Stock Market Short-term Support May Come Into Play

Stock-Markets / Stock Markets 2018 Jan 31, 2018 - 09:39 AM GMTSPX is getting some lift at the Short-term support level at 2815.25. It suggests that may be the downside limit for this decline. If so, it may have its work cut out for it at the gap, which refused to be filled this morning. My best estimate is that SPX may make a probe (lower) to the Short-term support level before attempting a bounce.

However, the situation is fluid and a break of Short-term support could cause the wheels to fall off…

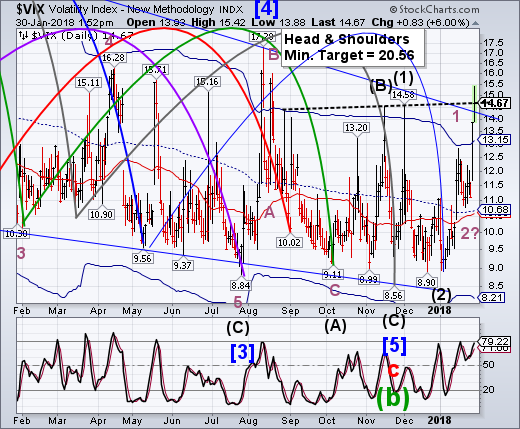

VIX is now using the neckline at 14.60 for support. This may confirm the validity of the Head & Shoulders formation and an indication that there is more rally ahead.

ZeroHedge comments, “Well, that escalated quickly...

The Dow is down 400 points - the biggest drop since June 2016's Brexit vote surprise - and down over 600 points from its highs yesterday...

As is clear above, VIX is also spiking - back above 15 for the first time since August.”

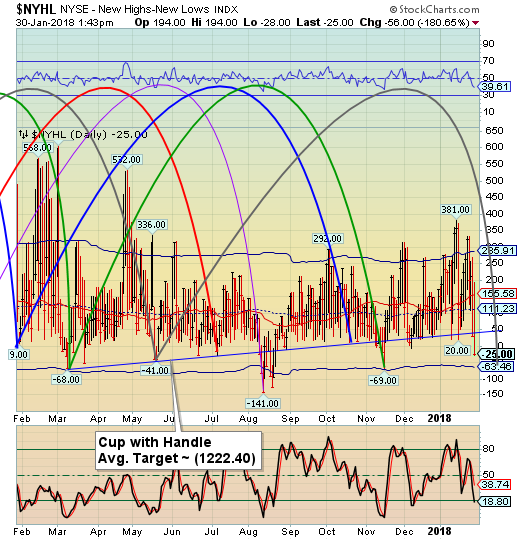

The Hi-Lo Index remains in negative territory, reinforcing the sell signal. I have been taught that actual confirmation comes at the close, but the Hi-Lo has been hovering near the bottom all day. So, it’s not a done deal yet, but looking awfully good.

A look at the monthly VIX chart shows an interesting phenomenon. VIX is actually in a 20-year Broadening Top! If the past is any indication, we may see the VIX go to the top of this formation in the next 12 months which I have estimated to be 133.32. It could actually be higher.

If I recall correctly, the old VIX (VXO) went to 149.00 in the 1987 crash. Unfortunately, my VXO chart only goes back to 1990. It was said that it was “broken” and that is when the new VIX was re-formulated on January 19, 1993. You see, VIX is measured in percentages and it should not go above 100.00.

Could it happen again? I believe so. Wall Street will find a way.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.