Tesla - Can A Company Be Great And A Great Short?

Companies / Electric Cars Oct 12, 2017 - 01:42 PM GMTBy: John_Rubino

One of the fascinating things about financial bubbles is how they transform great companies into screaming short sale candidates. Put another way, bear markets tend to throw even the prettiest babies out with the bathwater.

One of the fascinating things about financial bubbles is how they transform great companies into screaming short sale candidates. Put another way, bear markets tend to throw even the prettiest babies out with the bathwater.

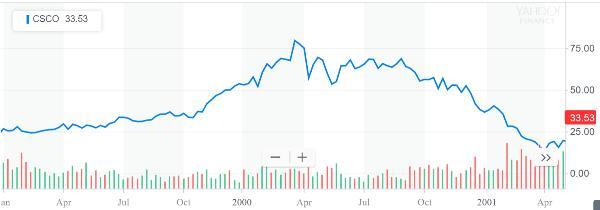

Here, for instance, is what happened to Cisco Systems, the dominant maker of networking gear (the devices that run the Internet) when the 1990s tech stock bubble burst, bankrupting many of its customers and causing its earnings to miss expectations. Its stock fell by more than three-fourths and those who had bought it during the previous year’s euphoria got hosed.

Cisco recovered, as great companies do, and continues to lead its part of the tech world. Current market cap: $160 billion.

And here’s Bank of America, which was a rock-solid dividend paying machine during the 2000s housing bubble – until the bubble burst and everyone defaulted on their mortgages. B of A stock fell by 90% and it stopped paying dividends, leaving its (mostly retiree) shareholders with massive capital losses and zero current income.

It too subsequently recovered and, along with Goldman, Morgan and its other money center bank peers, is now back to manipulating markets with impunity and paying rich dividends. Its market value is a little north of $270 billion.

Which brings us to the current bubble, bigger and broader than its predecessors and so – presumably – full of more great companies about to morph into life-changing shorts. Consider Tesla:

You have to love this company. Founded and run by Elon Musk, who inspired the Tony Stark character in Iron Man, it’s a leading maker of electric cars (which are both insanely fun to drive and the solution to the oil part of the fossil fuels dilemma) and solar panels (solution to the coal part of fossil fuels). So it’s about as cool as a company can be.

But after rising by more than 1000% in the past five years it now trades at nearly 6x sales – an extremely rich multiple for an established company – and is having some dramatic production problems with its newest models:

To sum up, Tesla is facing a combination of richly-valued stock, overvalued stock market, and failure to meet its goals for this and presumably the next couple of quarters. So it fits the profile of the great company with internal and external problems that make its stock price hard to justify.

Will it (and its Big Tech peers) be the next Big Short? That probably depends on when the current bubble bursts and whether governments this time around respond by directly buying large cap stocks. Those things are unknowable, but right now the shorts have a lot of data points on their side.

Full disclosure: Various members of the DollarCollapse staff are looking hard at shorting Tesla.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.