A Vision for the European Economic Future

Economics / Euro-Zone Jan 26, 2018 - 12:10 PM GMTBy: Enda_Glynn

Hi everyone,

Hi everyone,

I have seen the Future for the European Economy,

And it is not looking good.

The EU tracks a wide number of european wide economic indicators,

Everything from consumer credit,

to unemployment expectations in the future.

Much of the data is survey based,

and so it involves an individual opinion on a subject.

It is simply amazing how well much of these indicators work as contrarian indicators!

The old saying goes,

"when your taxi driver tells you to buy stocks, it is time to sell ".

Lets have a run down through some of these charts to set the scene in europe.

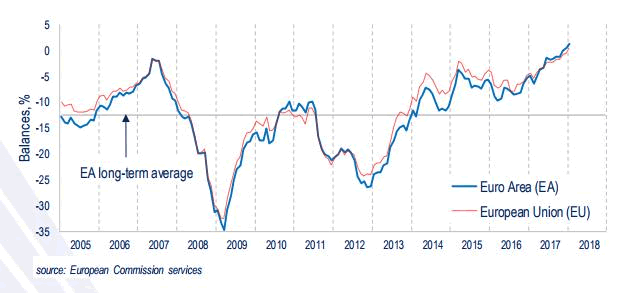

Consumer confidence rate of change:

This indicator increased at the highest rate in over 13yrs in December.

accelerating at a faster rate than every year running up to the 2007 high in stocks.

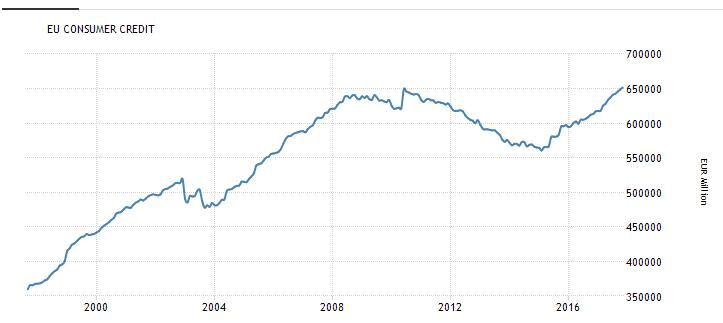

Consumer credit:

The level of revolving credit to the consumer has now hit its highest level in history!

The consumer has maxed out the credit card again.

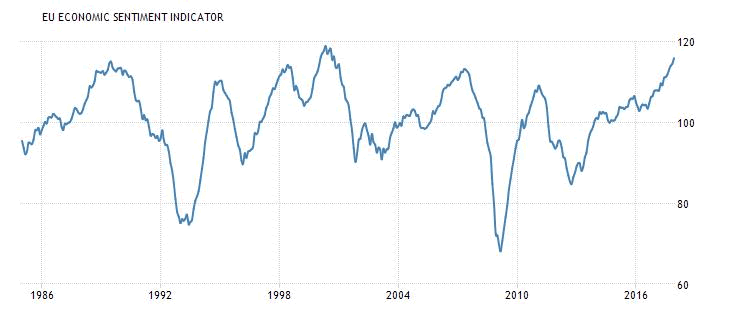

EU economic sentiment indicator:

This index has hit a 18yr high,

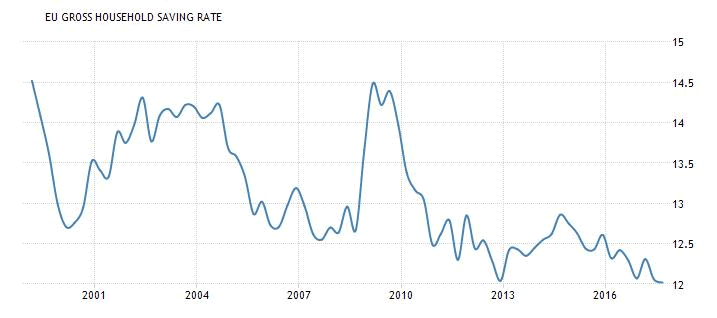

Gross household savings rate:

People are so confident,

that they have stopped saving!

This index is now at the lowest level since they began tracking.

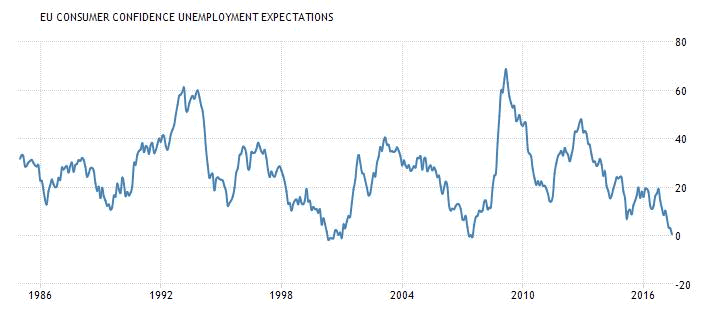

Unemployment expectations:

People in europe do not expect to become unemployed any time soon.

