Crude Oil Price Correction

Commodities / Crude Oil May 15, 2017 - 06:23 PM GMTBy: Ed_Carlson

Crude gained $1.62/bbl. last week and closed at 47.84 but still below the 200-dma. BWI (bandwidth indicator) fell in non-confirmation of the rally.

Support is at 45.25. I suspect we will see a run to the 200-dma at 49.00 prior to new lows in crude however, the detrended oscillator is overbought warning of a pullback early this week.

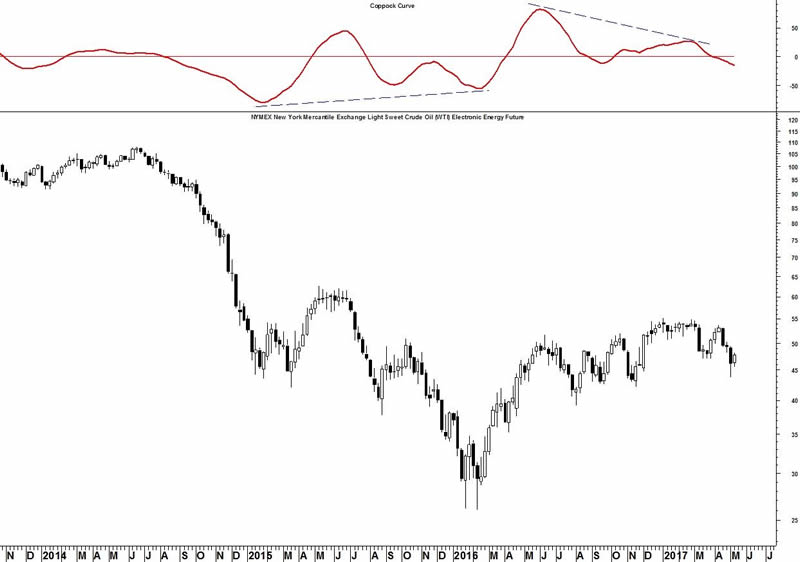

The weekly Coppock failed to confirm last winter’s new high warning of a serious correction (chart).

Cycles: An annual high is due in late May.

Coppock Curves: Daily is rising but the weekly is falling. The monthly is rolling over.

Seasonality is bullish in May.

Try a "sneak-peek " this month at Seattle Technical Advisors.com

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2017 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.