Don’t Fight the Fed! Or the Rest of the World’s Central Banks

Stock-Markets / Financial Markets 2018 Jan 29, 2018 - 04:23 PM GMTBy: Michael_Pento

On March 9, 2009, The Wall Street Journal’s Money and Investing section posed this ominous question: "How low can stocks go?" The stench of economic malaise was suffocating as the Dow Jones Industrial Average (DJIA) rounded off its fourth straight week of losses, and the S&P 500 touched below 700 for the first time in 13 years. Goldman Sachs cautioned the S&P could fall to 400, while CNBC’s Jim Cramer was busily calculating the stock valuations of the DJIA components based on balance sheet cash levels.

On March 9, 2009, The Wall Street Journal’s Money and Investing section posed this ominous question: "How low can stocks go?" The stench of economic malaise was suffocating as the Dow Jones Industrial Average (DJIA) rounded off its fourth straight week of losses, and the S&P 500 touched below 700 for the first time in 13 years. Goldman Sachs cautioned the S&P could fall to 400, while CNBC’s Jim Cramer was busily calculating the stock valuations of the DJIA components based on balance sheet cash levels.

Yet miraculously, as the market pundits stood despondently believing there was nothing positive on the economic horizon and that no stock was worth buying at any price, investors stared into the abyss and took a leap of faith. And just like that, the market had bottomed. Dow 6,440.08 was a buying opportunity, and with the Fed’s QE spigot operating on full throttle, the Dow was poised for a historic take-off.

Oh, what a difference nine years make! Today, the Dow has now crossed the then unimaginable level of 26,000. The rationalizations abound; lower corporate taxes, less regulation and sizzling business and consumer confidence all scream “happy days are here again!” With nothing but blue skies ahead, the only question left for Wall Street to ponder is the uncertainty of how many days it will take before the Dow crosses another 1,000-point milestone.

But not so fast…Remember, the stock market climbs a wall of worry, and in 2009 that wall was seemingly insurmountable. Back then the sentiment was that nothing could go right--yet the market endured as economic and financial Armageddon loomed around every corner. Today, the exact opposite scenario is evident. The belief prevails that nothing can go wrong. However, hiding in plain sight there is one gigantic cliff the market has already started to head down. But the real reason behind the next violent crash in the equity market is the current bursting of the worldwide bond bubble.

The stock market now resembles an unstable uranium 235 isotope. The splitting catalyst will be the result of slamming $10 trillion worth of negative-yielding sovereign debt and $230 trillion worth of total global debt into the reversal of central bank money printing and unprecedented interest rate suppression.

Remember this truth: If the market can rise on sluggish growth, it can also fall when growth seems fine.

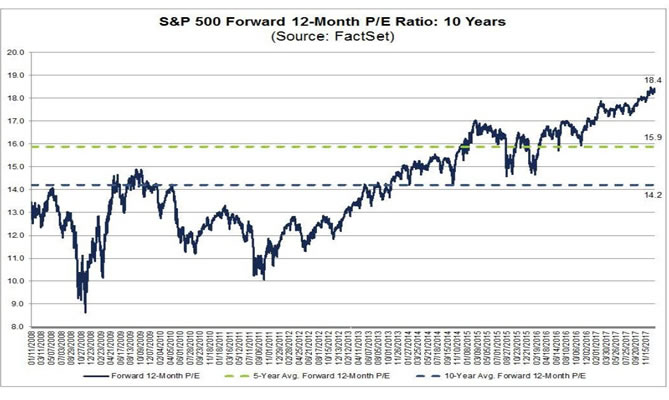

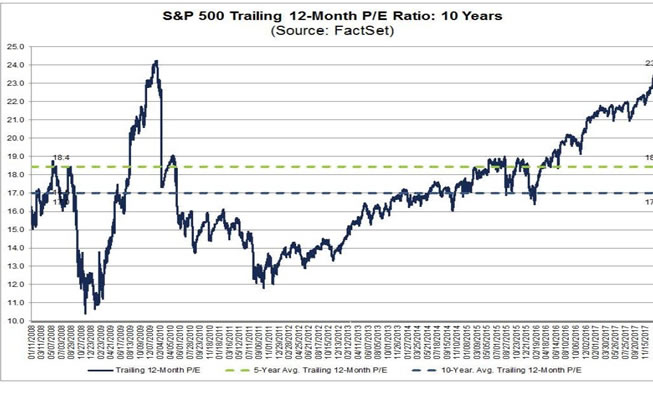

Investors must determine what has already been priced into shares and what lies ahead for growth. It is essential to keep in mind that the market is over-priced according to almost every metric. For instance, even if all the rosy economic projections pan out for the tax cuts, the market is still trading at 18.6 times forward 2018 earnings, according to FACT SET--the market trades typically closer to 15 times earnings. The trailing PE ratio is now at its highest going back to 2009.

In addition to this, we have cash levels at all-time lows and margin debt at all-time highs. Mutual funds and ETFs that focus on stocks just recently raked in $58 billion in new money, according to Bank of America Merrill Lynch. And at 150%, the total market capitalization of equities has never been higher in relation to the underlying economy.

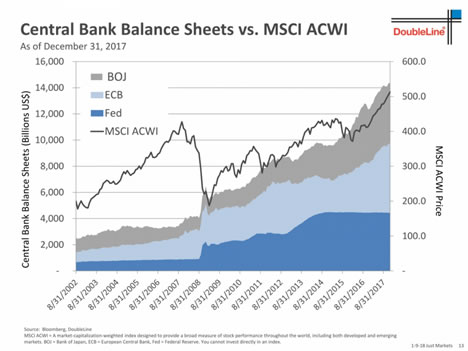

Since the bottom in 2009 the markets have been driven higher by oceans of central bank liquidity (QE)

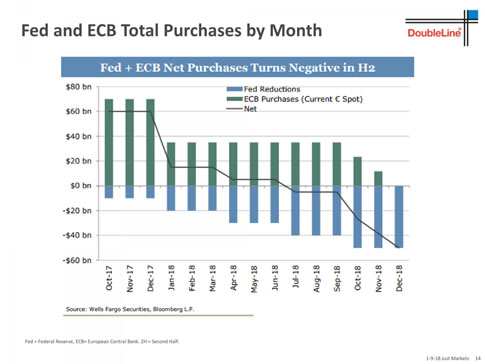

But the most salient point here is that the QE party is winding down in all corners of the globe. Even in Japan, where the central bank’s balance sheet has started to decline for the first time since 2012. In case you forgot, Japan opted for the even more potent “QQE” –Qualitative and Quantitative Easing. Under QQE the Bank of Japan had been buying Japanese Government Bonds, corporate bonds, REITs, and equity ETFs. But, they have recently announcing tapering’s in the size of its asset purchases.

In order to be bullish of stocks today you have to also be willing to fight not just the Fed, ECB and BOJ; you have to go against a plethora of the globe’s central banks that are in various stages of tightening monetary policy. In addition to the banks just mentioned, you have to throw in; China, Canada, England, Turkey, Malaysia, Mexico and even Ukraine that have recently made hawkish moves.

We’ve all heard the mantra don’t fight the Fed; and history has proven that axiom to be correct. Therefore, to ride against the global tide of central bank tightening is much more than merely unwise. It is unprecedentedly inane and dangerous! Especially given this coordinated hawkish turn occurs in the context of a record amount of debt and massive asset bubbles that pervade worldwide.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance www.earthoflight.caLicenses. Michael Pento graduated from Rowan University in 1991.

© 2018 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.