Maybe The Economy Is Too Good For Investors

Economics / US Economy Mar 03, 2018 - 03:01 PM GMTBy: WMA

In the early 19th century, London financier Nathan Rothschild said “buy on the sound of cannons, sell on the trumpets”. The cannons referred to the start of war (valuations are therefore attractive as disorder begins) and the trumpets refer to the peace treaty ending the conflict (at which time timid investors pile back into risky financial assets). Warren Buffet has often reiterated the same idea first enounced by Rothschild saying “buy when there is blood in the streets” (eg, when valuations are very low).

In the early 19th century, London financier Nathan Rothschild said “buy on the sound of cannons, sell on the trumpets”. The cannons referred to the start of war (valuations are therefore attractive as disorder begins) and the trumpets refer to the peace treaty ending the conflict (at which time timid investors pile back into risky financial assets). Warren Buffet has often reiterated the same idea first enounced by Rothschild saying “buy when there is blood in the streets” (eg, when valuations are very low).

Friends, there is no blood to be seen in the economy or financial markets, as of yet. Some commentators are still even painting a rosy picture of the economy: the Fed remains friendly, inflation is contained, U.S. corporate tax cuts will boost company earnings, Trump will have the economy growing above trend, etc. On financial markets, investor sentiment indicators (prior to February’s selling) hit cycle highs. Our own WMA Market Sentiment Indicator hit a multi-year high of 90 (in the Extreme Optimism zone) in January before melting back down to a neutral rating of 65 at of March 2.

As for the economy, despite the longevity of the economic expansion, no one dares to predict a precocious end to cycle. New Fed Chair Jerome Powell who delivered the Fed’s semi-annual testimony to Congress this week, told lawmakers that the next two years will be “good” ones for the economy. If he’s right, he’ll be at the controls when the current U.S. expansion becomes the longest on record. Just given the Fed’s track record of economic forecasts, we’ll be amazed if the next recession does not hit before 2020.

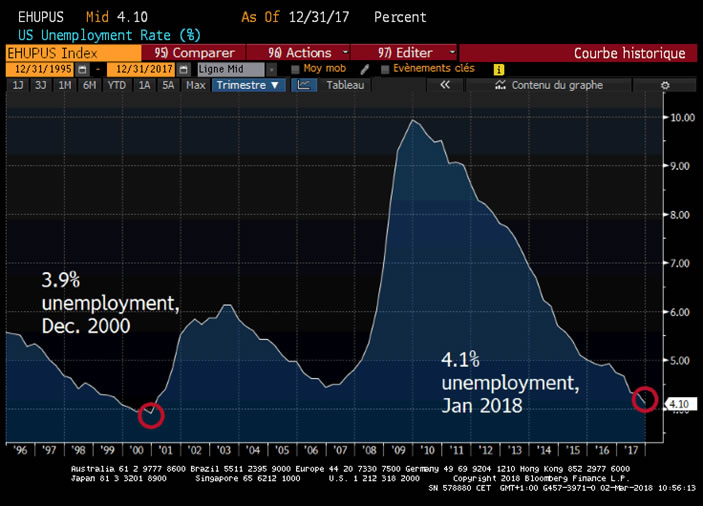

Powell is hoping to pull off an unparalleled soft landing of a U.S. economy with a rock-bottom unemployment rate. Our problem is reality: history has shown that it is very hard to soft land an economy once you’re below full employment. The difficulty for the central bank is trying to slow economic growth enough to edge up unemployment but not so much as to trigger a contraction in gross domestic product. It’s going to take some real good policy making and lots of LUCK to avoid a recession before 2020. At 4.1% in January, unemployment is already below Fed officials’ 4.6% estimate of its long-run sustainable rate, according to the median projection of policy makers in December. As shown in the chart below, once unemployment gets below full employment (estimated to be 4.5% - 5.0% unemployment today), it’s hard to being the economy back from the edge. The January jobless reading is the lowest since 2000. Back then, the Fed under Alan Greenspan was raising interest rates to try to bring a red-hot economy off the boil. The tighter credit ended up contributing to a recession the following year as the Nasdaq stock market bubble burst.

To soft land the economy, Powell opened the door to the Fed raising rates four times this year as he acknowledged stronger economic growth may prompt policy makers to rethink their plan for three hikes. His comments sent equity prices skidding and bond yields higher this week.

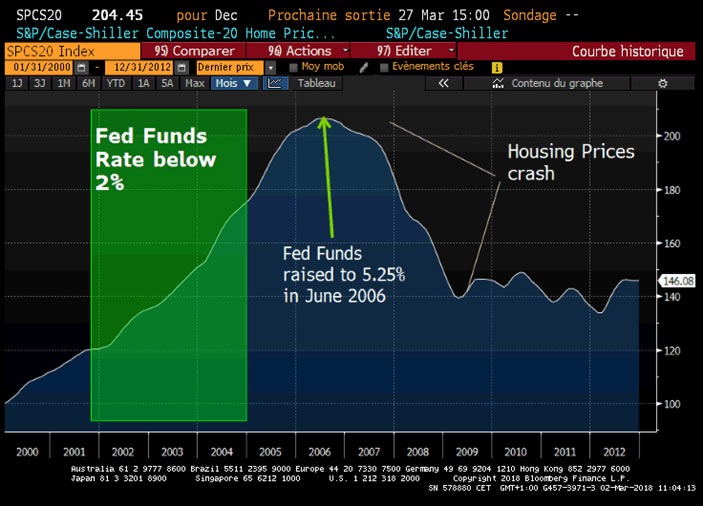

Indeed, this has an air of déjà vu from the Housing Bubble of 2001-2006, brought on by Greenspan’s decision not to bring rates up quickly after the 2001 recession. Is it possible the Fed has not learned its lessons of the past? Leaving interest rates below equilibrium levels creates financial market distortions (bubbles) which cause greater pain than the economic woes that Band-Aid policy was attempting to smooth over.

The chart below illustrates the Fed’s policy rate and the path of home prices as measured by the Case-Shiller 20-City Home Price Index. Two years of a below 2% Fed Funds rate dragged 30-year mortgage rates down to 5%, which was low in a non-QE economy. Of course in the end the Fed had to raise rates (too late) to check out-of-control speculation in the housing market, pricking the bubble and setting up the Great Recession.

Conclusion

So where is the economy today? Not only do we have an economy that is growing at an above-trend pace -- at a time when the labor market is already quite tight -- but the economy will be getting an extra boost in 2018 and 2019 from the recently enacted tax legislation. Essentially we are getting fiscal stimulus, on top of eight year of continual monetary policy stimulus…all in the ninth year of the expansion. Economist Larry Summers speculated this week that the next recession will be particularly severe, especially if the Fed does not get rates higher before the next recession arrives. Both the Fed and the Federal government (fiscal policy) have fired all of their bullets off during the expansion! Summers introduces a legitimate concern: with rates already low and the tax cuts/spending measures already enacted, what tools do policy makers have left to enact counter-cyclical policy during the next recession? (Please don’t answer more QE). We don’t have an answer, and worse, we don’t believe our policy makers do either.

By Williams Market Analytics

http://www.williamsmarketanalytics.com

We provide insightful market analysis and account management founded upon our very successful systematic, disciplined approach to investing. Our investment analysis revolves around two inputs: company valuation and our quantitative, market-based indicators. Learn more about our approach and our strategist.

© 2018 Copyright Williams Market Analytics - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.