Orphaned Poisoned Waters,Severe Chronic Water Shortage Imminent

Politics / Environmental Issues Jun 06, 2017 - 04:40 AM GMTBy: Richard_Mills

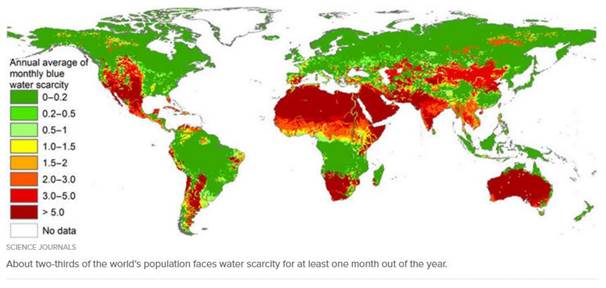

There's a lot of water on the planet we inhabit – an estimated 326 million trillion gallons or 1,260,000,000,000,000,000,000 liters. Hard to believe are reports water is going to get much dearer in our near term future – yet Peter Voser, chief executive of the world's second-largest energy company, Royal Dutch Shell, warned us, as far back as June 2011, that global demand for fresh water may outstrip supply by as much as 40 per cent in 20 years if current fresh-water consumption trends continue. And Voser isn’t the only one warning about future fresh water shortages…

There's a lot of water on the planet we inhabit – an estimated 326 million trillion gallons or 1,260,000,000,000,000,000,000 liters. Hard to believe are reports water is going to get much dearer in our near term future – yet Peter Voser, chief executive of the world's second-largest energy company, Royal Dutch Shell, warned us, as far back as June 2011, that global demand for fresh water may outstrip supply by as much as 40 per cent in 20 years if current fresh-water consumption trends continue. And Voser isn’t the only one warning about future fresh water shortages…

The U.S. Agency for International Development (USAID) predicts that by 2025, one-third of all humans will face severe and chronic water shortages.

“According to the United Nations, water use has grown at more than twice the rate of population increase in the last century. By 2025, an estimated 1.8 billion people will live in areas plagued by water scarcity, with two-thirds of the world's population living in water-stressed regions as a result of use, growth, and climate change.” National Geographic

The World Economic Forum has placed the world water crisis in the top three of global problems, alongside climate change and terrorism.

Our fresh water resource

Our planet is 70 percent covered in ocean – 98% of the world’s water is in the oceans. Which makes 98% of the world’s water unfit for drinking, or irrigation.

Just 2% of the world’s water is fresh. The vast majority of our fresh water, 1.64%, is in its frozen state and locked up in the polar ice caps, Greenland’s ice sheet and glaciers. Once it melts its contaminated by seawater, either by melting directly into the oceans or running to the world’s oceans through a stream or river.

Our available freshwater, .36% of the water on the planet, is found underground in aquifers and wells, and on the surface in lakes and rivers.

“In many parts of the world, in particular in the dry, mid-latitudes, far more water is used than is available on an annual, renewable basis. Precipitation, snowmelt, and stream flow are no longer enough to supply the multiple, competing demands for society’s water needs. Because the gap between supply and demand is routinely bridged with non-renewable groundwater, even more so during drought, groundwater supplies in some major aquifers will be depleted in a matter of decades. The myth of limitless water and the free-for-all mentality that has pervaded groundwater use must now come to an end. NASA Jet Propulsion Laboratory hydrologist James Famiglietti, Nature Climate Change

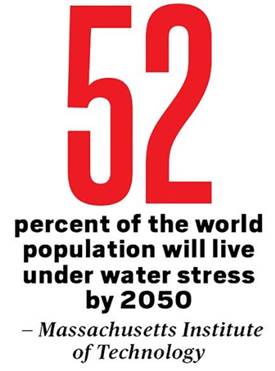

There are currently 7.4 billion of us sharing the world’s fresh water resources. By 2050 the United Nations (UN) expects the world’s population to reach 9.7 billion. Feeding everyone in 2050 could require 50% more water than is needed now.

One of the greatest issues facing us in the 21st century is how we will share this less than half a per cent of usable freshwater to feed our increasing population. If the predicted 40 percent shortfall occurs, and United Nations (UN) population growth estimates are correct, by 2050 we’ll need to feed 2.3 billion more people using far less fresh water than we have available today.

One of the greatest issues facing us in the 21st century is how we will share this less than half a per cent of usable freshwater to feed our increasing population. If the predicted 40 percent shortfall occurs, and United Nations (UN) population growth estimates are correct, by 2050 we’ll need to feed 2.3 billion more people using far less fresh water than we have available today.

Advances in technology, innovation, and best practices/conservation are already clashing with finite water resources, relentless population growth, changing diets, a lack of investment in water infrastructure and increased urban, agricultural and industrial water usage.

