Stocks Went Sideways, No Quick Reversal Means Trouble

Stock-Markets / Stock Markets 2018 Feb 01, 2018 - 10:55 AM GMTBy: Paul_Rejczak

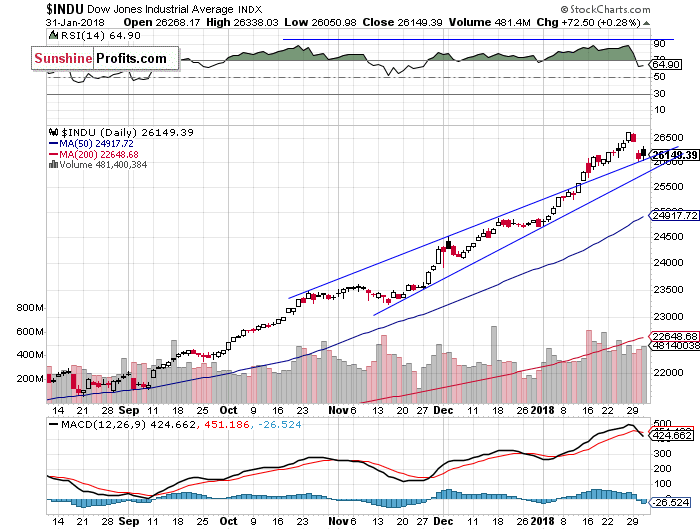

The main U.S. stock market indexes gained 0.1-0.3% on Wednesday, as they fluctuated following recent move down. Investors were uncertain ahead of quarterly earnings, FOMC Rate Decision, economic data releases. The S&P 500 index remained below its Tuesday's relatively big daily gap down. It currently trades around 2.1% below its January 26 record high of 2,872.87. Yet, it remains 4.7% above its December 29 close of 2,673.61. The Dow Jones Industrial Average gained 0.3% on Wednesday, as it bounced off support level at 26,000, and the technology Nasdaq Composite gained 0.1%.

The main U.S. stock market indexes gained 0.1-0.3% on Wednesday, as they fluctuated following recent move down. Investors were uncertain ahead of quarterly earnings, FOMC Rate Decision, economic data releases. The S&P 500 index remained below its Tuesday's relatively big daily gap down. It currently trades around 2.1% below its January 26 record high of 2,872.87. Yet, it remains 4.7% above its December 29 close of 2,673.61. The Dow Jones Industrial Average gained 0.3% on Wednesday, as it bounced off support level at 26,000, and the technology Nasdaq Composite gained 0.1%.

The nearest important level of support of the S&P 500 index is at 2,790-2,810, marked by the January mid-month consolidation. The next level of support remains at 2,770-2,780, marked by some previous local lows. On the other hand, the nearest important level of resistance is at 2,840-2,850, marked by Tuesday's daily gap down of 2,837.75-2,851.48. The next resistance level remains at around 2,870-2,875, marked by Friday's record high of 2,872.87. The resistance level is the price level at which the selling interest is strong enough to overcome buying pressure and push the price lower. It usually refers to previous high or highs, gap downs, trend lines, retracement levels etc.

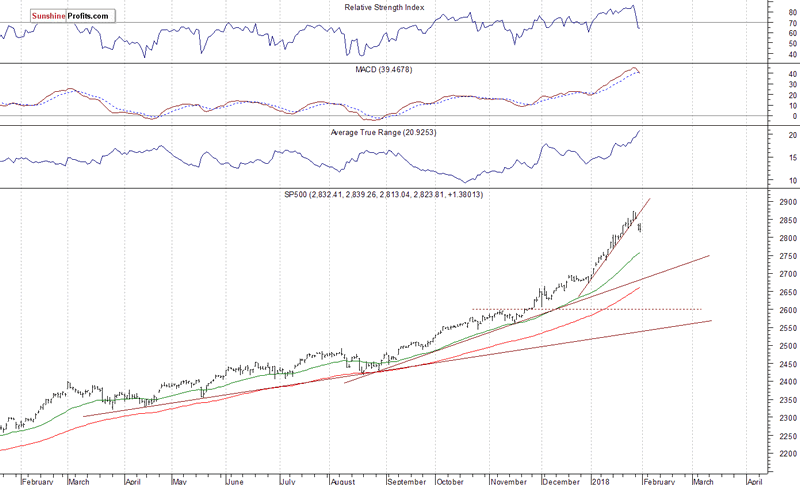

We still can see medium-term technical overbought conditions on the daily chart of the S&P 500 index. There is a pretty big chance that the index reached some major medium-term high on Friday. It broke below its month-long upward trend line on Tuesday following gap-down opening of the trading session, confirming reversal of the uptrend. The market is likely to continue lower, but its short-term downside potential seems limited by a support level of 2,800:

Mixed Expectations, More Consolidation

Expectations before the opening of today's trading session are mixed, because the main indexes index futures contracts trade between -0.2% and +0.4% vs. their Wednesday's closing prices. The European stock market indexes have gained 0.1-0.5% so far. Investors will wait for some economic data announcements today: Initial Claims, Nonfarm Productivity at 8:30 a.m., Construction Spending, ISM Manufacturing PMI at 10:00 a.m. The market expects that the ISM Manufacturing number was at 58.7 in January. Investors will also wait for some important quarterly corporate earnings releases.

