Is There Gold “Hype” and is Gold an Emotional Trade?

Commodities / Gold and Silver 2017 Jun 16, 2017 - 07:41 AM GMTBy: GoldCore

– Very little hype in gold

– Very little hype in gold

– Sentiment is important in the gold market as is other markets particularly stocks

– Article ignores the large body of research showing gold is safe haven asset

– Gold may struggle to breach $1,300 in short term

– Trading gold and short term speculation is high risk and for professionals

– Important for investors to focus on long term fundamentals which remain sound

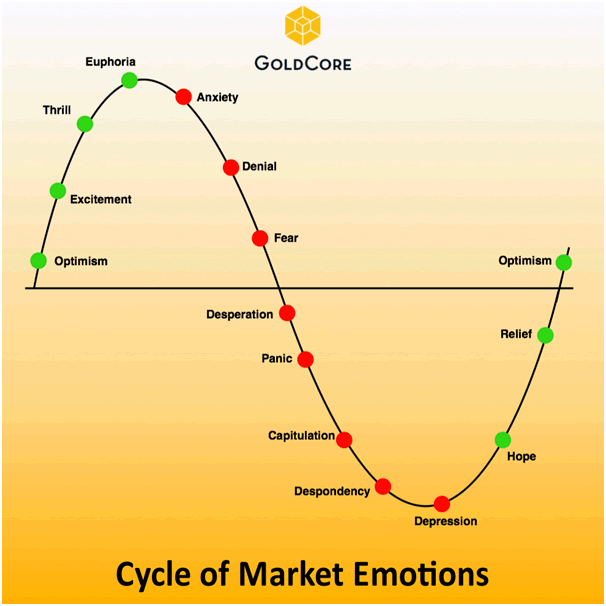

Cycle of Emotions – Hope Phase Now (GoldCore)

Earlier this week Shelley Goldberg , commodities strategist for Roubini Global Economics wrote about how gold was set to disappoint the ‘gold bulls – again.’ Goldberg argued that we should ‘throw out all the fancy analysis and realize that gold is an emotional trade.’

Aside from yesterday’s little hiccup following the Fed announcement, the gold price has had a great year. Goldberg agrees, ’After breaking through a six-year downtrend line, gold rose last week to its highest level since Nov. 4, and is up an impressive 10.5 percent this year.’

Despite this performance Goldberg argues that we shouldn’t ‘believe the hype’ when it comes to gold. The hype she is referring to seems to be made up of the various op-eds and analysis that argue $1,300/oz is a key barrier for the metal to break through in order to set off on a bull run.

A very straightforward presentation of the ‘number of reasons why gold is in demand’ makes up the bulk of Goldberg’s article, yet she concludes ‘with so many valid reasons for gold to rally further, why am I a doubter? The most rudimentary reason is that gold is also an emotional trade and $1,300 is a round number. One need not be a superstar technical analyst. Just consider that for both psychological and systematic reasons, traders and algorithms like to sell on landmark numbers that also serve as a testing ground for a rally’s sustainability.’

Is the evidence that traders like to trade off ‘landmark numbers’ but analysis says it should go higher evidence that there is ‘hype’? We disagree. Rather we argue that not only is there relatively little hype in the gold market but that it is significantly outshone by all the reasons Goldberg gives herself, for why gold demand is up.

Where is the hype?

A brief google search of ‘$1,300 gold’ and my own daily experience of reading gold commentary does not bring me to the conclusion that there is hype. Gold has had a great year, but it has also surprised and disappointed many of us for the last couple of years. We are all aware that $1,300 is the next significant level, but most think that it needs to go higher than this in order to get any significant momentum.

This is something most seem relatively balanced about. There is a huge amount going on both politically and economically at the moment. As we often conclude so many of these commentaries, there is uncertainty everywhere and that includes gold’s performance.

We are not even seeing any ‘hype’ when it comes to physical gold buying. Gold demand is down in the US and we are not in any religious periods that mean manic gold buying as we often see during wedding season in India or New Year in China.

The focus on $1,300 reduces the argument for gold down to one thing – people only care about gold because of the price. This isn’t true, partly because of the six very comprehensive and real reasons Goldberg herself gives to the bullish argument to own gold but also thanks to academic evidence, history and sentiment.

Why is gold demand up?

Goldberg offers six reasons for gold’s popularity at present:

- Role as an inflation hedge

- US Dollar performance

- Interest rates

- Only commodity showing strength

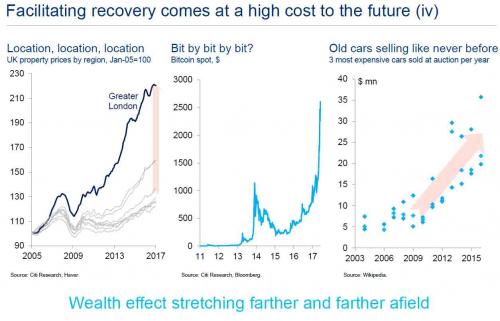

- Concerns over overvalued sectors

- Geopolitical risks pushing safe haven demand

These are all very significant reasons for gold’s performance of late. What we tend to see in mainstream commentary regarding gold is the suggestion that when one of these issues begins to ‘improve’ then gold will begin to suffer. This is a very short-term perspective and one which is supported by traders and speculators. It does not take into account long term fundamentals, all of which these six listed factors feed into. The long term fundamentals are not just influenced by these factors but also history, gold’s performance in a portfolio and sentiment.

Does the price matter?

Of course the price matters, we all like to know what we can sell something for should we need to. But does it matter as much as Goldberg seems to think it does?

