More Strange And Disturbing Action In The Paper Gold Market

Commodities / Gold and Silver 2017 Dec 06, 2017 - 02:20 PM GMTBy: John_Rubino

For at least the past decade the behavior of the people who trade gold futures contracts – and thereby determine the metal’s price – has been generally predictable: The “commercials” – big banks and companies that buy gold to do things with it – have suckered the speculators – mostly hedge funds who chase trends – into going very long and very short at exactly the wrong time.

Which means the price action in gold six or so months in the future was broadly predictable. When the speculators were way long, it was going down and vice versa.

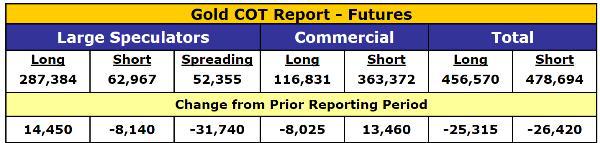

But this year the action – as portrayed in the commitment of traders report (COT) – has departed from the script. After taking on near-record long positions early in the year, the speculators have barely scaled them back from levels that are extremely bearish for gold. Meanwhile gold, instead of tanking as recent history says it should, has been treading water.

And now both the speculators and the commercials have started ramping up their current bets, with speculators going from very long to even more long and commercials going from very short to even more short.

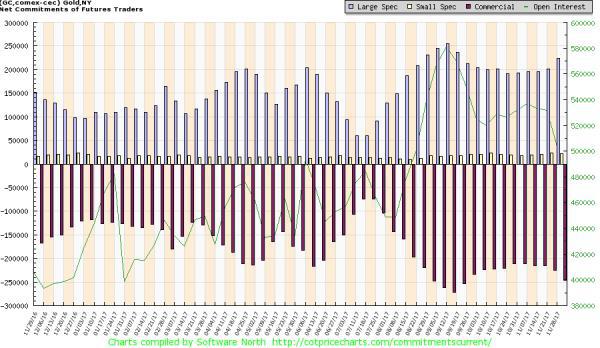

Here’s the same data in graphical form. Where historically the silver bars on top (speculator longs) and the red bars below (commercial shorts) would be expected to converge at the middle of the chart, they’ve diverged and stayed far apart. So the speculators have not been washed out and instead are becoming even more bullish.

If history still matters (a big if in today’s world) the COT trends point to a bad six or so months for precious metals. Though – and this might be the rationale for many speculators – the global financial system has become so fragile that betting on a crisis that sends capital pouring into safe havens is now a permanently good idea.

In that case the solution for individuals is easy: Just buy silver and let nature take its course.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.