The Struggle for Bolivia Is About to Begin

Politics / Emerging Markets Oct 13, 2017 - 10:28 AM GMTBy: Dan_Steinbock

While middle class Bolivians are demonstrating against the incumbent president’s bid to extend term limits, the country is thriving after a decade of progress under Evo Morales.

While middle class Bolivians are demonstrating against the incumbent president’s bid to extend term limits, the country is thriving after a decade of progress under Evo Morales.

Recently, thousands of Bolivians took part in protests in San Francisco square in La Paz demonstrating against President Evo Morales’ bid to extend term limits.

In a referendum last year, some 51 percent of Bolivian voters rejected Morales’ proposal to reform the constitutions to end current term limits.

In September, Morales’ Movement to Socialism (MAS) party requested the highest court to remove legal limits, which bar officials from seeking re-election indefinitely. The court has until December to rule on the request or extend the deadline for a decision.

In La Paz, the narrow urban middle classes expressed concerns that Morales was attempting to tighten his grip of power in a way that was reminiscent of President Nicolas Maduro in Venezuela.

But Bolivia is not Venezuela and Morales is not Maduro.

A decade of progress

As Bolivia’s first president to come from the indigenous population, Evo Morales began his political career as a trade unionist, like Brazil’s former President Lula. He has focused on greater equity, and poverty reduction.

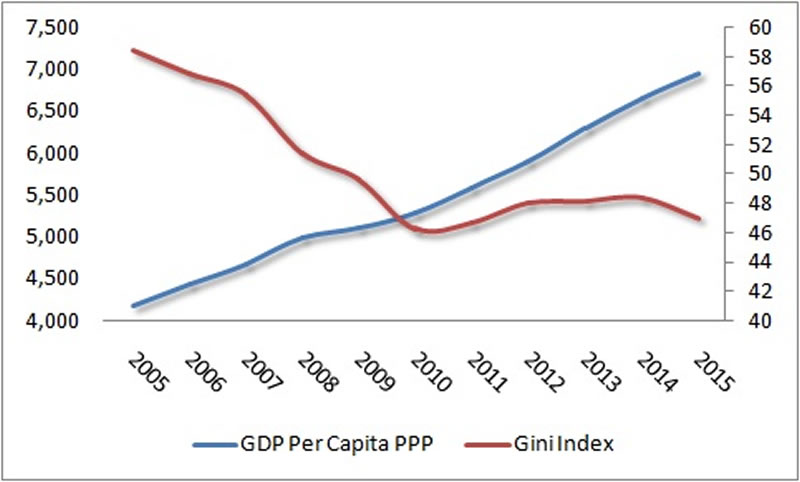

When Morales won the presidential election in 2006, per capita income in Bolivia was less than $4,200. Today, it exceeds $7,550. At the same time, Gini index, which measures income inequality, has plunged from more than 58 to 47.

Figure Bolivian Per Capita Income and Gini Index, 2005-2015

Sources: Per capita income, IMF; Gini Index, World Bank.

Unlike some of his predecessors, Morales has vocally criticized neoliberal policies and sought to reduce Bolivia’s dependence on the World Bank (WB) and International Monetary Fund (IMF).

Morales’ MAS represents a progressive alliance of indigenous people, mestizo working class, particularly miners, and socialist intellectuals. While 70 percent of Bolivians are mestizos, 20 percent are indigenous. Not surprisingly, his policies continue to be criticized by the domestic elite and US-led international organizations.

Nevertheless, Morales has a strong track record in people first policies, which shun the power of capital and highlight the importance of a truly independent Bolivia.

"A day like today in 1944 ended Bretton Woods Economic Conference, in which the IMF and WB were established," Morales tweeted last June. "These organizations dictated the economic fate of Bolivia and the world. Today we can say that we have total independence of them."

In the past, Bolivia's dependence on these agencies was so great that the IMF actually had an office in government headquarters and even participated in their meetings. That was very much in line with the economic interests of the ruling oligarchy, which MAS perceives as “anti-national.”

During the past decade, Bolivia’s trading relations have shifted, however. Today, the US and Japan account for 20 percent of Bolivian exports, whereas the share of Brazil, Argentina and China is twice as high. Similarly, the US and Japan account for 15 percent of imports, whereas the share of China, Brazil and Argentina is 50 percent.

From neoliberal inequities to inclusive growth

Since the postwar era, some of Bolivia’s largest struggles have targeted economic policies carried out by the IMF and the WB, particularly privatization and austerity measures, including cuts to public services, wage reductions, and the weakening of labor rights.

After Morales came to power in 2006, hydrocarbons have been nationalized, while social spending on health, education, and poverty programs has increased by over 45 percent. Poverty has been reduced from 60 percent to less than 40 percent and the rate of illiteracy from 13 percent to 3 percent.

Even as much of Latin America lingers in economic slowdown, Morales’ Bolivia has thrived as GDP has been tripled with an average growth of 5 percent annually, even as minimum wage has been quadrupled.

Nevertheless, the new normal of lower commodity prices and Bolivia’s critical economic transition translate to a precarious phase of development. In September, Morales asserted the country is entering the industrialization stage. Consequently, sharply lower commodity prices pose challenges to making further progress towards the objectives laid out in the Patriotic Agenda 2025, including eradication of extreme poverty, better access to health and education, and state-led industrialization.

As the authorities implement their 5-year development plan – Plan de Desarrollo Económico y Social 2016–20 – last decade’s sizable fiscal and external current account surpluses have turned into large deficits.

Real output growth is projected at 3.7 percent in 2016, on the back of large twin deficits and rapid credit growth, and is expected to converge towards 3.5 percent over the medium term, consistent with the new commodity price normal.

What next?

Obviously, Bolivia’s right-wing opposition wants to make sure that Morales cannot run for a fourth term in the 2019 race. Yet, as Justice Minister Hector Arce has said, “any constitutional reform needed can be implemented when the will of the people is at stake.”

After all, historical precedents do not bode well. In the mid-1960s, after 12 years of progressive rule by the Revolutionary Nationalist Movement (MNR), a military junta captured power in Bolivia, while the US Central Intelligence Agency (CIA) provided both training and finances to the Bolivian military dictatorship. Until the 1980s, that paved way to decades of weak governments and violent military coups.

Moreover, U.S. efforts at regime change in Venezuela and indirect interventions in Brazil highlight the likelihood of intensified pressures by Washington that could well undermine the progress of the past decade in this nation of 11.4 million people.

While Morales’ Western critics are suspicious about his bid to extend term limits, Morales knows only too well that his departure could strengthen the opposition that is centered in the wealthy eastern lowland province of Santa Cruz, the narrow urban middle class and the conservative oligarchy.

The struggle for Bolivia’s future is about to begin.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2017 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.