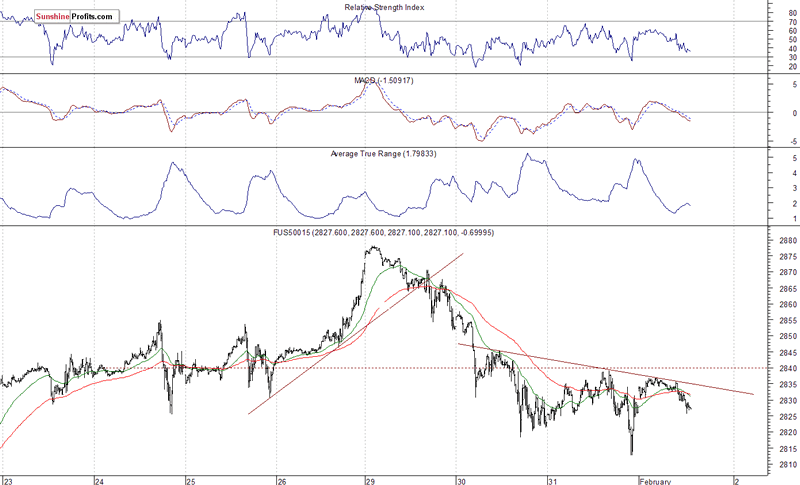

The S&P 500 futures contract trades within an intraday downtrend, as it retraces some of its yesterday's bounce off support level at around 2,815-2,820. For now, it is a consolidation following Monday-Tuesday move down. Is this a bottoming pattern or just flat correction within a new downtrend? It's hard to say, because the market will be very much news driven in the near future. The nearest important level of support remains at around 2,815-2,820. The price reached this area twice recently. If it breaks below, potential support level is at 2,800. On the other hand, resistance level is at 2,840-2,845, marked by short-term local highs. The next level of resistance is at 2,850-2,855, among others. The futures contract extends its fluctuations after Tuesday's sell-off, as the 15-minute chart shows:

Nasdaq 100 Remains Below 7,000 Mark

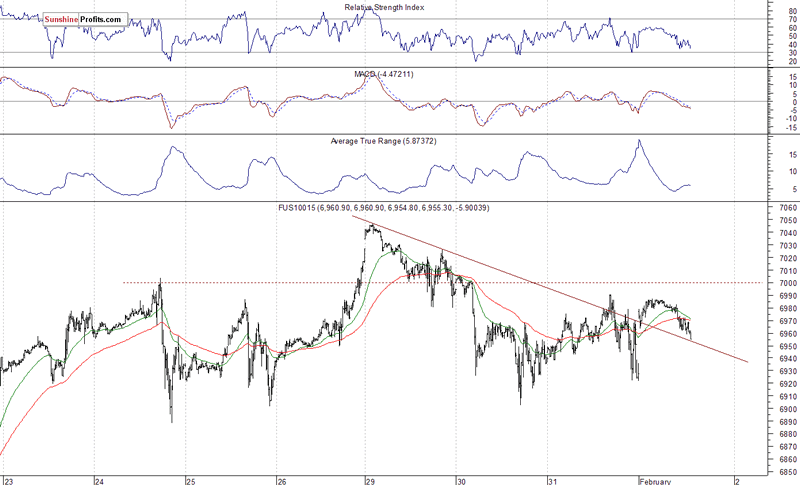

The technology Nasdaq 100 futures contract trades within a similar two-day-long consolidation following recent move down. However, it is relatively stronger than the broad stock market, as it remains above its last week's local lows. The market retraced around 150 points off its Monday's overnight record high so far. For now, it looks like a downward correction within an uptrend. Will quarterly earnings releases drive the market up to record high again? Yesterday's reactions to Microsoft, Facebook after-hours releases were positive, but far from euphoric. Investors will wait for after-hours' earnings releases from Apple and Amazon today. They may set the overall tone for the near future.

The nearest important level of support of the Nasdaq 100 futures contract is at around 6,900, marked by short-term local lows. On the other hand, level of resistance is at 6,980-7,000, marked by previous support level, along with yesterday's local highs. The Nasdaq futures contract trades along its recent downward trend line. It continues to fluctuate just below the level of 7,000, as we can see on the 15-minute chart:

