The Perfect Stock Market Crash Indicator Is Flashing Red

Stock-Markets / US Auto's Jul 30, 2017 - 02:20 PM GMTBy: John_Rubino

What’s the last big toy you buy when things have been good for a really long time and you already have all the other toys? An RV, of course. A dubious thing to own if you already have a house, but when the good times seem likely to roll on forever, why the hell not?

And what’s the first thing you sell when you lose your job and your stocks are tanking? That very same RV. Which makes new RV sales a useful indicator of our place in the business cycle.

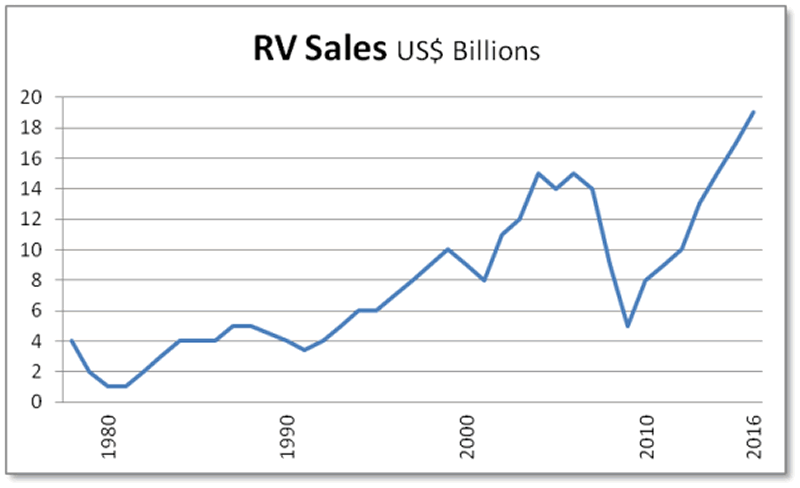

What does it say now? Here you go:

Notice the mini-spike in the late 1990s and the major spike in mid-2000s, both of which were followed by corrections. Now note the mega-spike from 2010 and 2016.

And how are things going so far this year? Well, the space is on fire:

‘The RV space is on fire’: Millennials expected to push sales to record highs

(CNBC) – RV shipments are expected to surge to their highest level ever, according to a forecast from the Recreation Vehicle Industry Association.It would be the industry’s eighth consecutive year of gains.

Thor Industries and Winnebago Industries posted huge growth in their most recent earnings report.

Those shipments are accelerating, and should grow even more next year, the group said. Sales in the first quarter rose 11.7 percent from 2016.

Much of the growth can be attributed to strong sales of trailers, smaller units that can be towed behind an SUV or minivan, which dominate the RV market. The industry also is drawing in new customers.

As the economy has strengthened since the Great Recession, and consumer confidence improved, sales have picked up, said Kevin Broom, director of media relations for RVIA.

What we have here is another classic short. During the past couple of recessions, RV stocks plunged as everyone came to their senses and stopped buying $60,000 motel rooms. Based on the above chart that’s a pretty good bet to repeat going forward. Let’s revisit this play in a couple of years.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.