Manchester Attack Sees Asian Stocks Fall, Gold Firm

Commodities / Gold and Silver 2017 May 23, 2017 - 04:38 PM GMTBy: GoldCore

The appalling attack in Manchester overnight in which over 22 people have been killed has led to a slight uptick in risk aversion in markets.

Investors are cautious after police said they were treating a bombing at a concert in the Manchester Arena as a “terrorist incident”.

Asian stocks gave up gains after the attacks and European indices had a subdued start.

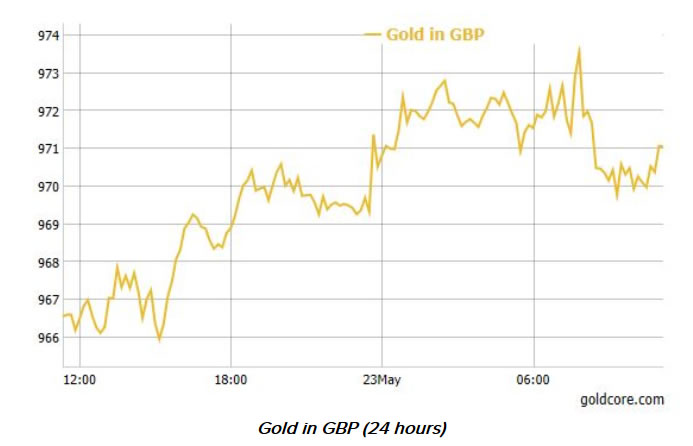

Gold rose in the aftermath of the attacks to three week highs prior to giving up some of the gains by mid morning trading.

Sterling fell marginally and gold in sterling terms rose as high as £973.55 prior to consolidating near £970. Sterling was down 0.2 percent against the dollar to $1.2978 after falling 0.3 percent on Monday.

If the blast is confirmed as a terrorist incident, it would be the deadliest attack in Britain by militants since four British Muslims killed 52 people in suicide bombings on London’s transport system in July 2005.

The attack has come just two-and-a-half weeks before an election that British Prime Minister Theresa May is expected to win easily.

Polls showing that the contest was tightening had added to sterling’s woes recently. A terrorist attack will likely benefit the Tory Party and Theresa May as they are perceived to be tougher on terrorism than the Labour Party.

Terrorist events have not impacted markets globally in recent months and years. However, the concern is that with consumers indebted and consumer sentiment vulnerable, a spate of terrorist attacks or worse a terrorist ‘spectacular’ akin to ‘September 11’ could badly impact already fragile economies and increasingly frothy financial markets.

The UK’s counter-terrorism chief has said that terrorists want to inflict an “enormous and spectacular” terrorist atrocity on the UK.

The uncertain political climate in the UK and the United States is weighing on the dollar and sterling. Concerns over U.S. political turmoil and the complete mess that is the current U.S. political situation will lead to continuing demand for safe haven gold.

This has led to gold’s recent gains and should contribute to gold eking out further gains in the coming weeks.

Gold Prices (LBMA AM)

22 May: USD 1,255.25, GBP 967.17 & EUR 1,123.07 per ounce

19 May: USD 1,251.85, GBP 962.17 & EUR 1,122.03 per ounce

18 May: USD 1,261.35, GBP 968.21 & EUR 1,133.95 per ounce

17 May: USD 1,244.60, GBP 961.70 & EUR 1,122.13 per ounce

16 May: USD 1,234.05, GBP 958.98 & EUR 1,117.93 per ounce

15 May: USD 1,231.50, GBP 952.32 & EUR 1,124.61 per ounce

12 May: USD 1,227.90, GBP 955.06 & EUR 1,129.55 per ounce

Silver Prices (LBMA)

22 May: USD 16.95, GBP 13.04 & EUR 15.10 per ounce

19 May: USD 16.77, GBP 12.90 & EUR 15.02 per ounce

18 May: USD 16.81, GBP 12.90 & EUR 15.10 per ounce

17 May: USD 16.90, GBP 13.03 & EUR 15.22 per ounce

16 May: USD 16.72, GBP 12.97 & EUR 15.13 per ounce

15 May: USD 16.59, GBP 12.83 & EUR 15.12 per ounce

12 May: USD 16.30, GBP 12.68 & EUR 14.99 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.