The Fed’s Massive Debt Bubble in Picture Form

Interest-Rates / US Debt May 15, 2017 - 03:29 AM GMTBy: Graham_Summers

As we’ve been outlining over the last few weeks, the auto-loan industry is increasingly looking like Subprime 2.0: the needle that will pop the credit bubble.

As we’ve been outlining over the last few weeks, the auto-loan industry is increasingly looking like Subprime 2.0: the needle that will pop the credit bubble.

Since 2009, roughly 1/3 of all new auto-loans have been subprime. That in of itself is bad, but we are now discovering that the industry in general has a problem with fraud (shades of the Housing Bubble) as well.

As many as 1 percent of U.S. car loan applications include some type of material misrepresentation, executives at data analytics firm Point Predictive estimated based on reports from banks, finance companies and others. Lenders’ losses from deception may double this year to $6 billion from 2015, the firm forecast.

Source: Bloomberg

Obviously, the auto-loan bubble is nowhere near as large as the housing bubble ($1.2 trillion vs. $14 trillion).

But I’m not saying auto-loans will be the crisis… I’m saying auto-loans will be the needle that triggers the crisis.

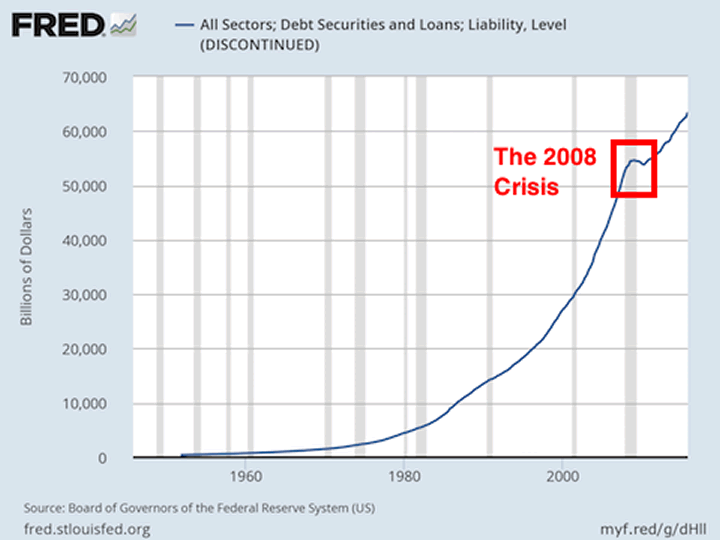

Since 2009, the Fed has created a massive bubble in debt securities.

This includes:

1) Municipal Bonds

2) Corporate Bonds

3) Mortgages

4) Consumer credit debt

5) Auto-loans

Here it is in all its glory.

Just as housing was a small percentage of the debt build up to the 2008 crisis, auto-loans are a small percentage of the post-2008 debt buildup.

But both asset classes had fraud and subprime lending as an underpinning.

This is Subprime 2.0: the needle that will burst the debt bubble.

A Crash is coming… it’s going to horrific.

And smart investors will use it to make literal fortunes from it.

If you’re looking for a means to profit from this we’ve already alerted our Private Wealth Advisory subscribers to FIVE trades that could produce triple digit winners as the market plunges.

As I write this, ALL of them are up.

And we’re just getting started.

If you’d to join us, I strongly urge you to try out our weekly market advisory, Private Wealth Advisory.

Private Wealth Advisory uses stocks and ETFs to help individual investors profit from the markets.

Does it work?

Over the last two years, we’ve maintained a success rate of 86%, meaning we’ve made money on more than EIGHT out of every ten trades we make.

Yes, this includes all losers and every trade we make. If you followed our investment recommendations, you’d have beaten the market by a MASSIVE margin.

However, if you’d like to join us, you better move fast…

… because tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.