Investment in water management as a percentage of GDP has dropped by half in most countries since the late 1990s.

Water is a commodity whose scarcity will have a profound effect on the world within the next decade - the danger to us from the worsening ecological overshoot concerning the world’s fresh water supply makes the reevaluation of our values mandatory. We will have to drastically change the way in which we view our freshwater as a resource.

“Current estimates indicate that we will not have enough water to feed ourselves in 25 years time.” International Water Management Institute (IWMI) Director General Colin Chartres

There is widespread legacy surface and groundwater contamination continuing today that makes valuable water supplies unfit for other uses.

Abandoned and orphaned mine sites

When a mining company wants to dig up specific minerals, it has to remove rock from the earth to do so. Any rock removed that does not contain economic amounts of the wanted mineral is called waste rock. Mining companies put this waste rock in piles called “dumps.”

The economic rock (ore) is then crushed and ground for processing in the mill. Many different chemicals (reagents) such as ammonia, chlorine, hydrochloric acid, sulphuric acid, cyanide and mercury can be used to extract the desired mineral(s) from the crushed material. The wastes from this process are called “tailings.” Tailings can kept in “ponds” - large underwater containment areas or dry stacked on land. Tailings are contained underwater so no air gets at them. Both tailings and waste rock can contain sulphide minerals.

There are thousands of abandoned mines and sites around the world that display unbelievably high levels of contamination from toxins used in and extracted during the mining process. Historically conventional mineral extraction involved virtually unregulated processing of the ores. There also wasn’t any regulated disposal of the unwanted rock and tailings.

Acid Rock Drainage (ARD)

Acid Rock Drainage results from the oxidation of sulfide minerals such as pyrite, marcasite, pyrrhotite, chalcopyrite and arsenopyrite. These sulfide minerals oxidize in the presence of water and oxygen forming sulphuric acid.

This means you can have drainage from a mine site that is highly acidic and sulfate rich. This drainage dissolves and releases heavy metals (like lead, zinc, copper, arsenic, selenium, mercury, and cadmium) into aquifers and surface water - waters contaminated by ARD have low pH, low alkalinity and high concentrations of heavy metals and sulphates.

This process can and does occur naturally, but mining activities can obviously expose a significant amount of material in what is a very short amount of time. Mining ups the scale and hence the impact of the acid generation far beyond what is normally found in nature because of the sudden large-scale exposure to air and water of previously buried material containing sulphide minerals.

Dry stack tailings, and waste rock piles expose massive amounts of sulphide minerals directly to the environment. Torrential rains can cause acid to literally run out of these piles.

Acid rock drainage can affect the immediate area around the contaminated site for decades. It can travel far downstream and drain into underground aquifers impacting areas and drinking water many ten’s, perhaps hundreds, of kilometers from where it originated. Water pollution from dry stack tailings piles, waste rock dumps and tailings ponds may need to be managed for decades, if not centuries, after a mine closes. In countries with long histories of mining the sheer magnitude of the problem can be considerable.

Legacy

Many abandoned and orphaned (those with no traceable owner) mine sites have severe impacts on ecosystem integrity and human health. ARD is seeping out of these sites contaminating fresh water sources and surrounding lands putting local communities at risk. These communities are left to deal with the toxic legacy, or, much more frequently, because of a lack of financial where withal and political clout, to try and live with the contamination and its impacts on their and their family’s health.

There are thousands of sites around the world that contain mining-related arsenic, mercury and other substances. Many of these sites are already ecological disasters and many more are contamination time bombs waiting to go off, not if - when. It’s no wonder the public is increasingly demanding that their government at all levels, and the companies responsible, address the contamination.

Treatment for ARD

Toronto based BacTech Environmental Corp. (CSE: BAC, OTC: BCCEF, WKN: A1H4TY) is a pioneering, environmental technology company that has developed and commercialized a proprietary technology (registered trademark is BACOX) to remediate highly toxic tailing areas resulting from abandoned mining operations.

BACOX is a biological reactor leaching process that uses naturally occurring bacteria to safely oxidize sulphides in waste rock and tailings, thereby eliminating a major source of acid rock drainage. The bacteria used are harmless to both humans and the environment.

In the bioleaching process, toxic elements such as arsenic and mercury are stabilized. The tailings created by bioleaching are benign, and zero environmental damage occurs as a result of the process. Bioleaching treats the disease - not just the symptom.

Telamayu

Interestingly BacTech’s BACOX bioleaching process not only stabilizes the contained toxic substances but captures both precious and base metals for commercial sale. With the chance of recovering commercially viable metals from the tailings, BacTech has a strong value proposition for investors.

In association with the Bolivian government mining agency, COMIBOL, the company has established a tin, silver and copper tailings project in that country called Telamayu.

