Gold and Bond Yields

Commodities / Gold and Silver 2017 Dec 06, 2017 - 02:23 PM GMTBy: Donald_W_Dony

As the U.S. economy continues to expand, the response by the FOMC is to slowly raise interest rates in attempt to extend the business cycle as long as possible.

This action of ratcheting-up short-term rates is positive for bond yields.

After steadily declining since 2008, the U.S. 10-year Treasury Bond yields have found a floor in 2012 and 2016 at 1.50 percent.

Yields have since gained ground and have modestly risen to 2.40 percent in recent months.

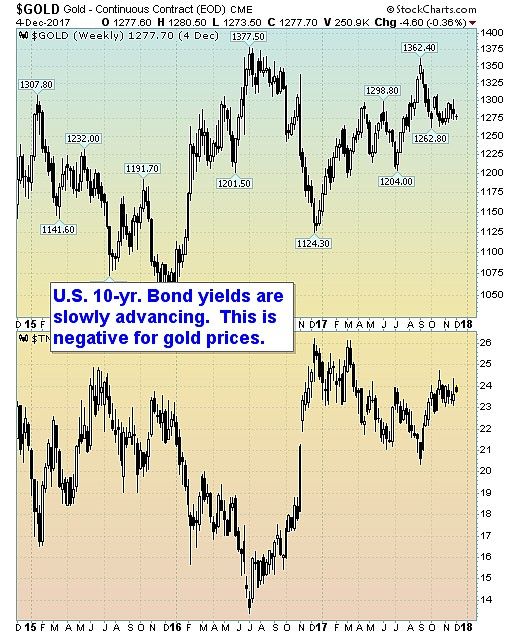

Gold prices, in response, have struggled to advance and remained capped under $1400 over the last four years.

In fact, gold prices and U.S. 10-year Bond yields have formed a tighter opposite correlation since 2015.

And as the Fed is now on a program to slowly tighten and raise bonds yields to contain the growing U.S. economy, we expect little upside potential for gold prices in the near future.

Bottom line: The FOMC is expected to raise the benchmark rate in 2018 to 2.10 percent. As the current rate is 1.00 to 1.25 percent, the projected rate next year is approximately twice what the present rate is.

This would suggest the 10-year bonds would advance to about 3.00 percent next year from their current 2.40 percent.

As bond yields and gold have an inverse relationship, the expected increased in the Fed rate next year should keep a cap on gold prices in 2018.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2017 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.