Canada Real Estate Bubble

Housing-Market / Canada Jun 30, 2017 - 06:39 AM GMTBy: Harry_Dent

I’ve been seeing a lot in the news lately about Canadian and Australian real estate prices. Here’s just a sampling:

I’ve been seeing a lot in the news lately about Canadian and Australian real estate prices. Here’s just a sampling:

New Brunswick real estate offers a lesson on peak housing prices

Condo flipping on the rise as Vancouver market heats up

Face it Canada – you’re a real estate addict and no one wants a cure

Canada real estate industry welcomes Buffett to the neighborhood

Canada’s red hot real estate heats up apartment market to heights not seen in 30 years

Canada is on the ‘A-list’ for commercial real estate investors, in a world of uncertainty

Most of what we’re hearing is that there’s little to worry about with our neighbor’s real estate prices shooting to the moon.

Well, as I told 5 Day Forecast readers yesterday, there IS something to worry about. Something BIG.

Today, I’ll share with you what I told Boom & Bust subscribers yesterday…

Between early 2006 and late 2012, real estate in the U.S. took a whipping worse than what the Great Depression dished out. It lost 34% compared to the 26% it shed back in the early 1930s.

But property prices in Canada and Australia hardly paused, and then they continued their march higher.

Canadian home prices are now 84% higher than in the U.S.!

Despite Canadian’s slightly lower incomes!!

And the Aussies’ are even higher. Home prices in Australia are now 107% higher than those in the U.S.!

It’s terrifying. Stephen King should turn it into one of his horror stories. It’d be a best-seller.

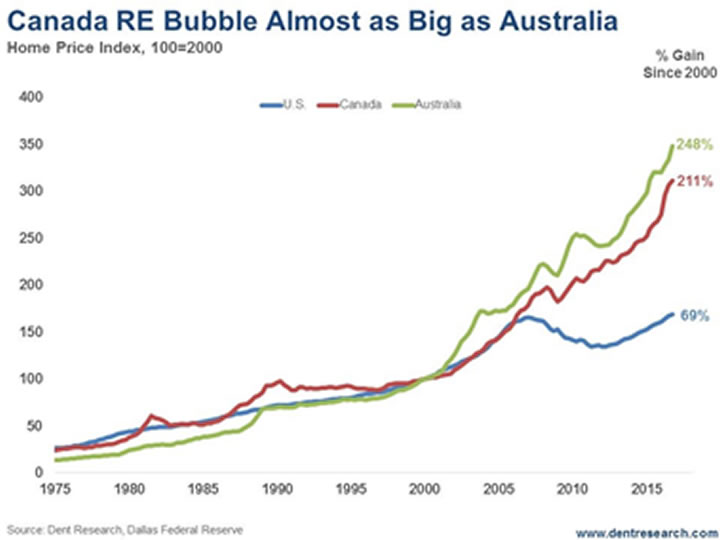

Look at this chart…

You can see how the trends in prices correlated closely for three decades, since 1975. But from early 2006 forward, the U.S. diverged, trending downward while all other English-speaking countries – including New Zealand, Great Britain, Singapore, and Hong Kong – seemed to dust themselves off and continue on.

Turns out, that was a blessing in disguise for U.S. property owners. It means that in the next larger and more global real estate crash, we’ll suffer less than our counterparts.

Both Canada and Australia’s real estate prices went exponential again after 2012. And to me, that suggests we’re in the final “orgasm” phase of these bubbles.

During my last speaking tour of Australia in late May, mainstream economists were finally admitting their country had a bubble. Now I’m seeing more and more articles about a bubble in Canada, with surging consumer debt.

It’s fuel on the bonfires!

Tread carefully here, readers. There’s trouble ahead…

What My Bubble Model Warns

Since 1975, the gains in Australian real estate values have been 25.5 times, while in Canada they’ve been 11.9 times, and 5.5 times in the U.S.

But the most important point, for me, is early 2000. That’s what I’ve identified as the real estate bubble origin. Gains since then have been 248%, 211%, and 69%, respectively.

My real estate bubble model calls for a fall 85% of the way back to that bubble origin, on average. That would imply a downside risk of 61% in Australia, 50% in Canada, and 35% in the U.S.

However, because of Australia’s stronger demographic trends, I don’t think its real estate market will suffer such an extreme loss. I suspect it’ll lose closer to 50%, but that’s still a kick to the gonads.

The worst-case scenario would see Australian real estate shed as much as 71%, while Canadian property lost 68%, and U.S. prices declined 41%.

All bubbles ultimately succumb to their own extremes. U.S. real estate burst earlier because of our subprime crisis, a problem not experienced in Canada and Australia. But, as home prices head into the stratosphere, fewer people can afford them, and eventually it all comes crashing down.

The median price-to-income ratios are highest in Australia, at 7.0. In Canada they’re 4.7. In the U.S., they’re 3.9 (which is modest, but still high). This means Australians must fork over seven times their income to buy a house!

As an aside, median price-to-income ratios are 18.0 in Hong Kong, 13.0 in China, 10.0 in New Zealand, and 4.2 in the U.K. (although London is higher).

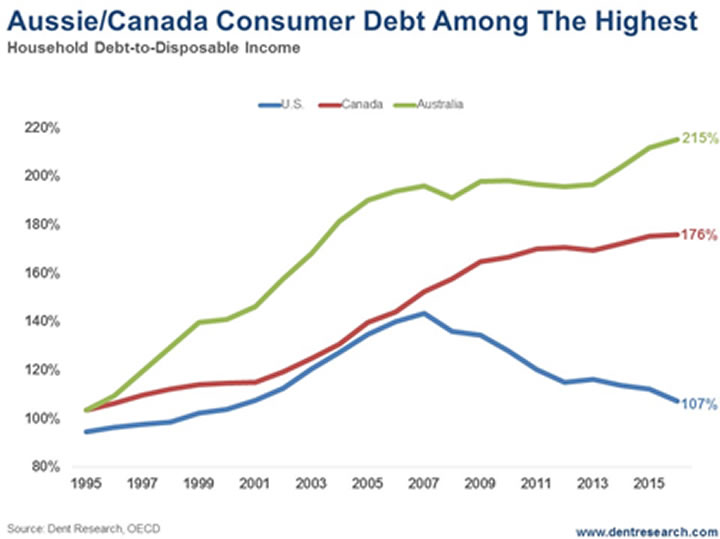

So, the rubber hits the road when it comes to consumer debt burdens, which are heavily weighted with mortgages.

That’s what will put a limit on this bubble, and it’ll happen sooner rather than later. Just look at debt ratios in these three countries..

Since 1995, just before the stock and real estate bubbles, consumer debt to disposable income ratios (after tax) have risen a crushing 215% in Australia (3.15 times), 176% in Canada, and, after our first crash, 107% in the U.S.

It’s time for a debt deleveraging!

And that goes for businesses and their commercial real estate even more because it almost always gets hit harder than residential property.

It may well be that the Canada bubble bursting triggers ours this time around. But Australia is the wild card due to the intensive foreign Chinese buying there.

Don’t believe these bubbles won’t burst. Instead, be prepared.

For the last few weeks, we’ve highlighted the prevalence of fake financial news. I include in this the stories we’re hearing about Canadian and Australian real estate.

To our subscribers who live in those countries… tread carefully. When property prices roll over, the asset becomes illiquid amazingly fast.

And to all our subscribers, watch out for my email on Friday, when I’ll continue this fight against fake financial news.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.