Will All Of This ‘Optimism’ Crash The Stock Markets?

Stock-Markets / Financial Crash Apr 13, 2017 - 04:40 PM GMTBy: Chris_Vermeulen

Currently, the short-term trend for the SPX is NEUTRAL. The intermediate and long term trends are still very BULLISH! There is No trend, in the market, at this time. It is neither overbought or oversold.

Currently, the short-term trend for the SPX is NEUTRAL. The intermediate and long term trends are still very BULLISH! There is No trend, in the market, at this time. It is neither overbought or oversold.

The SPX is in a ‘Non-Trending’ market. I expect this next retracement will be completed by the end of April 2017. I plan on taking advantage of this summer’s rally.

I am anxiously watching the 50-day moving average, for the next direction, as to whether they are about to roll over. This moving average is one of the most-watched technical indicators for institutional firms and helps shift market psychology. I am still looking for much higher highs in the stock market throughout 2017.

As I have mentioned, in my previous reports, I am expecting a pullback/consolidation in the equity markets.

I am expecting gold to cross $1300.00/oz. and silver to cross $19.00/oz. by the end of April.

In addition, I am expecting a “buy-in-May” event in 2017. This could begin our rally with the SPX reaching into the 2500 area during the summer.

This market is Not bearish, so I would suggest that you not trade against this very strong BULLISH UPTREND.

The Importance of Sentiment!

The markets direction is driven by “market sentiment” or “social mood.” Forget about “logic” when it comes to the markets. This is the reason why so many were looking the wrong way when Trump won the election.

“Market sentiment” in equities clearly suggested that we were heading higher in early November of 2016, regardless of who won the election.

Social experiments which were conducted, over the last 30 years, have proven this to be real, despite the general public’s belief to the contrary.

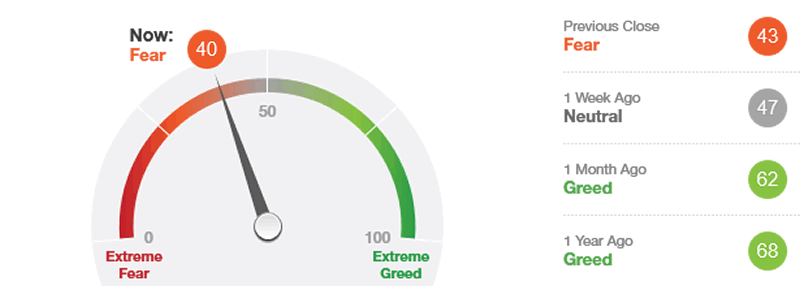

Market bottoms and tops typically occur when sentiment reaches an extreme. For instance, when Wall Street is “euphoric”, after a sustained rally, it suggests buying power is exhausted. When there is an exceptionally high number of bears, after a sustained downturn, a bottom will be close at hand.

The Consumer Confidence Index reached its’ highest level since December 2000, helped by American’s perceptions about business conditions and the job market. Business sentiment is also high. The National Federation of Independent Business, which represents small businesses, says optimism is at one of its’ highest levels in more than four decades, based, in part, on expectations of forthcoming positive developments in Washington, D.C. The National Association of Home Builders says builder sentiment rose in March to its’ highest level since June 2005.

Conclusion:

Presently, there is fear in the marketplace.

If you do not have a set of rules for trading, then this will definitely help you TIME your trades.

Patience Pays Off Using MRM – Momentum Reversal Method !

One of the key tenants of my Momentum Reversal trading is “waiting for the right trigger/event and getting in early”. I find this is one of the most difficult aspects for most traders to understand and to master.

Recent Trading Results Include:

UGAZ 74%

ERX 7.7%

NUGT 112%

URA 2.7%

SCO 7.4%

I currently have four active trades which I anticipate will take off with the next market swing!

Get Trade Alerts in Real-Time at: www.ActiveTradingPartners.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.