US Dollar Outlook and What it Means for Gold

Commodities / Gold and Silver 2017 Oct 13, 2017 - 02:27 PM GMTBy: Jordan_Roy_Byrne

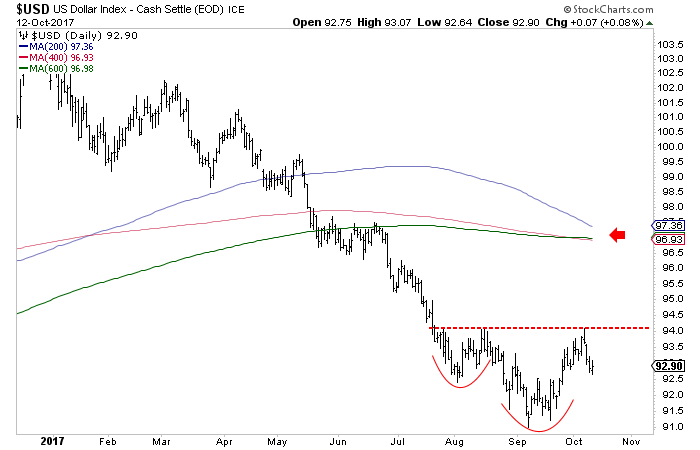

The US Dollar Index (USDI) bottomed in September a hair below 91.00 and has recently rallied up to 94. We were skeptical Gold would break its 2016 highs as it failed to show strong performance in the wake of the USDI’s decline to new lows. The market was discounting a coming rebound in the USDI and/or future weakness in Gold. In any event, although the USDI broke key levels which leave its bull market in question, it became quite oversold and was due for a sustained rebound.

The US Dollar Index (USDI) bottomed in September a hair below 91.00 and has recently rallied up to 94. We were skeptical Gold would break its 2016 highs as it failed to show strong performance in the wake of the USDI’s decline to new lows. The market was discounting a coming rebound in the USDI and/or future weakness in Gold. In any event, although the USDI broke key levels which leave its bull market in question, it became quite oversold and was due for a sustained rebound.

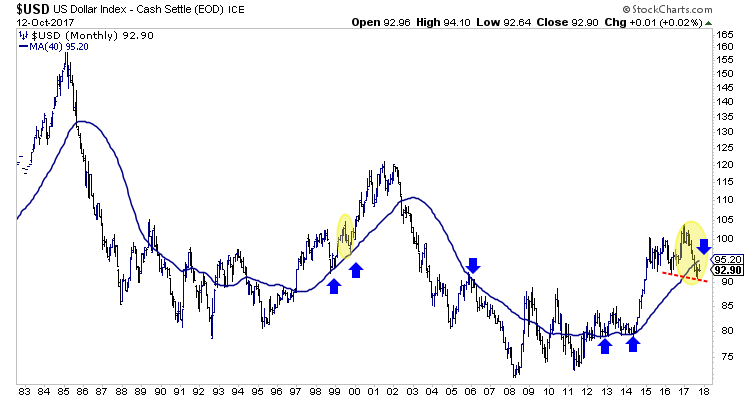

First let’s look at the big picture with a monthly bar chart and the 40-month moving average. As you can see, the 40-month moving average has been an excellent trend indicator and especially since the mid 1990s. The USDI lost that support in July and in addition, made a lower low. Neither happened during the previous two bull markets.

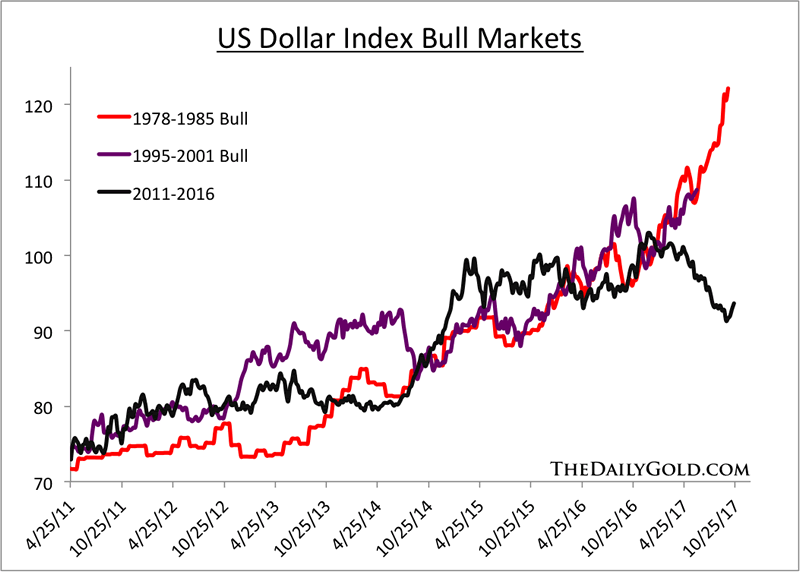

When comparing the bull market to the recent two bull markets we find that the recent correction began at the point at which the other two bull markets advanced toward their inevitable peaks.

While the longer term trend may have turned bearish, the short-term trend may have turned bullish. The USDI could be forming a reverse head and shoulders bottom. On a close above resistance at 94, the USDI has a measured upside target of 97. That target fits very well with the long-term moving averages which are coalescing around 97. (The aforementioned 40-month moving average should reach +96 in the months ahead).

We remain cautious on Gold in the near term as Gold’s correction would continue if the US Dollar Index breaks above 94. With that said, if the USDI’s primary trend has turned bearish then that certainly bodes well for precious metals and precious metals shares in 2018. If the greenback does break above 94 then we will be looking at 96 and 97 as potential levels where the rebound could reverse course. Our goal is to buy value with a catalyst or buy very oversold conditions within the junior space. This action has served us well since last December and should the USDI reach 96-97 then it could lead to low risk buying opportunities in juniors by year end.

To find out the best buys right now and our favorite juniors for 2018 consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.