Gold Bull Market Confusion Presents a Golden Opportunity

Commodities / Gold & Silver Aug 29, 2008 - 01:50 PM GMTBy: Andy_Sutton

You know there is something wrong when financial commentators are forced into being weathermen. During the better part of this new century, we have dealt with tightness in oil supplies and dire warnings of woe that would befall us should a hurricane get loose in the Gulf of Mexico . During this same period, we have been bombarded by higher costs across the full spectrum of items that are considered to be staples of living the in United States . Yet officials and media pundits have stubbornly insisted that inflation is ‘contained' or recently that it ‘will cool next year'.

You know there is something wrong when financial commentators are forced into being weathermen. During the better part of this new century, we have dealt with tightness in oil supplies and dire warnings of woe that would befall us should a hurricane get loose in the Gulf of Mexico . During this same period, we have been bombarded by higher costs across the full spectrum of items that are considered to be staples of living the in United States . Yet officials and media pundits have stubbornly insisted that inflation is ‘contained' or recently that it ‘will cool next year'.

Common sense dictates that the US is in a recession of at least some degree yet we get reports that the economy is now growing at a rapid pace. We are told all is well while jobs continue to disappear, defaults on all types of debt are skyrocketing, and a wave of bank failures appears imminent. Similar disparities exist in the housing market where the bottom is called monthly amid the reality that both sales and prices are plummeting. There is clearly a bull market in confusion.

For the past 8 years, wise investors have chosen to ignore the confusion and in many cases unplugged themselves from the traditional financial system, opting to become their own central bank and invest in gold and silver. Others have used a hybrid model of investing partially in the physical metals and partially in shares of precious metal miners and related companies. This has undoubtedly been the right move. The recent correction included, gold prices alone are up an amazing 45% just since my Survival Guide was published on 10/23/2006 . For those who have been in since the beginning of the move, the gains have been even larger.

Many in the mainstream press will quickly scoff at the idea of holding Gold and Silver because they don't pay dividends. So to be fair to their argument, I calculated the movement in the S&P500 Dividend Reinvested Index from 10/31/2006 to the last report at the end of this past July. Even with dividend reinvestment, the S&P500 is down 4.78% while Gold is up nearly 50%. This takes the primary argument against owning real money and blows its doors off. Granted, we're only looking at a period of not quite 2 years here, but given the macroeconomic events that have transpired it is clear that real money was the way to go.

The question we need to ask now is pretty simple. Is anything going to change moving forward that will reverse this trend? Or, put another way, what would need to happen to make precious metals unsuitable for investment? There are dozens of prerequisites, but we'll stick to the Big Four.

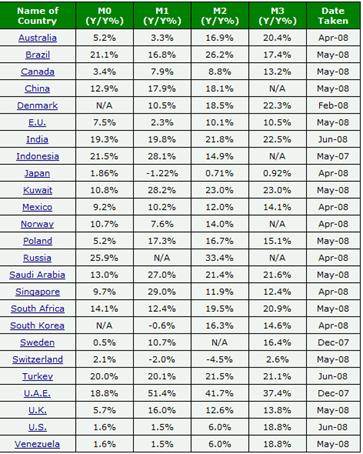

- Since precious metals, particularly Gold are proxies for inflation, we would need to see worldwide inflation slow dramatically. A quick look at the chart below tells us this is nowhere near happening. The global supply of money in US$ terms has increased by 12.4% since mid-2007 from $53.7 Trillion to $60.3 Trillion. We're still inflating like crazy. (Chart Compliments of dollardaze.org)

- Geopolitical risk would have to decrease. Risk tends to be friendly towards precious metals. This because deep down, most people understand that fiat money is not real money, but only has value because its backing government says it does. Its value is based almost entirely on perception. Wars and rumors of wars tend to undermine political and therefore financial stability. On the other hand, gold has been recognized as real money for thousands of years because it is desirable, portable, homogenous, and scarce . Scarcity and fiat money are 180 degrees diametrically opposite to each other.

- Systemic risk to the financial system would need to be swept away. This is no simple task and, despite what Bernanke & Company choose to say, it is clear that the systemic risk to the financial system is nowhere near close to abating. Bank failures are on the rise and credit spreads are at record levels. The housing debacle has left many financial hand grenades in the portfolios of investment and commercial banks the world over and many have yet to go off.

- Inflationary expectations would need to decrease significantly. Again, perception tends to be reality and if people are convinced that prices are going to continue to rise, then they will behave accordingly. They will seek out assets that protect their purchasing power. Commodities generally assume this role due to scarcity: they cannot be printed or digitally created like fiat money. And the more funny money that sloshes around chasing a finite quantity of goods, the more those goods will increase in terms of the fiat currency. To reverse this trend, people worldwide would have to get the idea that their money is going to buy more, not less. It is going to be difficult to accomplish that feat with the price of almost everything (except housing and stocks) going up.

Given just this cursory analysis, it is easy to see why Gold is a slam-dunk choice in terms of protecting wealth. Certainly, gold is prone to nasty corrections. Too often, people buy gold with the idea that they're going to get ‘rich'. These folks fail to properly understand why it is they should own gold in the first place and are easily shaken out when a correction occurs. Gold should not be purchased with the expectation that it will make you rich. It should be acquired to protect your purchasing power. The recent rout in precious metals presents a fantastic opportunity for new buyers to get on board and for people who already have positions to add to them as circumstances permit.

One caveat that needs to be mentioned is the fact that the precious metal markets are prone to intervention and manipulation. These activities are disruptive to normal market function and can create disparities between the price of futures contracts and the actual metals themselves. GATA covers these activities in great detail and has done a masterful job assimilating a vast array of resources, articles, and other materials related to this topic. I highly recommend getting up to speed on this important issue before investing – particularly if you're new to these markets.

In totality, the recent correction in precious metals should be viewed not as a tragedy, but rather as the opportunity of a lifetime.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.