Copper, Oil, Gold and US Stocks: Markets Big Picture Status

Stock-Markets / Financial Markets 2017 Sep 08, 2017 - 01:48 PM GMTBy: Gary_Tanashian

Sometimes I like to trot these lumbering monthlies out so we can quiet everything down and see where various markets are slowly heading.

Sometimes I like to trot these lumbering monthlies out so we can quiet everything down and see where various markets are slowly heading.

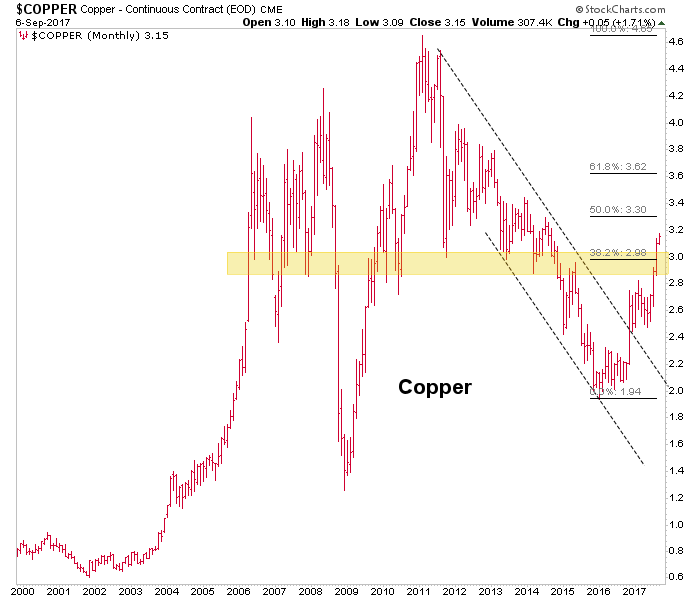

First of all, as I go down with my ‘strengthening US dollar’ ship*, I also mal-projected copper’s upside. I’d felt that $3/lb. would cap Doctor Copper because it is very clear lateral resistance at a handy 38% Fib retrace.**

* Well, insofar as I own UUP and EUO, it has not been fruitful; but that is the whole point because the positions are just a partial hedge against what has been a very successful long deployment in items rising against the declining USD. Still not thinking of dropping long-USD positioning, and I remember how long it took to see my bullish Treasury bond view get proven out against the herds earlier this year.

** Insert here the usual stuff about targets and resistance points being objectives, not stop signs.

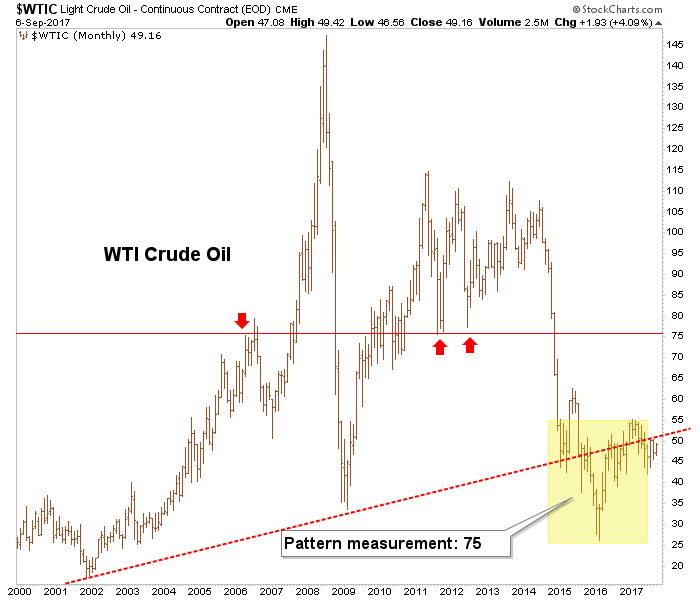

Crude Oil sported a bullish looking pattern last year but has faded this year. The pattern is still viable. I am not currently an oil bull, but if at any time you see WTIC go above 55, plan on 75.