On May 24, 2016, BacTech and COMIBOL signed an Association Contract for the Telamayu project. In exchange for providing the capital for the project, the construction and the operations for the plant, BacTech will receive 100% of the cash flow from the project for 18 months, or until such time as the debt against the project is retired, or whichever comes first. After completing the repayment of the debt, the project splits into a 55/45 ownership of the cash flow in COMIBOL's favor. BacTech is currently raising the monies to advance Telamayu towards production.

Telamayu is a mill site that has been processing material from local mines for 100 years. There is a power substation and an operating railroad servicing the area. In addition, the area already has a mining trained workforce.

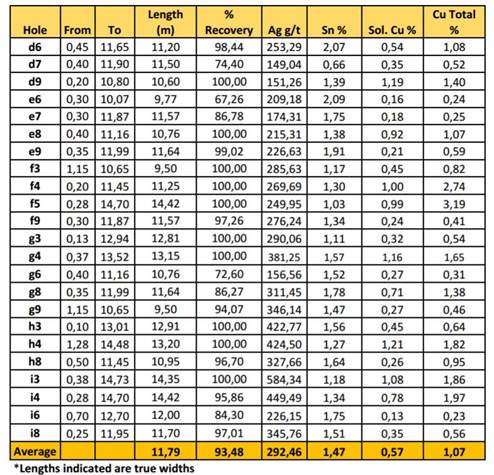

On May 16, 2017 - BacTech announced the latest assays from their joint venture Telamayu, Bolivia tailings project showing very impressive tin, silver and copper and results:

- Assays up to 2.09% tin.

- Assays of up to 18 oz/t silver.

- Copper assays were as high as 3.19%. The Telamayu mill was set up for tin, silver and zinc recovery, meaning the copper was passed through.

|

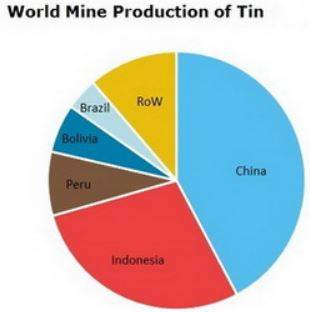

Almost 50% of the value for recovered metals is in the tin:

|

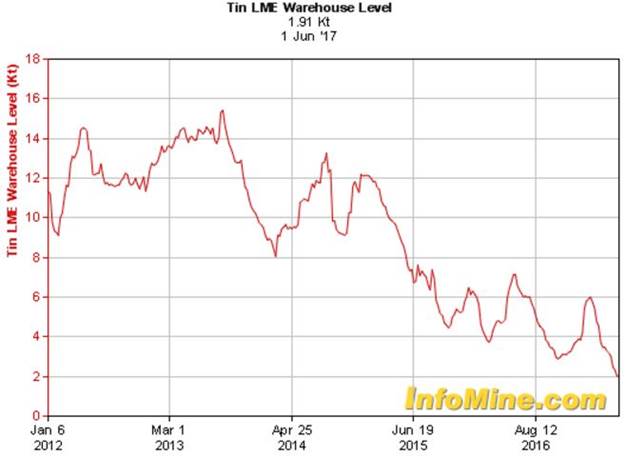

Peter Kettle, chief analyst at research group ITRI Ltd. said, in late 2016, that tin prices may rise to about $30,000 a metric ton in 2018-2019. Kettle also said the market will have a deficit of 10,000 tons to 15,000 tons in 2017.

Conclusion

I'm not against mining. In fact, I'm very much in favor of resource extraction. Mining, fishing and logging all provide quality high paying jobs and these industries are some of only a handful that create new money, bringing prosperity and security to communities.

|

We inhabit this earth and call it our home. Clean water, breathable air and a land free of contamination has to be the legacy we leave our children. Miners understand this and methods have changed. What once were acceptable practices are now recognized as unacceptable. When a metal’s, indeed any commodities, supply side is constrained, in combination with strong demand, that commodity is in a situation that almost guarantees upward pressure on its price. Add in geo-political concerns about the commodities major producers and a share price rise, in this author’s opinion, is already baked in. For us, as retail investors, the trick is to find a low cost potential future producer of that commodity with those kinds of dynamics. Buying that company before it’s been fully ‘de-risked’ means you have a chance to make very large gains for two very good reasons:

|

Protecting the quality of our fresh water resources is a huge challenge.

BacTech is accepting the challenge by helping to clean up dangerous legacy mining sites. And for that reason (and for potential cash flow adjusting the company’s market value), CSE:BAC should be on all our combating pollution radar screens.

Richard (Rick) Mills

Richard’s articles have been published on over 400 websites, including:

WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Beforeitsnews, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, Ninemsn, Ibtimes, Businessweek, HongKongHerald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Sign up for Ahead Of The Herd’s free highly acclaimed newsletter.

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2017 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.