US Government’s Promised Entitlements Exceed the Budget Seven Times in Some States

Politics / US Debt Sep 15, 2017 - 05:28 PM GMTBy: John_Mauldin

The US government balance sheet features $80 trillion to $200 trillion in unfunded liabilities. This amount stems from future entitlement program burdens that are, in effect, government promises.

No one is going to vote to reduce their entitlements. (Well, other than the very well-off, who don’t actually need those entitlements.)

Unfunded pension liabilities at the state and local have swollen to roughly $4–$6 trillion in the United States. And that may be understating the severity of the problem.

Kentucky Is an Example of How Severe This Problem Is

It’s easy to cite Illinois or New Jersey, but let’s look at a state like Kentucky.

The State of Kentucky released a remarkably candid self-appraisal of their pension liability issues earlier this year. If you optimistically (and unrealistically) assume between 6.75%–7.5% compounded returns for the future, Kentucky still ends up $33 billion underfunded.

To bring that number into focus, total State of Kentucky spending last year was $32.7 billion, which makes the underfunded portion of their pension liability larger than the entire state budget. But wait, it gets worse.

They asked themselves, what if we have to assume a more realistic discount rate for future returns?

Assuming a more realistic 4% (given the likely returns on their fixed-income portfolios), unfunded liabilities rise to $64 billion, roughly twice the state budget. If you assume a discount rate equal to the 30-year Treasury rate of 2.7%, the unfunded liability climbs to $84 billion – seven times more than the annual general fund spending would allow.

The Next Recession Will Compound the Problem

Now, this is all before we take into account a potential recession, which has in the past meant an average 40% loss on stock market equities, which would make Kentucky’s (and everyone else’s) pension woes even worse.

Further, the massive increases in debt, both in the US and globally, will make the next recovery and future growth even slower than this tepid recovery. (I’ve written about it a lot in my free weekly newsletter, Thought from the Frontline)

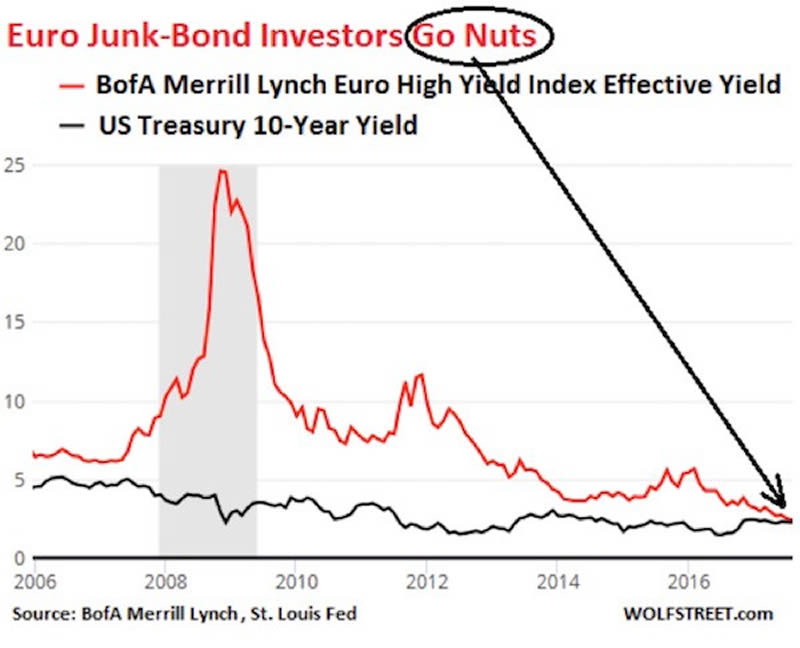

The next financial crisis will not look anything like the last financial crisis did. But it will rhyme. This next chart depicts an extreme example of what is happening around the world.

Scary levels of junk-bond debt with covenant-lite options – coupled with the Frank Dodd rules that don’t allow banks to operate in the corporate bond market as market makers – are going to mean that corporate debt, from the worst right on up to the best, will take a massive yield hit, as the flight for cash rhymes with what we saw in 2009.

Remember, in a crisis you don’t sell what you want to sell; you sell what you can sell. And at a bargain-basement price. We have monster mutual funds and ETFs investing in these high-yield corporate markets, and the redemptions from them are going to force selling into a market where there are no buyers.

If you’re wondering what will push the country into recession, look to the financial markets. That's where the excesses are being created. And for the record, I could spend another four pages showing charts like the one above.

Join hundreds of thousands of other readers of Thoughts from the Frontline

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.