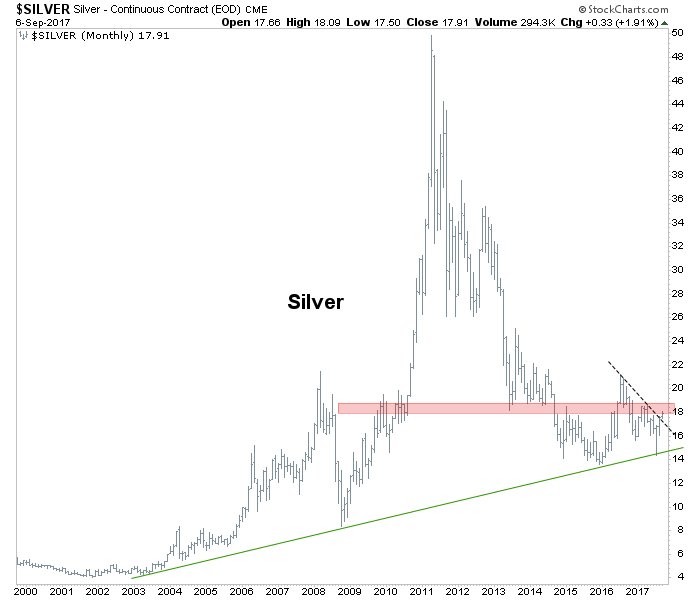

Silver is attempting to break the 2016-2017 downtrend line but is at a long-term resistance zone (see Doctor Copper above). Our short-term target – based on a daily chart pattern – is up to 18.50; but that does not break resistance. I am constructive on silver beyond any near-term reactions.

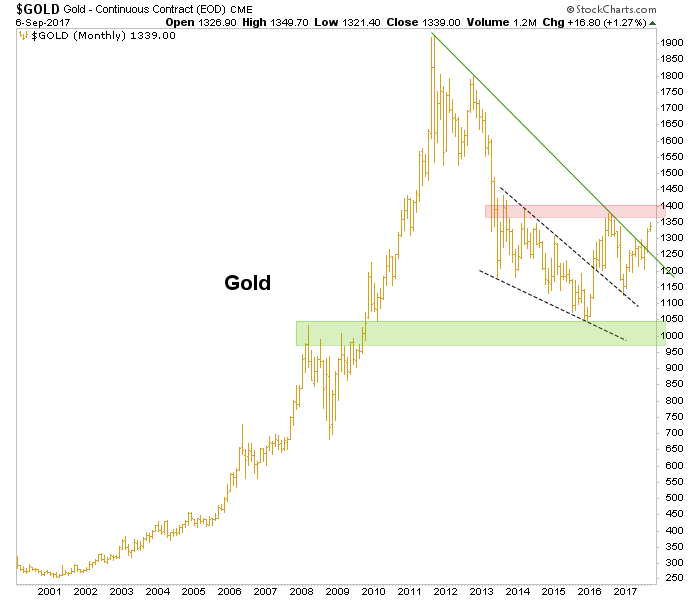

Another view of gold’s monthly situation, with more detail provided in yesterday’s post… Gold’s Vulnerability Remains. I am bullish, but the noted resistance will be tough to deal with and if peace breaks out, all the casino patrons buying because of the lunatic in North Korea will be cleaned out.

The S&P 500 and HUI show at risk and developing bullish, respectively. The risks to the stock market* were defined in this post on August 11: Potential Pivots Upcoming for Stocks and Gold. As for the HUI Gold Bugs index, let’s just say that it has long-since fulfilled its downside objectives and is working on a pivot to big picture bullish.

* These do not include the ‘years ending in 7’ hype, which is all too loudly being broadcast lately and if anything, would serve the bulls, not the bears. Look no further than the ‘1929 analog’ crap from a few years ago that utterly failed to be bearish.

Now let’s check in on the top caller and the markets he pimps…

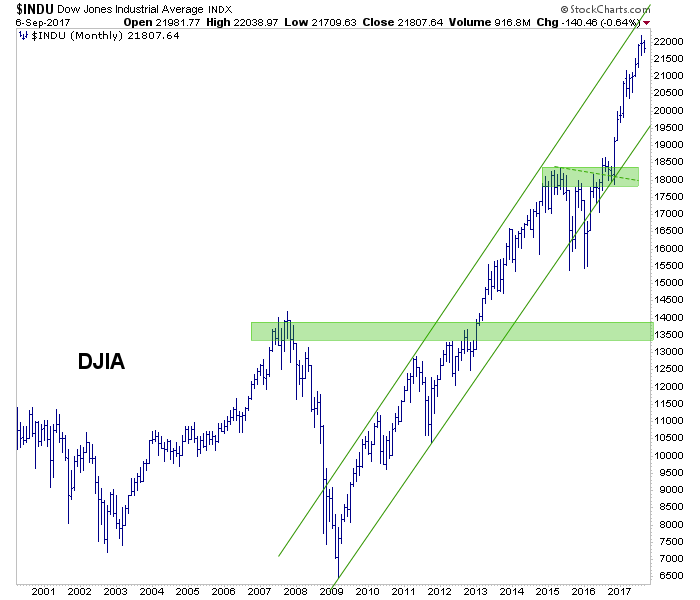

Dow really needs to shake everyone out with a drop to the 18,000s. FYI however, the biggest picture bull market does not end unless 13,500 gets taken out. That would be one hell of a bear within a bull and then we’d see how well the ‘stocks for the long run’ crowd can stick to its guns. For now, if a correction comes about let’s only project the 18,000s.