This indicator now matches the sentiment at the high in 2000 and in 2007!

And what happened following those particular sentiment extremes?

So,

according to the man on the street,

the general outlook for the european ecomony is for a bright future with absolutely no upsets whatsoever.

everything is just fine in Europe!

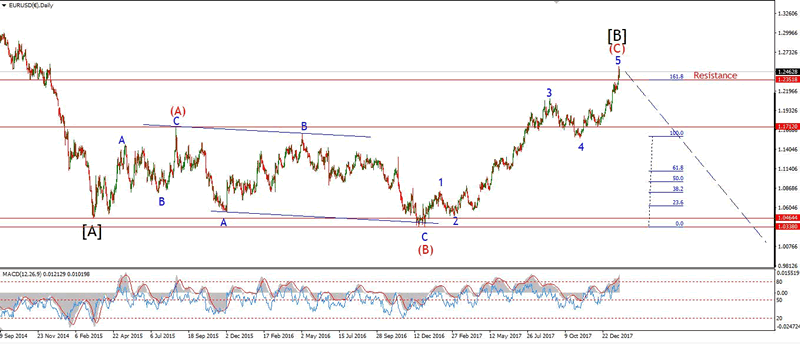

And of course the EURUSD is sitting at a three year high,

at the end of a very large corrective pattern.

What could possibly go wrong?

On that note, lets get into the latest wave patterns in operation in EURUSD.

UPCOMING RISK EVENTS:

USD: Advance GDP q/q, Durable Goods Orders m/m.

EUR: M3 Money Supply y/y,

GBP: Prelim GDP q/q, BOE Gov Carney Speaks.

JPY: BOJ Gov Kuroda Speaks.

EURUSD

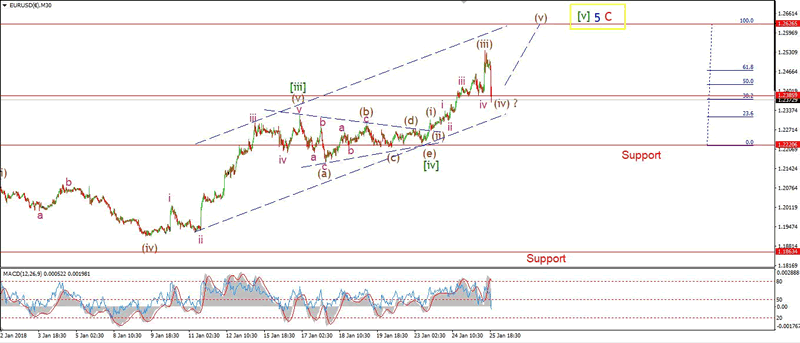

30 min

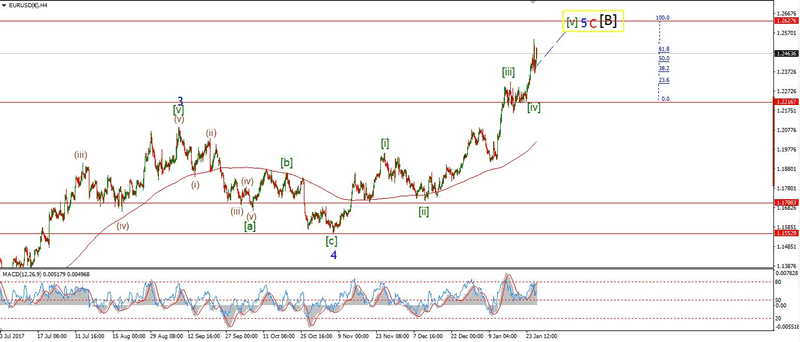

4 Hours

Daily

My Bias: long term bearish

Wave Structure: Topping in wave [B] black.

Long term wave count: lower in wave [C] black.

The correction in wave 'iv' pink was short lived today,

Wave 'iv' seems to have traced out a running flat correction.

And off that low today the market shot higher in wave 'v' pink.

That completes a five wave pattern in wave (iii) brown.

Wave (iv) has started this evening with initial support at the previous fourth wave of 1.2385.

The price is moving lower as I write,

So wave (iv) brown might complete quite quickly also.

For tomorrow;

Watch for a low in wave (iv) brown at nearby levels.

Wave (v) brown should then carry the price higher into the target at 1.2600 to complete the larger five wave structure.

WANT TO KNOW the next big move in the Dollar, GOLD and the DOW???

Check out our membership plan over at Bullwaves.org,

You can see into the Elliott wave future every night!

Enda Glynn

http://bullwaves.org

I am an Elliott wave trader,

I have studied and traded using Elliott wave analysis as the backbone of my approach to markets for the last 10 years.

I take a top down approach to market analysis

starting at the daily time frame all the way down to the 30 minute time frame.

© 2018 Copyright Enda Glynn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.