Sign of Gold and Silver Stocks Outperformance

Commodities / Gold & Silver Stocks 2017 May 04, 2017 - 03:27 PM GMTBy: P_Radomski_CFA

Precious metals moved visibly lower yesterday, but we can’t say the same about gold and silver mining stocks. The miners refused to follow the metals lower and the question is if this is a sign of a local (or major) bottom.

In our opinion, it’s too early to say so. Miners did outperform yesterday, but due to the recent major technical development (namely, the breakdown below the key long-term support line), the implications are not necessarily bullish.

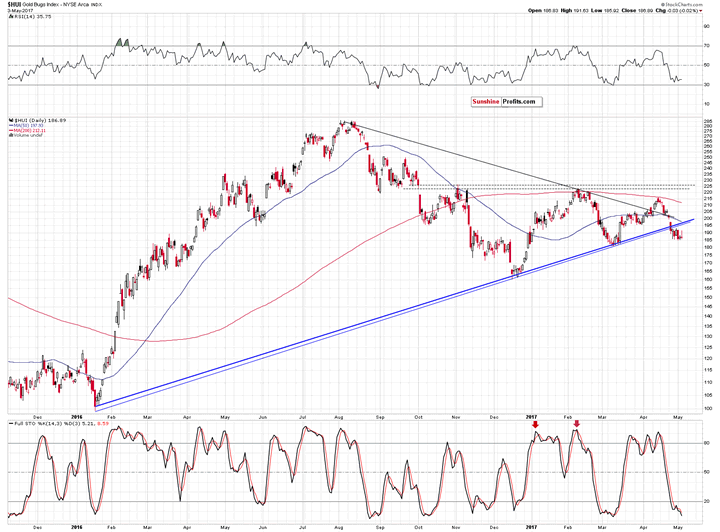

Let’s take a closer look at the HUI Index chart (chart courtesy of http://stockcharts.com).

In a recent Gold Trading Alert, we wrote the following:

Wednesday’s decline immediately confirmed Tuesday’s comments, but we may need to wait an extra day or so for another wave lower. Why? The key breakdown (the one in gold stocks that we focused on in yesterday’s alert) may need to be verified. As epic as the above may sound, it doesn’t actually seem to be a big deal.

How high could gold miners rally based on the reversal? Most likely back to the previously broken support line and the previous lows. Both coincide close to 195, so a move to this level would not surprise us and it would not change anything as it would be very small.

If the HUI Index closes today’s session above 195, it could imply another short-term upswing before the big plunge. However, a lot would depend on what happened in other markets – gold miners themselves have visible resistance at about 200 (declining resistance line and the 50-day moving average), so any resulting rally could easily end right there. All in all, it doesn’t seem that any bullish implications of the reversal are strong at this time.

The above puts yesterday’s “strength” into perspective. It was not a strong reaction per se – it was a weak way for mining stocks to rally and verify the previous breakdown. They didn’t even correct to the lower of the mentioned levels (195).

What does it imply for the following days? Generally, nothing new. Miners could still move higher to the mentioned resistance area and it would not change the bearish outlook for miners that is based on the breakdown below the key rising support / resistance line and multiple other technical factors (i.a. silver’s likely decline). However, at this time, such a reversal is less likely and we have already seen a form of consolidation – a small ABC (zigzag) pattern (with the first high on April 28 and the second one yesterday), so technically, the main move (decline) can now return. The overall implications for the PM market remain bearish. Naturally, the above could change in the coming days and we’ll keep our subscribers informed, but that’s what appears likely based on the data that we have right now.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.