Desperation at Washington Mutual (WaMu) Puts US Taxpayers at Risk

Companies / Credit Crisis 2008 Aug 31, 2008 - 02:10 PM GMTBy: Mike_Shedlock

Desperation is in the air at Washington Mutual (WM). That WaMu is offering 5% on CDs should be proof enough. From LastNightInVegas .

If the 5% rate WaMu is offering on CDs isn't indication enough that there's trouble brewing, the fact that WaMu is promoting it with a hand drawn white board sign certainly clinches it.

Desperation is in the air at Washington Mutual (WM). That WaMu is offering 5% on CDs should be proof enough. From LastNightInVegas .

If the 5% rate WaMu is offering on CDs isn't indication enough that there's trouble brewing, the fact that WaMu is promoting it with a hand drawn white board sign certainly clinches it.

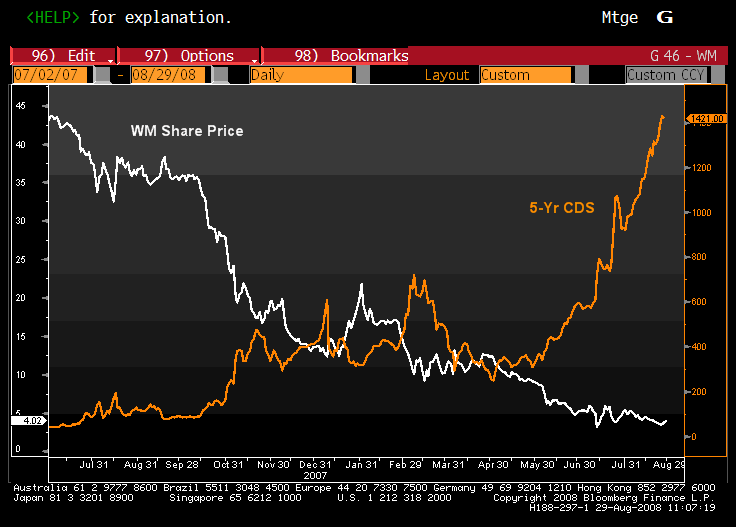

On a more serious note, please consider the following chart of WaMu credit default swaps courtesy of Chris Puplava at FinancialSense .

WaMu 5-Year Credit Default Swaps

For more on Credit Default Swaps

Pimco: What Are Credit Default Swaps and How Do They Work?

Wikipedia: Credit Default Swaps

CBOT: CDS Example

In rally attempt after rally attempt in the financial sector, Washington Mutual is one of the last stocks to participate. There is good reason for this action. It's called "Death Spiral Financing". Previously I talked about Death Spiral Financing at WaMu, Merrill Lynch, Citigroup .

This is a different form of death spiral financing. WaMu is paying 5% on CDs at a time the Fed Funds Rate is 2.0% and the discount rate is 2.25%. Where can WaMu invest money safely and return 5%? The answer is nowhere.

It is a moral hazard that WaMu can even offer CDs at 5% with FDIC guarantees. Money is increasingly flowing to such endeavors, at taxpayer risk. Supposedly FDIC is self insured. I say supposedly. And although I am certain that FDIC guarantees will be honored, I am increasingly suspicious of how those guarantees will be honored.

LondonBanker has an excellent article on this subject called Is the FDIC another troubled monoline? It's a good read. Please take a look.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.