Loan Shark Nation: Forcing Our Kids To Choose Between Student Loans And Everything Else

Personal_Finance / Student Finances Feb 17, 2018 - 01:52 PM GMTBy: John_Rubino

It’s mid-winter, which means millions of high school seniors are winding up their childhoods and planning for what comes next. For many this next stage is college.

It’s mid-winter, which means millions of high school seniors are winding up their childhoods and planning for what comes next. For many this next stage is college.

But in yet another example of how we baby boomers have rigged the system in our favor at the expense of pretty much everyone else, student loans – barely necessary when most boomers graduated 40 years ago – have become a life-defining problem for our kids and grandkids.

A college degree is now so expensive that for most students it requires massive borrowing. But the starting salary in most fields has risen so slowly that growing numbers of indebted grads can’t reduce – let alone pay off – their loans. From today’s Wall Street Journal:

Jumbo Loans Are New Threat in U.S. Student Debt Market

During the housing boom of the 2000s, jumbo mortgages with very large balances became a flashpoint for a brewing crisis. Now, researchers are zeroing in on a related crack but in the student debt market: very large student loans with balances exceeding $50,000.A study released Friday by the Brookings Institution finds that most borrowers who left school owing at least $50,000 in student loans in 2010 had failed to pay down any of their debt four years later. Instead, their balances had on average risen by 5% as interest accrued on their debt.

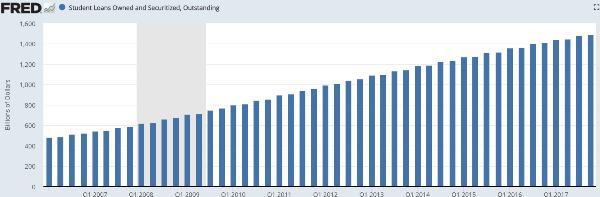

As of 2014 there were about 5 million borrowers with such large loan balances, out of 40 million Americans total with student debt. Large-balance borrowers represented 17% of student borrowers leaving college or grad school in 2014, up from 2% of all borrowers in 1990 after adjusting for inflation. Large-balance borrowers now owe 58% of the nation’s $1.4 trillion in outstanding student debt.

“This is comparable to mortgage lending, where a subset of high-income borrowers hold the majority of outstanding balances,” write Adam Looney of Brookings and Constantine Yannelis of New York University.

“A relatively small share of borrowers accounts for the majority of outstanding student-loan dollars, so the outcomes of this small group of individuals has outsized implications for the loan system and for taxpayers,” the authors say.

The problem is particularly acute among borrowers from graduate schools, who don’t face the kinds of federal loan limits faced by undergraduate students. Half of today’s big balance borrowers attended graduate school. The other half went to college only or are parents who helped pay for their children’s education.

Grad school borrowers tend to be among the best at paying off student debt because they typically earn more than those with lesser degrees. But the rising balances unearthed in the latest study suggest that pattern might be changing.

Overall across the U.S., one-third of borrowers who left grad school in 2009 hadn’t paid down any of their debt after five years, compared to just over half of undergraduate students who hadn’t, federal data show.

The findings on graduate schools are particularly noteworthy because the government offers little information on the loan performance of grad students, who account for about 14% of students at universities but nearly 40% of the $1.4 trillion in outstanding student debt.

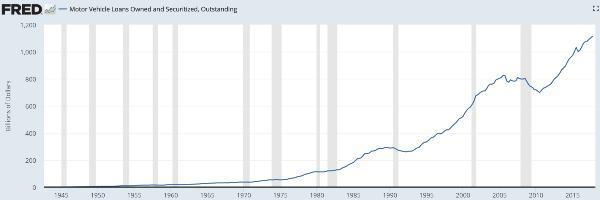

Now, a 25-year-old with massive student debt probably doesn’t qualify for a mortgage. But they might be able to get a car loan, which partially explains why auto loans are rising right along with student loans. A car is necessary to get to work, and borrowing is the only way to get a car if a big piece of your income is going towards student loan interest.

So that’s our world: Stocks, bonds and real estate – long since acquired by baby boomers who graduated college with minimal student debt and therefore had the cash flow to invest – are way up, making us the richest generation ever. Meanwhile our kids and grandkids are going ever deeper in debt with no apparent way out.

Of course there is an eventual way out: Someday they’ll inherit our manipulated wealth. But in the meantime their inability to cover our Social Security and Medicare is forcing the government to pick up the slack with trillion-dollar deficits as far as the eye can see, more or less offsetting the value of our estates.

The only real solution? A massive devaluation that shifts resources away from owners of financial assets like bonds and towards debtors who get to discharge their loans with cheaper currency. All roads, in short, lead to currency crisis — and soaring gold and silver.

By John Rubino

Copyright 2018 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.