Cooling Global Economy Ensures Commodity Correction to Continue

Commodities / CRB Index Sep 04, 2008 - 03:08 AM GMTBy: Donald_W_Dony

The recent rise of the U.S. dollar has triggered the peak in the commodity market and likely halted any further advances for this index during the 2006-2010 market cycle. As energy and precious metals are normally the last sectors to crest during a market cycle, their current weakness signals the start of a broader correction.

The recent rise of the U.S. dollar has triggered the peak in the commodity market and likely halted any further advances for this index during the 2006-2010 market cycle. As energy and precious metals are normally the last sectors to crest during a market cycle, their current weakness signals the start of a broader correction.

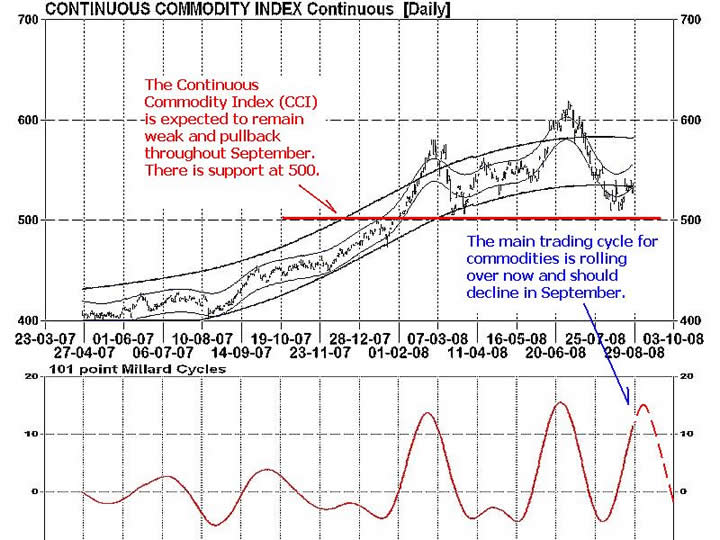

The equally weighted Continuous Commodity Index (Chart 1) reached a peak in mid-summer after several months of strong advances.

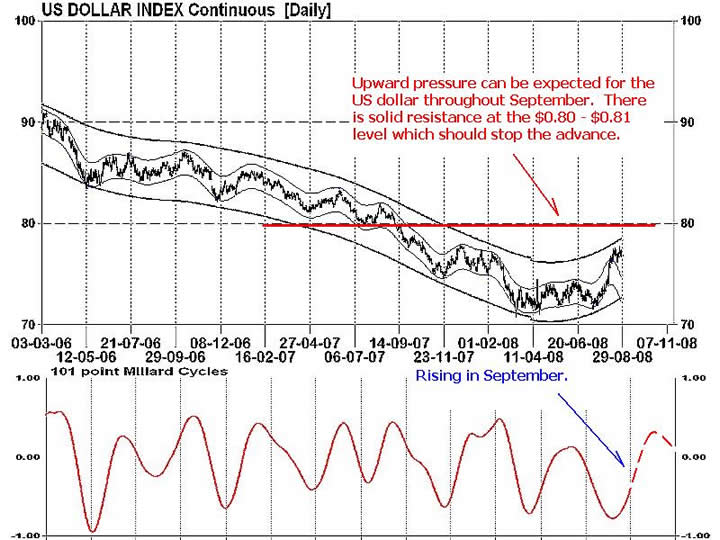

Downward pressure began for the Commodity Index as the U.S. dollar gained strength against a basket of world currencies and started to climb in early summer (Chart 2). A less hawkish stance against inflationary pressures from European central banks rotated funds out of the EURO and into the American currency. Though the fundamentals for the Greenback have not changed significantly, traders view the prospect of stable to lower interest rates for the EURO as a signal to buy the USD.

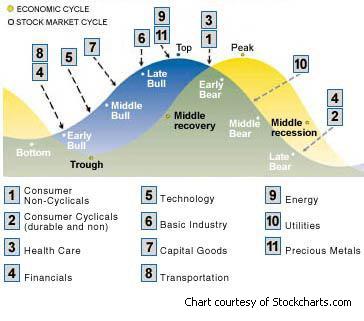

As the business cycle (Chart 3) has just crested in the first half of 2008, the expectation are that weaker demand will continue as the economies contract. Lower energy and base metal usage is already being registered in China and the U.S. and this decline in natural resource demand is anticipated to continue until the projected completion of the cycle in 18-24 months.

The stock market cycle (Chart 3) which typically precedes the business cycle by 6-9 months, is approximately 50% completed in its bear market decline. This cycle is expected to reach a low in 12-18 months. As commodities normally rise later in a market cycle, the expectations that most commodity prices will likely remain flat to down.

Bottom line: Expect commodities to continue their correction into September and early October. Longer-term, with cooling global economies, commodity prices are not expected to advance to new highs until after the 2006-2010 market cycle. Look for the Continuous Commodity Index to test support at 500 by early October.

Investment approach: Though commodities are still in a secular bull market, portfolios should consider a lower percentage of natural resources until the end of the 2006-2010 market cycle.

More research on commodities, global and North American equities can be found in the September newsletter

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.