferred issue. Down 13 points to 3. In June it too was trading over 30.

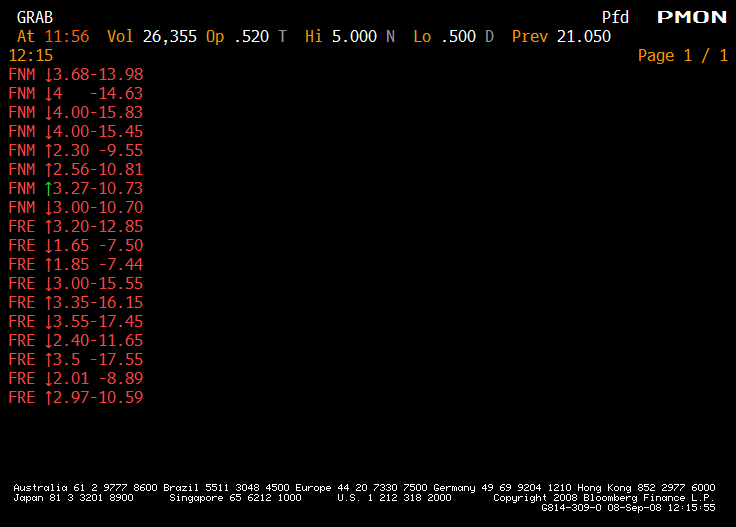

Fannie & Freddie Preferreds

The above chart is of various Fannie and Freddie preferred issues. That char is courtesy of Bennett Sedacca and Minyanville .

Who Thought Wrong?

- Those who thought preferred shareholders would be saved thought wrong.

- Those who thought gold would rally strong on the news thought wrong.

- Those who thought the dollar would collapse on the news thought wrong.

- Those who thought treasuries would be massacred on the news thought wrong.

What an amazing day but it's not over yet. The casino is still open. In weekend action, Paulson Rolled The Dice At Taxpayer Expense . Today after a strong opening, it's looking like snake eyes for both the taxpayer and equity holders.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.