Kuwait Stock Exchange Index (KWSE): Watch out below!

Stock-Markets / Middle East Jul 03, 2017 - 06:56 AM GMTBy: MarketsToday

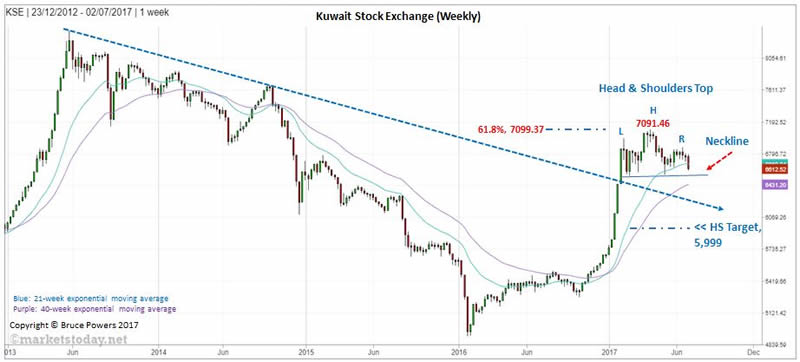

The Kuwait Stock Exchange Index (KWSE) is sitting on the edge of a cliff. We may soon see a decisive reversal of the uptrend begun from the January 2016 low. Following the January 2016 low the KWSE advanced as much as 44.4 per cent as of the 7,091.46 peak reached in early-April. That high completed a 61.8% Fibonacci retracement of the long-term downtrend.

During the rally the index moved well above the pivotal 40-week exponential moving average (ema), and as of January broke out above the long-term downtrend line. This is all bullish behavior for the long-term.

Nevertheless, over the past five months a well formed potential head and shoulders top trend reversal pattern has formed. The right shoulder is lower than the left. This reflects increasing selling pressure as the rally defining the left shoulder was formed, and therefore increases the odds that the pattern could give a bearish signal soon.

There is no confirmation that the pattern will lead to a bearish move until there is a trigger below the neckline. This will occur on a drop below 6,545. At that point selling pressure should intensify. Weakness is confirmed on a daily close below 6,534, the low of the head and shoulders pattern.

Once triggered there is a good chance of at least reaching the 38.2% Fibonacci retracement at 6,258.73 before seeing support that could lead to a tradeable bounce. However, the minimum target derived from the topping pattern is 5,999. That’s an interesting price because if it is reached a 50% retracement of the full uptrend will have also been completed. The 50% mark is at 6,001.50.

The above bearish scenario becomes suspect if we see a daily close above the right shoulder high at 6,867.62. (www.marketstoday.net/en/)

Bruce Powers, CMT

Chief Technical Analyst

http://www.marketstoday.net/

© 2017 Copyright Bruce Powers- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.