For much of the time you are holding gold, you should perhaps look at the price in the same way one might view the price of their house. It’s nice to know what its worth but at that moment in time you know you have no plans to sell it and you still need a roof over your head.

Short-term the price of gold may well struggle to breach $1,300. For now it is likely to stay between $1,260-$1,280, especially given the recent Fed announcement and various uncertainties in the global economy. This might sound like bad news for an investor who entered the gold market at nearly $2,000/oz in September 2011. But did the investor buy gold because of its US dollar price or because of the long-term fundamentals and gold’s role as a safe haven?

Just like when you own a house, you also buy home insurance. So when you invest and have savings you should have a form of financial insurance. Of course, the price of this financial insurance matters, but you will also be considering all the factors that affect your investments both long and short-term, you are not just focused on the price.

It’s a safe haven. It’s academic

“…there is plenty of global geopolitical risk to popularize haven investments, from the spreading of radical Islamic terrorism, to unpredictable North Korean, Philippine and Russian strongmen, to Brexit and the potential for other European Union members to exit, to Gulf Cooperation Council nations severing ties with Qatar and heightening tensions in the Middle East. Add to that global warming, climate risk and wars over water. Then consider the U.S., where a special counsel has been set up to investigate Russian meddling in the 2016 election and where hopes are fading for a economic bump from President Donald Trump’s pro-growth fiscal agenda.”

Goldberg seems to think that gold’s role as a safe haven (or form of financial insurance) is only valid due to geopolitical risk. In fact, gold acts as a safe haven against the initial five reasons she lists for gold demand climbing.

Back in February, we defined a safe haven as ‘An investment that is expected to retain its value or even increase its value in times of market turbulence. Safe havens are sought after by investors to limit their exposure to losses in the event of market downturns.’

In that same article we drew the reader’s attention to the growing body of research on gold and its financial role. Goldberg appears to be unaware of this academic evidence which appears to turn so called hype and emotional trading into real, analytical evidence for gold’s vital role in a portfolio, regardless of its price performance.

The academic research does not define gold as just having one role, for instance ’Hedges and Safe Havens – An Examination of Stocks, Bonds, Oil, Gold and the Dollar’ by Dr Constantin Gurdgiev and Dr Brian Lucey is an excellent research paper which clearly shows gold’s importance to a diversified portfolio due to gold’s “unique properties as simultaneously a hedge instrument and a safe haven.”

As Goldberg points out, sentiment for safe havens are high at present because of the geopolitical sphere. But, she also dismisses gold because it is an emotional investment. In truth, the two cannot really be separated; there is a fine line between sentiment and emotion.

If sentiment is high then we can perhaps feel too confident about an investment and we act on that emotion, and vice versa. But Goldberg seems to think that gold investors are unable to keep these feelings in check or that these are invalid reasons for investing at all.

Conclusion: What’s wrong with a bit of emotion?

“The desire of gold is not for gold. It is for the means of freedom and benefit” Ralph Waldo Emerson

Like any market, sentiment plays a big role in the price and demand for gold. There is also strong anecdotal evidence of gold demand being driven by emotion – the purchase of jewellery is the most obvious example but also consider demand for gold bars and coins during religious festivals. Additionally when people feel panicked or threatened (see Emerson’s quote) then demand for gold will go up.

None of these reasons make gold an investment that feeds of hype and should be ignored. Human emotions and sentiment drive markets, they have throughout history and they will continue to do so. What’s wrong with a bit of emotion? Very few humans can honestly say that some of the biggest life decisions they have made have not been as a result of emotion.

The key here is to be aware of when emotion is the only reason you are making an investment decision, rather than considering the other factors such as gold’s role in the wider economy, in your portfolio and its past performance.

Is gold an emotional trade? It depends on the trader. To give a blanket statement that ‘gold is also an emotional trade’ is to suggest that everyone who buys and sells gold is blinded by emotion.

Goldberg is dismissive of the multitude of factors that affect the decision to buy and hold gold, instead focusing on the price. Investors should always be aware of the risks when investing in gold, but investing in gold means you are considering and insuring yourself against the risks in the wider economy and political sphere. When you take these into account then you are unlikely to be worrying about so-called hype and an arbitrary number picked out of a price chart.

Gold Prices (LBMA AM)

14 Jun: USD 1,268.25, GBP 995.83 & EUR 1,131.41 per ounce

13 Jun: USD 1,261.30, GBP 992.26 & EUR 1,125.33 per ounce

12 Jun: USD 1,269.25, GBP 998.14 & EUR 1,131.28 per ounce

09 Jun: USD 1,274.25, GBP 1,001.31 & EUR 1,139.18 per ounce

08 Jun: USD 1,284.80, GBP 992.12 & EUR 1,142.70 per ounce

07 Jun: USD 1,292.70, GBP 1,001.07 & EUR 1,146.62 per ounce

06 Jun: USD 1,287.85, GBP 997.31 & EUR 1,144.77 per ounce

Silver Prices (LBMA)

14 Jun: USD 16.96, GBP 13.32 & EUR 15.14 per ounce

13 Jun: USD 16.82, GBP 13.21 & EUR 15.01 per ounce

12 Jun: USD 17.13, GBP 13.50 & EUR 15.27 per ounce

09 Jun: USD 17.35, GBP 13.60 & EUR 15.52 per ounce

08 Jun: USD 17.60, GBP 13.60 & EUR 15.67 per ounce

07 Jun: USD 17.60, GBP 13.64 & EUR 15.71 per ounce

06 Jun: USD 17.56, GBP 13.61 & EUR 15.62 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.