Backdrop For Gold Today Is As Bullish As It Has Been In A Long Time

Commodities / Gold and Silver 2017 Sep 26, 2017 - 03:31 PM GMTBy: GoldCore

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week.

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week.

December gold rose $14, or 1.1%, to settle at $1,311.50 an ounce. Prices, which lost about 2.1% last week, saw their highest finish since Sept. 15, according to FastSet data as reported by Marketwatch.

“The backdrop for gold today is as bullish as it has been in a long time,” said Mark O’Byrne, research director at GoldCore in Dublin.

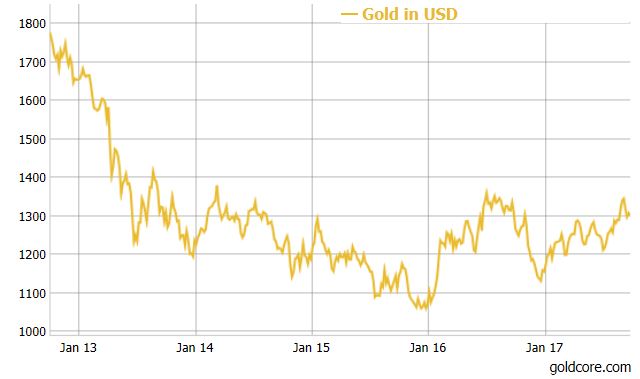

Gold in USD (5 years)

He expects gold prices to reach $1,400 before the end of the year.

With President Donald Trump “in the White House and the political situation in the U.S. and globally more uncertain than it has been in many years, gold will almost certainly continue to see robust safe-haven demand,” he said.

“This should push gold higher in the coming months.”

Recent military tensions between North Korea and the U.S. and its allies has helped to underpin gold’s haven status as a hedge against a sudden escalation in geopolitical tension.

According to media reports Monday, North Korean Foreign Minister Ri Yong Ho told reporters that Trump’s tweet that leader Kim Jong Un “won’t be around much longer” was a declaration of war, and Japanese leader Shinzo Abe on Monday called a snap general election in a bid to consolidate power in the midst of a diplomatic crisis with North Korea.

Gold is “coming out of a bear market, and “the technical position looks better and better after gold bottomed in December 2015,” said O’Byrne.

“Since then, we have seen a series of higher lows and higher highs.”

“Global demand remains robust with strong demand being seen in many sectors—especially in the ETFs and also in Chinese demand”, he said.

Gold is also considered a counter to what some market participants have described as lofty levels for U.S. equities potentially ripening for a correction.

The Dow Jones Industrial Average DJIA, -0.24% and the S&P 500 index SPX, -0.22% recently touched all-time highs, but traded broadly lower to start the week.

Gold gained even as the ICE U.S. Dollar Index DXY, +0.24% which measures the buck against a half-dozen currencies, was up 0.5%.

The two markets often move inversely as a weaker dollar can make commodities pegged to the currency, including most of the world’s gold, more appealing to buyers using weaker monetary units.

The dollar strengthened against the euro, which was under pressure after a heavy drop in support for mainstream parties in Germany’s general election on Sunday left the way forward in doubt for German Chancellor Angela Merkel’s conservative alliance.

Gold Prices (LBMA AM)

26 Sep: USD 1,306.90, GBP 969.59 & EUR 1,105.38 per ounce

25 Sep: USD 1,295.50, GBP 957.89 & EUR 1,089.26 per ounce

22 Sep: USD 1,297.00, GBP 956.15 & EUR 1,082.09 per ounce

21 Sep: USD 1,297.35, GBP 960.56 & EUR 1,089.00 per ounce

20 Sep: USD 1,314.90, GBP 970.53 & EUR 1,094.79 per ounce

19 Sep: USD 1,308.45, GBP 969.30 & EUR 1,091.25 per ounce

18 Sep: USD 1,314.40, GBP 970.16 & EUR 1,100.68 per ounce

Silver Prices (LBMA)

26 Sep: USD 17.01, GBP 12.67 & EUR 14.43 per ounce

25 Sep: USD 16.95, GBP 12.57 & EUR 14.27 per ounce

22 Sep: USD 16.97, GBP 12.52 & EUR 14.18 per ounce

21 Sep: USD 16.95, GBP 12.58 & EUR 14.24 per ounce

20 Sep: USD 17.38, GBP 12.84 & EUR 14.48 per ounce

19 Sep: USD 17.15, GBP 12.70 & EUR 14.31 per ounce

18 Sep: USD 17.53, GBP 12.94 & EUR 14.66 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.