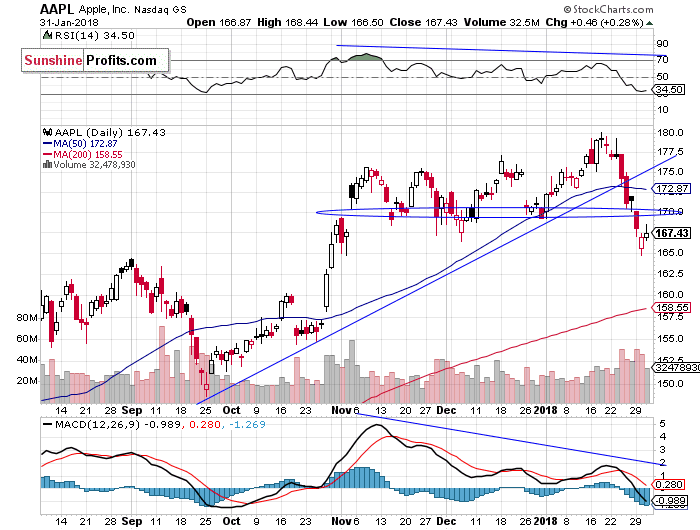

Let's take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com) - worth mentioning because Apple's market capitalization is close to $900 billion, which is almost two times more than the value of all the cryptocurrencies combined. It was relatively weak vs. the broad stock market recently, as it extended its short-term downtrend. The stock reached new record high two weeks ago, following short-term consolidation along the support level of $175. The market got closer to $180 mark, but it failed to continue higher. Consequently, the stock retraced its whole January advance. It broke below its November-December lows on Tuesday. The stock trades within a potential support level of $165-170. It acts weak ahead of today's quarterly earnings release. Positive reaction seems more likely than negative one, even if earnings disappoint. Investors may be willing to "sell rumors, buy news" here:

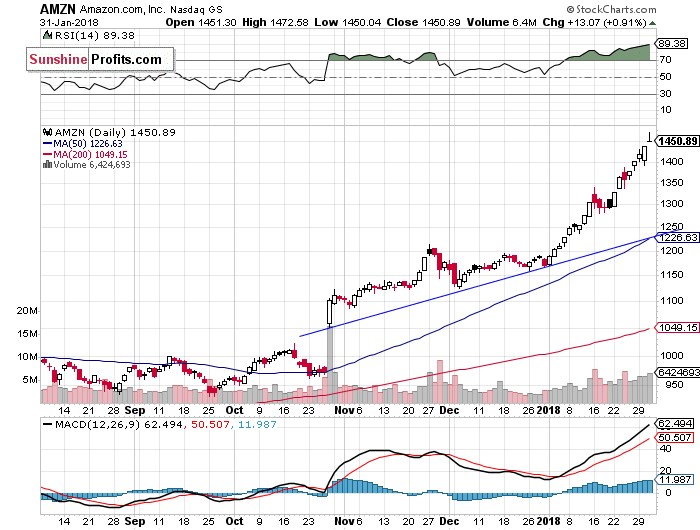

On the other hand, Amazon.com, Inc. stock (AMZN) is relatively very strong vs. the broad stock market. Despite an overall stock market weakness, it further extended its month-long rally yesterday. The stock broke above $1,450 mark. Amazon is expected to release its quarterly earnings today after trading session's close. It may act very different than in the case of Apple stock. We will probably see some "buy rumors, sell news" profit taking action:

The Dow Jones Industrial Average daily chart shows that blue-chip index retraced weeks-long record-breaking move up on Tuesday. For now, it looks like a downward correction, but we still can see medium-term negative technical divergences - the most common divergences are between asset’s price and some indicator based on it (for instance the index and RSI based on the index). In this case, the divergence occurs when price forms a higher high and the indicator forms a lower high. It shows us that even though price reaches new highs, the fuel for the uptrend starts running low. The market got close to its previously broken rising wedge pattern. It is acting as a support level right now. However, the price is walking a thin line here - just between that support level of around 26,000 and its relatively big Tuesday's daily gap down:

Concluding, the S&P 500 index was virtually flat on Wednesday, as investors hesitated following recent relatively big move down off new record highs. The broad stock market retraced its last week's advance, breaking below Tuesday-Thursday consolidation. Is this a new downtrend or just correction following month-long rally. For now, it looks like a correction, but we still see technical overbought conditions along with overly bullish investors' sentiment - there is no fear.

The S&P 500 index traded around 7.5% above its December 29 yearly closing price on Friday. This almost month-long rally seems unprecedented. The legendary investor John Templeton once said that "bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria”. So, is this an euphoria phase of the nine-year-long bull market? It's hard to say, but some major downside risks are growing.

There have been no confirmed negative signals so far, but we still can see medium-term overbought conditions. We can use indicators such as Relative Strength Index (RSI), Stochastic Oscillator, Money Flow Index to identify overbought conditions. For example, one can view a given market as "overbought" if the RSI indicator for this market is above 70. Paying attention to the overbought/oversold status of the market is very useful, but there are many other factors that need to be considered before placing a trade.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts

SunshineProfits.com

Stock market strategist, who has been known for quality of his technical and fundamental analysis since the late nineties. He is interested in forecasting market behavior based on both traditional and innovative methods of technical analysis. Paul has made his name by developing mechanical trading systems. Paul is the author of Sunshine Profits’ premium service for stock traders: Stock Trading Alerts.

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Paul Rejczak and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Rejczak is not a Registered Securities Advisor. By reading Paul Rejczak’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Paul Rejczak Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.