Tax Reform and the ‘Repatriation’ Trade

Politics / Taxes May 16, 2017 - 06:00 AM GMTBy: Gary_Tanashian

Since the Trump victory we have heard all about the coming fiscal policies that would replace the non-stop and brilliantly evil* monetary policies employed by the Fed since the 2008 market crash. These fiscal policies range from the hair-brained (rust belt factory job repatriation) to the silly (building a border wall in lieu of modernizing security-focused information and surveillance technologies) to the arduous (fixing the Healthcare system) to the sound (well-targeted tax cuts). We’ll get tax cuts, but how well targeted they’ll turn out to be will be debated endlessly and I for one don’t think the trend of the rich getting hyper richer and the poor getting poorer is going to reverse any time soon. For reference, see this post at Biiwii.

Under the taxation aspect of the coming fiscal policy bundle, a consensus is gathering about how unbelievably beneficial this will be to the large, multi-national technology companies. We are talking the likes of Apple, Intel, Cisco, Microsoft, etc. So much so that Tom McClellan is even talking about a “QE coming for Tech” in the form of repatriation of massive hordes of sheltered tax dollars.

Now, these are the financial markets and as with the bullish play on Europe’s actual QE as noted by Kevin Muir of the Macro Tourist, we need to realize that these kinds of stories come out in mature bull markets. I am not saying I am not on board; indeed I still lean bullish on the markets, but resoundingly bullish assertions… meet grain of salt.

That said, I am personally watching Cisco drop after recently selling its pop. I am also still holding Intel despite its drop last week because it’s chart is intact. What’s more, if this ‘tax dollar repatriation as QE’ theme starts to look doable we will go with it. This is a market all about liquidity after all and if the Trump administration would quit acting like a bunch of lunatics long enough to concentrate on the sounder of their proposed policies, we will get a chance to actually find out if the theory meets the coming reality.

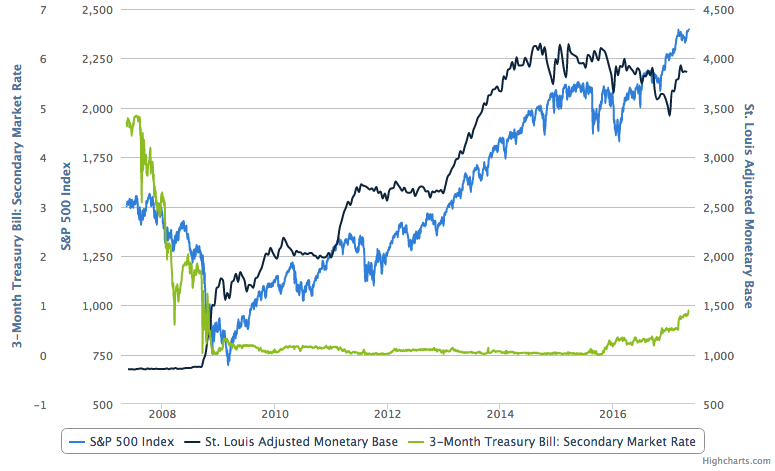

Here is a chart of the S&P 500 (source: Slope Charts) and its constant companions, post-2008; the Monetary Base (MB) and the 3 Mo. T-Bill rate, which is a reflection of the Fed Funds Rate. There are a lot of inputs into the MB, but suffice it to say it is a measure of the Fed’s willingness to monetize bond assets in order to keep the system liquid. The T-Bill yield is now rising as the Fed slowly withdraws its absurd ‘ZIRP (almost) Eternity’ policy. If/as the Fed stands down, the job that’s been done by that black line is going to have to come from somewhere because distortions are built in to this FrankenMarket.

People can argue all they want about how the economy is doing (it’s okay) or the fundamentals behind stocks (overvaluation aside, they are fine too when taking a surface look). But it is all underpinned by distortion, from QEs implemented every time the market hiccupped to the 7 year run of the war on savers known as ZIRP.

The bottom line is that you’re on, Donald. This is not a TV show. You need to stop clowning around and be real about this. Stop obsessing on “fake news”, firing people indiscriminately, and please stop the nonsense about repatriating US factory jobs that are gone forever (and should be gone forever as progress and automation march on).

Trump needs to get tax reform right because we appear to be in a shift from the monetary to the fiscal. If I had to pick which is sounder, it would be fiscal by a country mile. But I don’t have faith in Trump to get through a day without making a fool of himself, let alone oversee something as intricate as the reformation of the tax code.

The point I am trying to make here is that if the Fed remains in policy abdication mode, the fiscal side had better be ready when the market and eventually the economy need it. What if the transition is not a smooth one as the markets currently seem to be expecting?

* The simple fact is that money has been fire hosed into the system at the expense of savers in order to boost asset prices and by definition, the wealth of asset owners. Further, in many cases the first users of the new ‘money’ have been giant financial institutions, which were first bailed out and then have benefited by doing business as usual, where in 2008 there almost was no more business to be done after these firms were left to their own devices in almost wrecking the system.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2017 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.