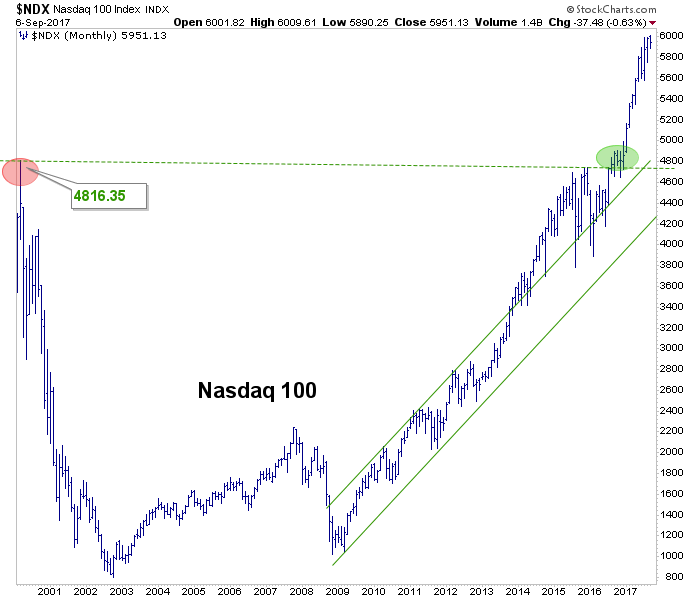

Nasdaq 100… words are really not necessary. 4800, which was once an upside target of ours, is key support.

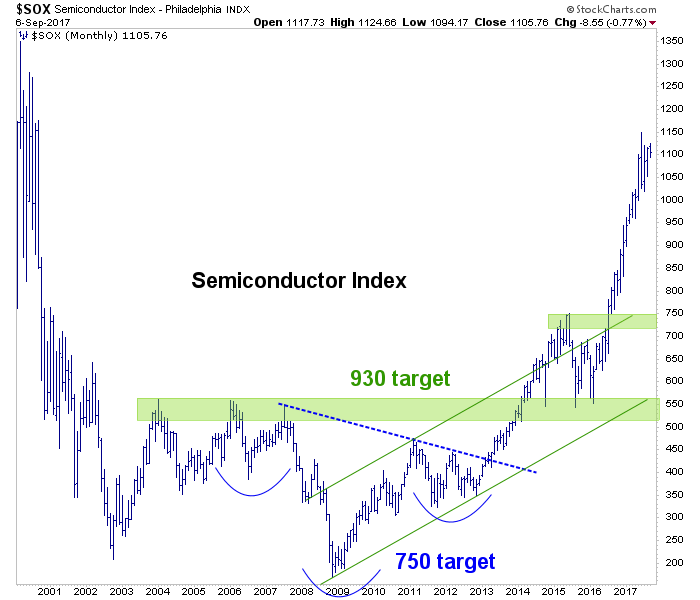

The Semiconductor index has been an upside leader ever since we got our positive Semi Equipment ‘booking’ signals in January of 2013. Typical of the stock market, SOX then went on to crush even our best target, which I did not even fully believe at the time it was projected.

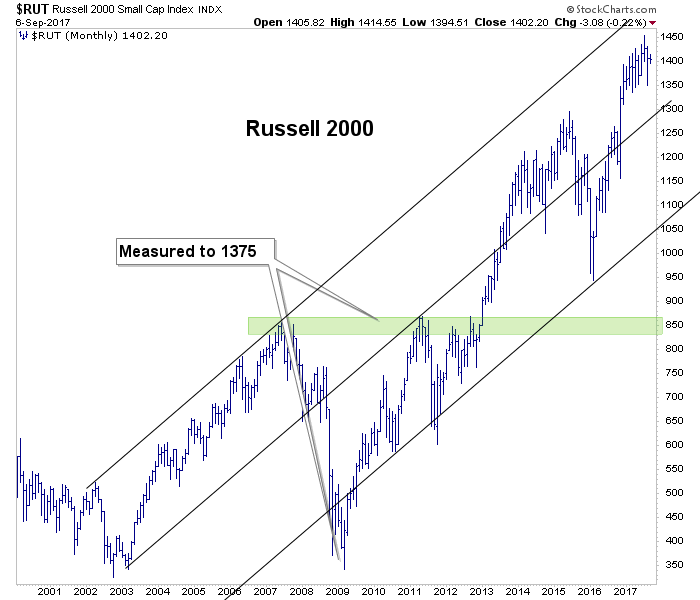

Russell 2000 as well. I did not believe the 1375 target and that was my bias, which I’ve learned to keep well segregated, doing the thinking for me.

It bears repeating that the above are slow moving big pictures. The short and intermediate-terms can make many moves contrary to what the monthly charts have laid out. But it is good to keep different time frames in view because perspective and frame of reference are only everything in noisy stock markets replete with chartists either wittingly or unwittingly promoting their already conceived notions. After all, there are many different technical angles through which to view any single market!

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2017 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.