Young Guns of Gold Podcast – ‘The Everything Bubble’

Commodities / Gold and Silver 2017 Oct 11, 2017 - 05:22 PM GMTBy: GoldCore

– Young Guns of Gold Podcast – ‘The Everything Bubble’

– Precious Metal Roundtable discuss gold in 2017 and outlook

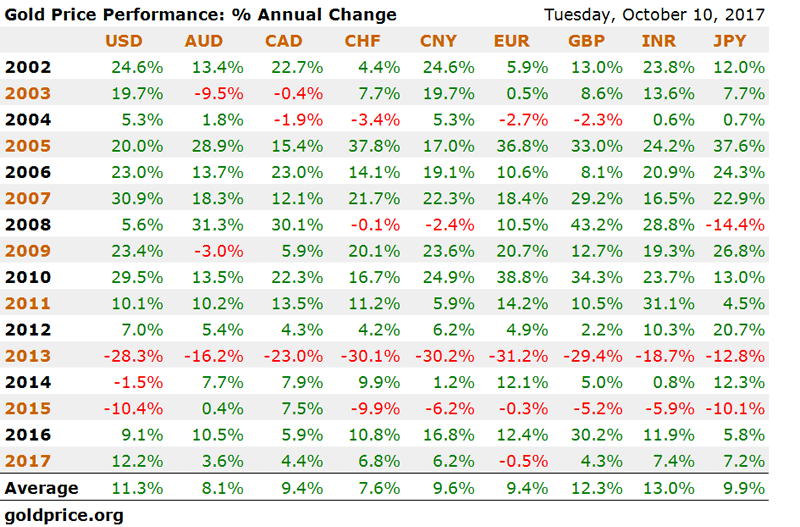

– Gold +9.1% year to date; Performing well given Fed raising rates, lack of volatility and surge in stock markets

– “People are expecting too much from gold”

– Economy: Inflation indicators, recession on the horizon, global debt issues

– Global demand: ETF inflows, Russia central bank purchases, Germany investment figures and international coin demand bode well for gold

– “First monetary inflation, then asset inflation, next is price inflation …”

– Gold bull market resumed; silver should outperform gold

Indicators point to inflation, a recession is on the horizon and the ‘Everything Bubble’ is the great threat to financial stability – these are the conclusions of the Young Guns of Gold who hosted a Precious Metal Roundtable, this week.

Jan Skoyles from GoldCore and Jordan Eliseo of Australia’s ABC Bullion were hosted by Ronald Stoeferle of Incrementum in a reboot of their Young Guns of Gold podcast.

The Young Guns of Gold discussion was broken into three parts:

- Gold, Markets and Macro

- Gold’s Role in a Portfolio, 2017 and beyond

- Gold on the international stage

- Engagements and buying diamonds : )

Executive Summary

- High expectations of Trump’s reflationary growth policy dampened the gold price increase in 2016. However, Gold was still up 8.5% in 2016 and is up 10.6% since Jan. 2017.

- The further development of the normalization of monetary policy in the US is the litmus test for the US economy and it is decisive for how the gold price will develop.

- If the normalization of monetary policy does not succeed – which we expect so – gold will pick up momentum.

- Based on the premise that the bull market in gold has resumed, we expect the gold-silver ratio to decline.

In order to listen to and watch the Young Guns of Gold podcast click here.

Gold Prices (LBMA AM)

11 Oct: USD 1,290.20, GBP 978.62 & EUR 1,091.90 per ounce

10 Oct: USD 1,289.60, GBP 977.77 & EUR 1,094.61 per ounce

09 Oct: USD 1,282.15, GBP 976.23 & EUR 1,092.01 per ounce

06 Oct: USD 1,268.20, GBP 970.43 & EUR 1,083.93 per ounce

05 Oct: USD 1,278.40, GBP 969.28 & EUR 1,086.51 per ounce

04 Oct: USD 1,275.55, GBP 960.87 & EUR 1,085.11 per ounce

03 Oct: USD 1,270.70, GBP 959.00 & EUR 1,081.87 per ounce

Silver Prices (LBMA)

11 Oct: USD 17.15, GBP 13.00 & EUR 14.51 per ounce

10 Oct: USD 17.12, GBP 12.98 & EUR 14.53 per ounce

09 Oct: USD 16.92, GBP 12.86 & EUR 14.41 per ounce

06 Oct: USD 16.63, GBP 12.73 & EUR 14.20 per ounce

05 Oct: USD 16.66, GBP 12.64 & EUR 14.19 per ounce

04 Oct: USD 16.83, GBP 12.67 & EUR 14.29 per ounce

03 Oct: USD 16.61, GBP 12.53 & EUR 14.13 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.