Has Gold Production Peaked?

Commodities / Gold and Silver Stocks 2017 Jun 30, 2017 - 04:45 PM GMTBy: Arkadiusz_Sieron

We often hear about ‘peak gold’, i.e. the maximum level of the global production of the yellow metal. According to some analysts, the gold supply already peaked in 2016 or it is likely to peak very soon, offering hope for gold bulls. We do not agree with them. The notion of gold peak is flawed and should not be a basis for investing in gold.

We often hear about ‘peak gold’, i.e. the maximum level of the global production of the yellow metal. According to some analysts, the gold supply already peaked in 2016 or it is likely to peak very soon, offering hope for gold bulls. We do not agree with them. The notion of gold peak is flawed and should not be a basis for investing in gold.

And here is why. It’s extremely difficult – or even impossible – to determine the peak in gold production, as the level of mining depends on many factors, including future discovery of new deposits and technological breakthroughs. Look at the chart below.

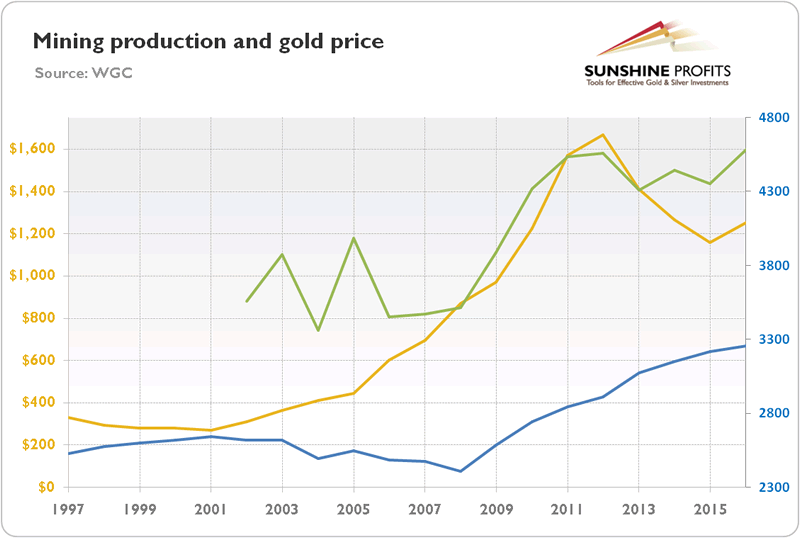

Chart 1: The mining production (blue line, right axis, in tons), total supply (green line, right axis, in tons), and the price of gold (yellow line, left axis, annual average, in $) from 1997 (2002) to 2016.

As one can see, the level of mining production has been rising since 2008, despite continuous calls for a ‘gold peak’ (for example, Goldman Sachs warned against a gold peak in 2015).

However, such analyses are based on estimates of “X years of known mineable reserves of gold”. The key word here is “known”. In reality, the level of known reserves also increases over time due to new discoveries and better technology. Everything comes down to price – mining of gold will not simply end when we will deplete all relatively easily accessible deposits. It will be continued, but at higher costs. And higher gold prices (we assume here for the sake of discussion) would trigger searches for more deposits, exploration of previously unfeasible sources and developments in new technologies which could increase our ability to mine gold similar to the shale technology in the oil market.

If you want an example, look once more at the chart above. There was a peak in 2001. But the mining production entered an upward trend again in 2008 because of factors we have just mentioned. Hence, even if we see a gold peak, it does not necessarily imply a long period of decline in gold supply.

And there are even more important problems with the idea that gold peak will be bullish for gold investors. First, the decline in gold mining does not equal with a decrease in total supply of gold, as there are plenty of scrap gold which could be recycled (in 2016, recycling accounted for 28 percent of gold supply).

Second – and most importantly – the decline in the gold supply does not need to lead to a rise in the price of gold. The chart above clearly shows that between 2008 and 2012 gold prices increased in tandem with the mining production and the total supply. This is because gold is a unique commodity, as there are enormous gold holdings in the world. Thus, the notion of a production peak in gold is irrelevant. Perhaps it might have a limited use in the case of the oil or copper markets, but it does not apply to the gold market. The reason is very simply: the annual mining production is a negligible fraction of the total gold stock (it’s estimated at 1-2 percent of the global gold holdings).

Hence, you can close all mining companies and nothing will happen. Or almost nothing, at least compared to other commodity markets. Turn off the tap of oil and you will have a global catastrophe. Close copper mines and the global industrial production will collapse. This is because these commodities are used on an ongoing basis and their reserves are very small. However, gold is practically not consumable and it has a relatively high stock-to-flow ratio.It implies that the traditional theory of supply and demand does not apply to gold. The dynamics of annual supply (and demand) is thus meaningless for price discovery. Deficits and surpluses, or peaks and bottoms in production, do not drive the price of gold. As a reminder, the amount of gold equal to the annual mined supply changes hands in less than a week in the London market alone. So why should precious metals traders care about the peak in gold production resulting in a future few percent decline in annual mining production?

The key takeaway is that there is a lot of buzz about the annual dynamics of demand for gold and its supply, with some analysts calling for buying bullion due to the ‘peak gold’. To be clear, there are a lot of reasons to own the yellow metal – it’s a safe-haven asset and portfolio diversifier – but the projected declines in mining production are not among them. One thing is that these forecasts are often wrong, while another is that contractions may be only temporary. However, the most important issue is that to understand the price of gold (the same applies to silver, though to a lesser degree), investors should not look at the new supply coming to the market each year, but to the total supply that already exists and comes to the market from the holders of the yellow metal. Simply put: gold is really unique commodity and investors should not forget to factor that matter into their investments.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.