So That’s What Stock Market Volatility Looks Like

Stock-Markets / Stock Markets 2018 Jan 17, 2018 - 10:47 AM GMTBy: John_Rubino

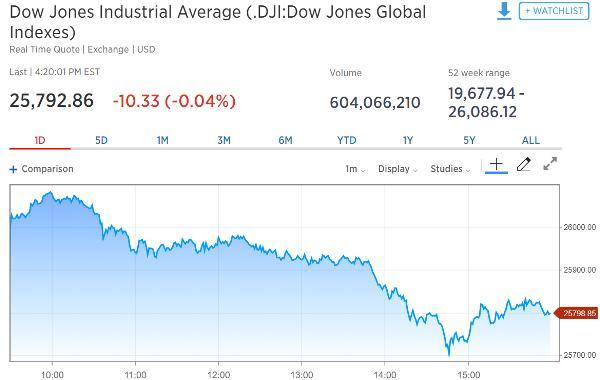

2017 was literally the smoothest stretch of highway that US stocks have ever traveled. Rising almost every day and seldom falling hard, they made it virtually impossible for investors to lose money. Here’s the Dow Jones Industrial Average over the past two years. Note how unnaturally smooth the recent action was.

As a result, measures of volatility (i.e., fear) like the Vix fell to all-time lows. Note how the index’s wild swings of the past gradually give way to a steady decline that mirrors the steady ascent of share prices in the previous chart.

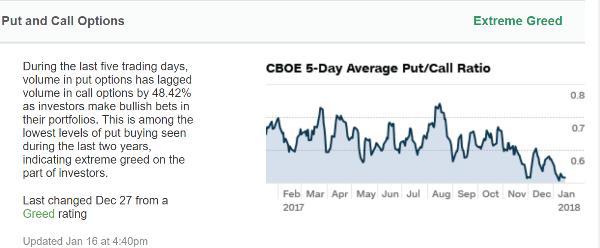

Rising prices and declining volatility convinced individual investors (sigh) that stocks will always behave this way. Retail money began pouring into both equities and call options. The following chart is compiled by CNN, and shows the put/call ratio (lower means more bullish) plunging to a record low, which the chart labels “Extreme Greed.”

But today something different happened. Stocks opened massively higher, riding the momentum of last week’s record close. The Dow pierced 26,000 for the first time ever, making all those tech stock positions and call options look like strokes of genius. Then those gains evaporated in a 282 point reversal, one of the biggest of the past few years.

The Vix, in response, jumped by 14%, after an even bigger spike intra-day:

Whether this the start of a trend won’t be clear for a while. But what is clear is that today’s reversal and vol spike are consistent with the aftermath of every single previous period of soaring prices and collapsing volatility. By sucking dumb money into the market, blow-off bubble tops eventually beget their opposite.

So while today might or might not be one of those times, when the next bust does come, it will probably start like this.

By John Rubino

Copyright 2018 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.